Crete Property Tax (Ultimate Guide 2025)

- Last Update Feb. 18, 2025

Buying property in Crete?

Then you’ll want to know exactly what you’re getting into when it comes to taxes and fees.

Because here’s the truth: owning real estate in Greece isn’t just about the purchase price.

There are upfront costs, yearly taxes, and even extra fees when you rent, sell, or inherit a property.

And if you don’t plan ahead, you could end up paying way more than expected.

But don’t worry.

This guide breaks everything down in plain English—so you know exactly what to expect before making a move.

Let’s start with the first expense you’ll encounter when buying property in Crete: the real estate transfer tax.

Real Estate Transfer Tax (RETT): What Buyers Need to Know

So, you’ve found the perfect property in Crete.

📞 Let’s Talk About Your Property Investment

Thinking about buying property in Crete? We’re here to help.

Contact Us TodayBut before you pop the champagne, there’s one major cost you need to factor in—the real estate transfer tax (RETT).

This is the tax you pay when purchasing a resale property, and it’s based on either the officially assessed value or the actual sale price—whichever is higher.

Right now, the RETT in Greece is set at 3%.

But there’s a catch: you also pay an extra 3% municipal tax on top of the RETT amount.

Here’s what that looks like in real numbers:

- Buying a property for €200,000? Expect to pay around €6,180 in transfer tax.

- Going for something bigger at €500,000? Your tax bill jumps to €15,450.

Now, if you’re buying brand-new construction, things work a little differently.

Instead of paying RETT, new properties are typically subject to Value-Added Tax (VAT) at 24%.

But there’s good news—Greece has suspended VAT on new properties until the end of 2025, meaning you might avoid this cost entirely.

⏳ Time Left to Buy VAT-Free Property

Greece’s VAT exemption on new properties expires soon! Act before it’s too late.

*The VAT suspension expires on January 1, 2026.

That’s a solid tax break, but only if you buy before the deadline.

Of course, transfer tax isn’t the only thing you’ll be paying upfront.

Let’s talk about the hidden costs of buying property—like notary, legal, and registration fees—that most buyers don’t think about until it’s too late.

Additional Property Purchase Costs: Notary, Legal, and Registration Fees

The real estate transfer tax isn’t the only cost you’ll need to budget for when buying property in Crete.

In fact, many buyers are caught off guard by the extra fees that come with closing a deal.

These aren’t optional expenses—they’re mandatory costs that cover everything from legal checks to official registration.

Property Transaction Cost Calculator

Transaction Fee Breakdown

Real Estate Transfer Tax (3.09%): €0

Lawyer Fees (1.5%): €0

Notary Fees (1.5%): €0

Agency Fees (2%): €0

Property Registration (0.6%): €0

Total Extra Fees: €0

Total Property Cost (incl. Fees): €0

And if you don’t factor them in, your “great deal” might end up costing more than expected.

Let’s break them down one by one.

First, notary fees.

In Greece, every property purchase must be notarized by a licensed notary public.

This isn’t just a formality—it’s a legal requirement.

The notary ensures the sale is legally binding and records the transaction in the public registry.

How much does this cost?

Notary fees are usually 1% to 2% of the property’s tax-assessed value, plus VAT.

🏡 Find Your Dream Property

We specialize in helping investors find the best real estate in Crete.

Browse ListingsSo for a property valued at €300,000, notary fees could range between €3,000 and €6,000.

Then there’s the lawyer’s fee.

While hiring a lawyer isn’t mandatory for every purchase, it’s highly recommended, especially if you’re buying from abroad.

A real estate lawyer will verify ownership records, check for outstanding debts, and ensure there are no legal surprises waiting for you down the road.

Legal fees vary, but most lawyers charge 1.5% to 2.5% of the purchase price, with a minimum fee of around €1,500. For high-value properties, the percentage often decreases slightly.

Next, we have cadaster fees.

Every property must be registered with the Hellenic Cadaster, Greece’s official land registry.

This registration legally confirms ownership and prevents future disputes.

The cost?

0.475% to 0.775% of the property’s tax value, plus a small fixed fee of around €50–€100.

And finally, real estate agency fees.

If you worked with a real estate agent, you’ll need to pay their commission at closing.

🏡 Property Purchase Roadmap

Follow the step-by-step process to secure your property in Greece.

In Greece, standard agency fees range from 2% to 3% of the final sale price, plus VAT.

However, it’s always good to confirm the exact rate before signing an agreement.

