Greek Retirement Visa (Ultimate Guide 2025)

- Last Update Feb. 12, 2025

- Why Retire in Greece?

- Who Can Apply? (Eligibility & Requirements)

- Step-by-Step Application Process

- How Much Does It Cost? (Full Cost Breakdown)

- Living in Greece as a Retiree

- Healthcare for Retirees in Greece

- Tax Benefits & Financial Considerations

- How to Maintain & Renew the Greek Retirement Visa

- Common Mistakes & How to Avoid Them

- Frequently Asked Questions (FAQs)

Why Retire in Greece?

Picture this: You wake up in a quiet seaside village, the morning sun warming the whitewashed buildings.

The streets are lined with small cafés, where locals sip their coffee, chatting about the day ahead.

The cost of living is lower than back home, the food is fresh, and life moves at a pace that lets you enjoy every moment.

This is what retirement in Greece looks like.