So, when you add everything up, here’s a rough idea of how much extra you’ll need beyond the purchase price:

- Notary fees: 1%–2%

- Lawyer fees: 1.5%–2.5%

- Cadaster fees: 0.475%–0.775%

- Real estate agency fees: 2%–3%

That means if you’re buying a €250,000 property, your total additional costs could range from €10,000 to €15,000. And that’s before property taxes kick in.

Once the purchase is finalized, the next financial responsibility is ongoing ownership taxes—starting with Greece’s most well-known tax, ENFIA.

Annual Property Tax (ENFIA): How Much You’ll Pay Each Year

Buying property is just the beginning.

Once you own real estate in Crete, you’ll need to pay an annual property tax called ENFIA.

And here’s where many buyers make a mistake.

They focus on the upfront costs but forget about the long-term tax obligations—which can add up over time.

That’s why it’s crucial to know exactly how much you’ll owe each year before signing on the dotted line.

ENFIA, or Uniform Real Estate Ownership Tax, is based on a government-assessed property value, not necessarily what you paid for the property.

ENFIA Property Tax Calculator

Estimated ENFIA Tax

Base Tax Rate per m²: €0

Adjusted Tax Rate: €0

Total ENFIA Tax: €0

*This calculator provides an estimate only and should not be considered official financial advice.

The tax consists of two parts:

The first is the main tax, which applies to all properties.

This is calculated per square meter and depends on location, age, and zoning regulations.

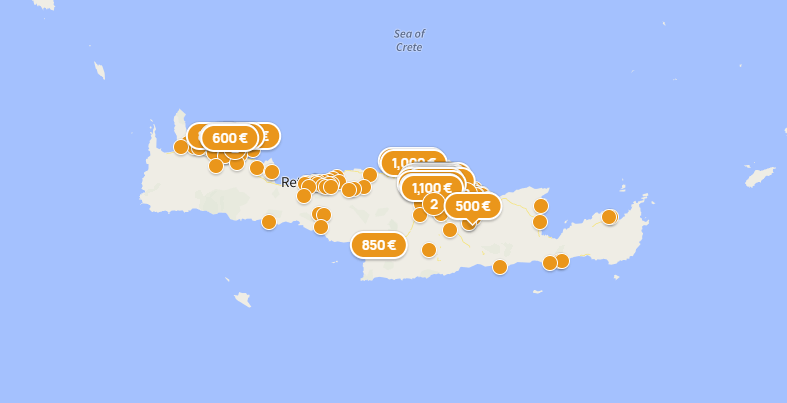

Most residential properties in Crete fall into a rate between €2 and €16 per square meter.

The second is the supplementary tax, which only affects high-value properties.

If the total value of your real estate holdings in Greece exceeds €500,000, you’ll pay an additional progressive tax on the excess amount.

So how much should you expect to pay?

A 100m² apartment in a central area of Crete might have an annual ENFIA tax of €250–€500, while a luxury villa could owe several thousand euros.

Properties in high-demand locations or those with large land plots typically see higher tax rates.

The good news?

ENFIA can be paid in installments, making it more manageable.

📜 Understand Property Laws in Greece

Not sure about the legal process? We provide expert guidance.

Learn MoreThe Greek government typically allows up to 10 monthly payments, with deadlines spread throughout the year.

For most property owners, ENFIA is the biggest recurring tax obligation.

But it’s not the only one.

There’s also a municipal tax—which, unlike ENFIA, is tied to your electricity bill.

Municipal Property Taxes: What You Pay Through Your Electricity Bill

Most property owners in Crete focus on ENFIA—but there’s another tax that many don’t realize they’re paying until they see it on their electricity bill.

This is the municipal property tax, a fee collected by local governments to fund essential services like waste collection, street maintenance, and public lighting.

Unlike ENFIA, you won’t get a separate tax bill for this one—instead, it’s automatically included in your electricity bill.

So how much does it cost?

The rate varies depending on the municipality, but in most areas of Crete, it ranges from €0.10 to €0.50 per square meter per year.

That means if you own a 100m² apartment, you could be paying anywhere from €10 to €50 annually, while a 200m² home might owe up to €100 per year.

And here’s something many property owners don’t realize: if your electricity is cut off, you’ll still owe this tax.

Property Tax Comparison: Greece vs. Other Countries

Explore how Greece's property tax rates compare to other European countries.

🇬🇷 Greece

0.1% – 0.6%

Greece offers some of the lowest property tax rates in Europe, making it attractive for investors.

🇵🇹 Portugal

0.3% – 0.8%

Portugal's property tax rates are higher, especially in urban areas and tourist-heavy locations.

🇪🇸 Spain

0.4% – 1.1%

Spain’s tax rates vary significantly by region, making some areas more expensive than others.

🇮🇹 Italy

0.4% – 0.8%

Italy’s property tax rates depend on whether the home is a primary or secondary residence.

*Data is based on general property tax rates and may vary by region.

In that case, you’ll need to pay it directly to the municipality instead of through the electricity provider.

Between ENFIA and municipal property taxes, owning a home in Crete comes with recurring tax obligations that don’t go away after the purchase.

But what if you want to turn your property into a rental?

That’s when rental income tax comes into play—and it has its own set of rules.

Rental Income Tax: What Property Owners Need to Know

Owning property in Crete isn’t just about having a place to live.

Many buyers see it as an investment—whether by renting it out long-term or listing it on Airbnb.

But here’s what most new landlords don’t expect: Greece has a strict rental income tax system, and failing to report earnings correctly can lead to serious penalties.

The moment you start earning rental income from your property, you must declare it to Greek tax authorities, even if you’re not a Greek tax resident.

🏡 Rental Profitability Estimator

Calculate your after-tax rental income and potential profit.

Estimated Rental Income

Annual Rental Income: €0

Annual Expenses: €0

Taxable Income: €0

Estimated Rental Tax (15%-45%): €0

Final Profit After Tax: €0

Rental income in Greece is taxed progressively, meaning the more you earn, the higher your tax rate.

Here’s how the current rates break down:

- If your annual rental income is up to €12,000, you’ll pay 15% tax on that amount.

- If you earn between €12,001 and €35,000, the tax rate jumps to 35% on the portion above €12,000.

- If your rental income exceeds €35,000 per year, you’ll pay 45% tax on everything above that threshold.

Unlike some countries, Greece doesn’t allow landlords to deduct many expenses from rental income, so taxes are calculated on the gross amount.

And if you’re thinking about listing your property on Airbnb or another short-term rental platform, be aware that these rentals follow separate regulations.

Short-term rental owners must:

- Register their property with Greece’s Independent Authority for Public Revenue (AADE) and obtain a Property Registry Number (AMA).

- Declare all income earned from short-term rentals, just like traditional rental income.

- Comply with municipal and zoning regulations, which may restrict Airbnb-style rentals in certain areas.

Failing to register your rental property or report earnings can result in heavy fines, with penalties reaching up to €5,000.

The bottom line?

Renting out your property in Crete can be highly profitable, but you need to understand the tax implications before getting started.

Now, what happens when it’s time to sell?

That’s where capital gains tax comes into play.

💰 Invest in Crete with Confidence

We help investors secure the best deals in the Greek real estate market.

Explore Investment OpportunitiesCapital Gains Tax: What Sellers Should Expect

Thinking about selling your property in Crete?

Here’s some good news—Greece currently has a suspension on capital gains tax (CGT) for real estate sales.

That means if you sell your property today, you won’t owe any tax on the profit you make.

But this tax break won’t last forever.

When Greece eventually lifts the suspension, sellers will once again be subject to a 15% capital gains tax on their profit.

So how is this tax calculated?

Capital gains tax applies to the difference between the original purchase price and the selling price, adjusted for inflation and documented renovation costs.

This means that if you bought a property for €200,000 and later sold it for €300,000, your taxable profit would be €100,000, and you’d owe €15,000 in CGT—assuming no deductions apply.

Right now, the suspension gives sellers a major advantage.

If you’re planning to flip a property or cash out on your investment, doing it while the tax is still paused could save you thousands.

Of course, not everyone sells their property—many owners pass it down to family members instead.

But even then, taxes still apply.

Inheritance Tax: How Property Transfers Work in Greece

Owning property in Crete isn’t just about the present—it’s also about what happens when you pass it down.

Unlike some countries where inheritance tax can be a financial burden, Greece offers significant tax breaks for direct family transfers.

But the rules still vary depending on who inherits the property and its value.

For children or spouses inheriting property, the first €150,000 is completely tax-free.

Anything above this threshold is taxed progressively, starting at just 1% and increasing as the inheritance value rises.

For example, if your child inherits a €300,000 property, they’ll only pay tax on €150,000—with rates between 1% and 10%, depending on the amount.

For siblings, grandchildren, and other relatives, the tax-free allowance is lower.

Non-relatives or distant heirs face higher tax rates, sometimes reaching 40% for large inheritances.

But inheritance tax isn’t the only cost involved.

The heir must also pay:

- Notary fees to officially process the inheritance.

- Cadaster fees to update property records.

- Any unpaid ENFIA or municipal taxes left by the previous owner.

If the inheritance process isn’t handled correctly, legal complications can arise—especially if multiple heirs inherit a property together.

📅 Tax Payment Deadlines

Stay ahead of key tax filing deadlines to avoid penalties.

🏠 ENFIA Payment Deadlines

📌 Due in 5 monthly installments from September to January.

📄 Rental Income Tax Filing

📌 Annual filing due by 30th June each year.

📈 Capital Gains Tax Reporting

📌 Report capital gains in the annual income tax declaration (by 30th June).

That’s why many property owners in Greece choose to gift their property before passing, since gifting offers even better tax benefits.

Gifting Property: Why Some Owners Choose to Transfer Before Inheritance

In Greece, many property owners choose to gift their real estate to family members instead of waiting for inheritance laws to take effect.

And there’s a good reason why—gifting often comes with major tax advantages.

For direct family transfers, Greece has one of the most generous tax exemptions in Europe.

If you’re gifting property to your child, the first €800,000 is completely tax-free.

That means you can pass down property without triggering any tax liability at all, as long as the total value doesn’t exceed this limit.

For other relatives, the tax-free threshold is lower, but still more favorable than inheritance tax.

Transfers to siblings, grandchildren, or other extended family members come with reduced tax brackets compared to standard inheritance rules.

Beyond the tax benefits, gifting property also:

- Prevents inheritance disputes by ensuring ownership is legally settled in advance.

- Reduces administrative costs since the property is transferred while the owner is still alive.

- Avoids potential future tax increases, as laws around property taxation can change at any time.

Of course, gifting property means giving up ownership rights immediately.

Once the transfer is completed, the new owner becomes responsible for all taxes and legal obligations, including ENFIA and municipal fees.

🔎 Need Help Finding the Right Property?

Tell us what you're looking for, and we’ll help you find it.

Get a Personalized SearchThat’s why some property owners choose a “usufruct” agreement, which allows them to transfer ownership but retain the right to use the property for life.

This way, they secure the tax benefits while continuing to live in or manage the property.

But whether you gift, inherit, or sell property, one thing remains the same—taxes don’t end with the transfer.

Even if you own a property outright, you’ll still need to navigate Greece’s property tax system each year.

Tax Incentives and Exemptions: How to Legally Reduce Your Property Tax Bill

Nobody likes paying more taxes than they have to.

And in Greece, many property owners don’t realize they qualify for exemptions or reductions that could significantly lower their tax bill.

If you know how the system works, you could cut down on ENFIA, reduce your transaction costs, or even pay zero tax on certain property purchases.

Let’s break down the main tax incentives available.

First, tax breaks for first-time homebuyers.

If you’re purchasing property in Crete as your primary residence, you could qualify for a full exemption from the real estate transfer tax—which means you won’t pay the standard 3% RETT.

This exemption applies to:

- Singles buying a home worth up to €200,000

- Married couples purchasing a home up to €250,000

The catch?

You must be a Greek tax resident to qualify.

If you’re a foreign buyer, this exemption won’t apply unless you establish tax residency in Greece before purchasing.

Another tax incentive applies to energy-efficient properties.

If you buy or renovate a property to meet high energy standards, you may be eligible for:

- Lower ENFIA rates for energy-efficient buildings

- Tax deductions for renovation costs that improve insulation, heating efficiency, or solar power use

Additionally, rural and agricultural properties in Crete often qualify for reduced ENFIA rates—especially in low-population areas where the government offers incentives to attract new residents.

And let’s not forget about Greece’s Golden Visa Program.

While this isn’t a tax exemption, it does provide a major incentive for investors.

If you buy property worth at least €250,000 in Crete, you can apply for a Greek residency permit, which grants visa-free travel across the EU.

That’s why understanding these tax benefits before purchasing can make a huge difference.

💡 Tax Facts You Should Know

But to actually take advantage of them, you’ll need to know how to use Greece’s online tax portal, TaxisNet—which is where all property tax payments, exemptions, and filings happen.

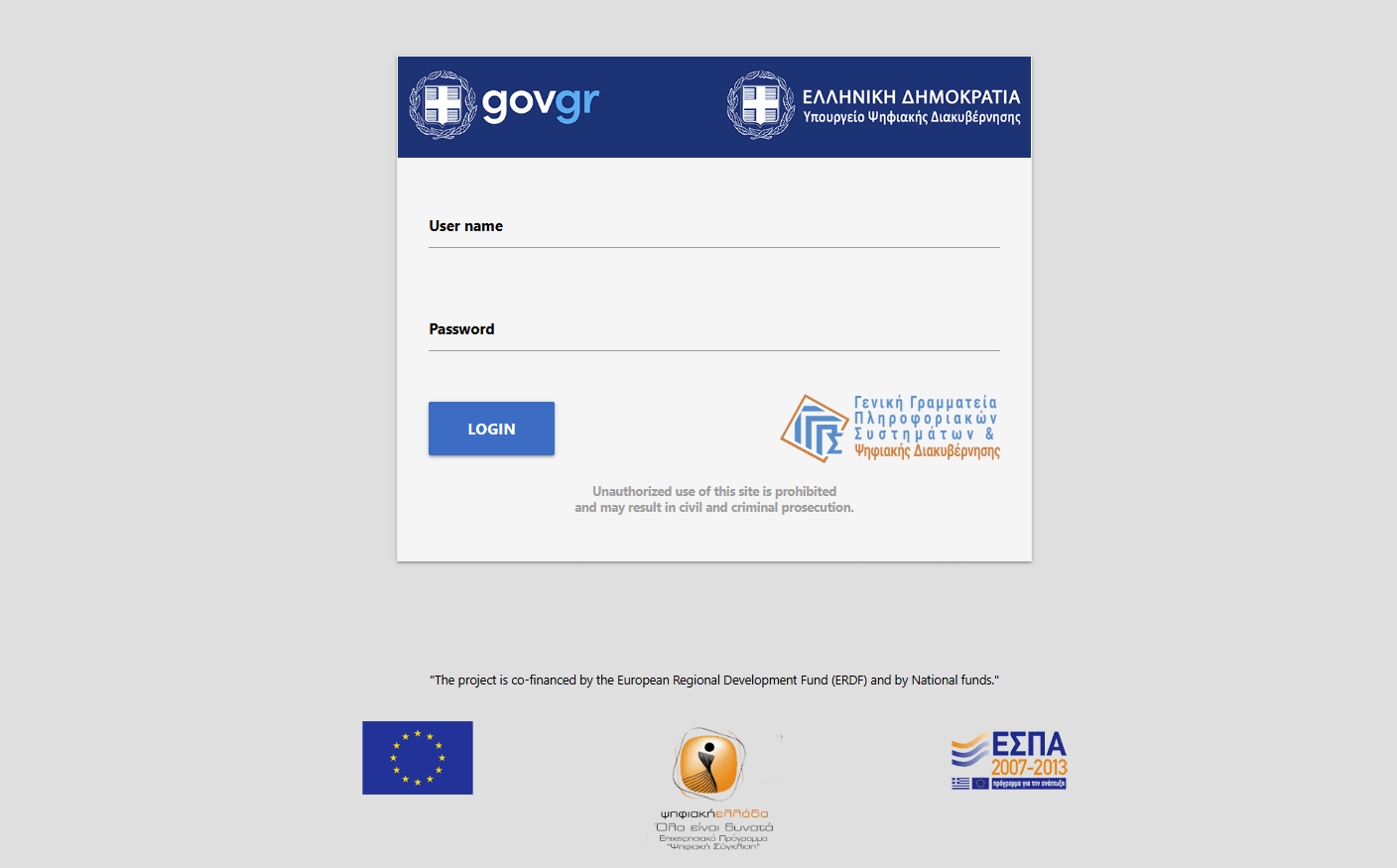

Using the Greek Tax Portal (TaxisNet): How to Manage Your Property Taxes Online

Owning property in Crete means dealing with Greek taxes.

And that means using TaxisNet—the country’s online tax portal where all tax filings, payments, and exemptions are managed.

The problem?

TaxisNet isn’t exactly user-friendly, especially if you don’t speak Greek.

But once you understand the basics, managing your property taxes online becomes much easier.

So, what can you do through TaxisNet?

First, you’ll use it to check and pay ENFIA.

Every year, Greek tax authorities update ENFIA assessments in the portal, allowing property owners to view their exact tax amount and choose whether to pay it in full or through monthly installments.

Second, it’s where you declare rental income.

If you’re renting out your property, you must report your earnings through TaxisNet—even if you’re a non-resident.

📞 Get Expert Investment Guidance

We help investors find the best real estate opportunities in Crete.

Contact Us TodayThe system automatically calculates how much tax you owe based on your reported income.

It’s also where you apply for exemptions and incentives.

If you qualify for a tax break—like the first-time homebuyer exemption or reduced ENFIA rates for energy-efficient homes—TaxisNet is where you’ll submit your application.

But before using the system, you’ll need a Greek tax identification number (AFM).

This is a legal requirement for all property owners in Greece, even if you live abroad.

Without an AFM, you won’t be able to access TaxisNet, register your property, or make tax payments.

Once registered, you log into TaxisNet using personal credentials, similar to an online banking system.

From there, you can:

- View your property tax assessments

- Download tax documents for legal purposes

- Pay taxes directly through the platform

- Update property ownership details if needed

For non-Greek speakers, navigating the system can be tricky.

That’s why many property owners work with a tax advisor who can handle filings and payments on their behalf.

The most important thing?

Missing a tax deadline in Greece can result in hefty fines, so knowing how to access and use TaxisNet is crucial for avoiding unnecessary penalties.

At this point, we’ve covered everything from purchase taxes to annual property obligations.

But how do you make sure you’re managing everything correctly?

That’s where strategic tax planning comes in.

Planning Ahead: Strategies for Managing Property Taxes in Crete

Buying property in Crete is exciting.

But if you don’t plan ahead for taxes, fees, and legal obligations, you could end up overpaying—or worse, facing unexpected fines.

The key to smart property ownership isn’t just paying taxes on time.

It’s knowing how to optimize costs, take advantage of exemptions, and avoid common mistakes.

So, how do you make sure you’re managing your taxes the right way?

First, stay ahead of annual property tax deadlines.

Greece allows ENFIA payments in multiple installments, but if you miss one, penalties start adding up quickly.

Setting up automated payments through TaxisNet or working with a tax expert ensures you never fall behind.

Second, consider whether it makes sense to register as a Greek tax resident.

If you plan to live in Crete long-term, becoming a tax resident could unlock first-time homebuyer exemptions and potentially lower ENFIA rates, especially for energy-efficient homes.

If you’re renting out your property, keep detailed records of all income and expenses.

While Greece has strict tax rules on rental income, knowing what you can and can’t deduct can make a significant difference in your tax bill.

And if you’re thinking about selling in the future, take advantage of Greece’s capital gains tax suspension while it lasts.

Once the tax is reinstated, sellers will owe 15% on profits—meaning now might be the best time to cash out without extra tax costs.

🔎 Need Help Finding the Right Property?

Tell us your requirements, and we’ll help you find the perfect match.

Get a Personalized SearchFinally, work with a tax professional who understands Greek real estate laws.

Whether you need help filing rental income, applying for tax exemptions, or navigating inheritance rules, having an expert on your side ensures you never overpay or miss an important requirement.

At the end of the day, managing property taxes in Crete isn’t complicated—if you plan ahead.

And the more you understand the system, the more you can optimize your costs and protect your investment.

How to Stay Tax-Compliant and Protect Your Investment

Owning property in Crete comes with incredible benefits—stunning landscapes, a relaxed Mediterranean lifestyle, and solid investment potential.

But to fully enjoy your property without financial surprises, you need to stay ahead of your tax obligations.

From the moment you buy, to the years you own, and even when you decide to sell or transfer your property, understanding Greek property taxes is essential.

Whether it’s the real estate transfer tax, annual ENFIA payments, rental income tax, or capital gains rules, having the right knowledge means avoiding penalties and optimizing costs.

If you’re buying, renting, or selling property in Crete, Totsi helps property owners navigate every step of the tax process—so you never overpay, miss a deadline, or run into legal issues.

➡ Need expert tax guidance?

Time to get the clarity you need to manage your property in Crete with confidence.

🏡 Your Dream Property in Crete Awaits

Whether you're looking for a new home, a vacation retreat, or a smart investment, we’re here to help you find the perfect property.

Contact Us NowFind Your Perfect Property

We’re Here to Answer All Your Questions About Buying Property in Crete

Start Your Property Journey

- STAY CONNECTED

Subscribe to Our Newsletter

Members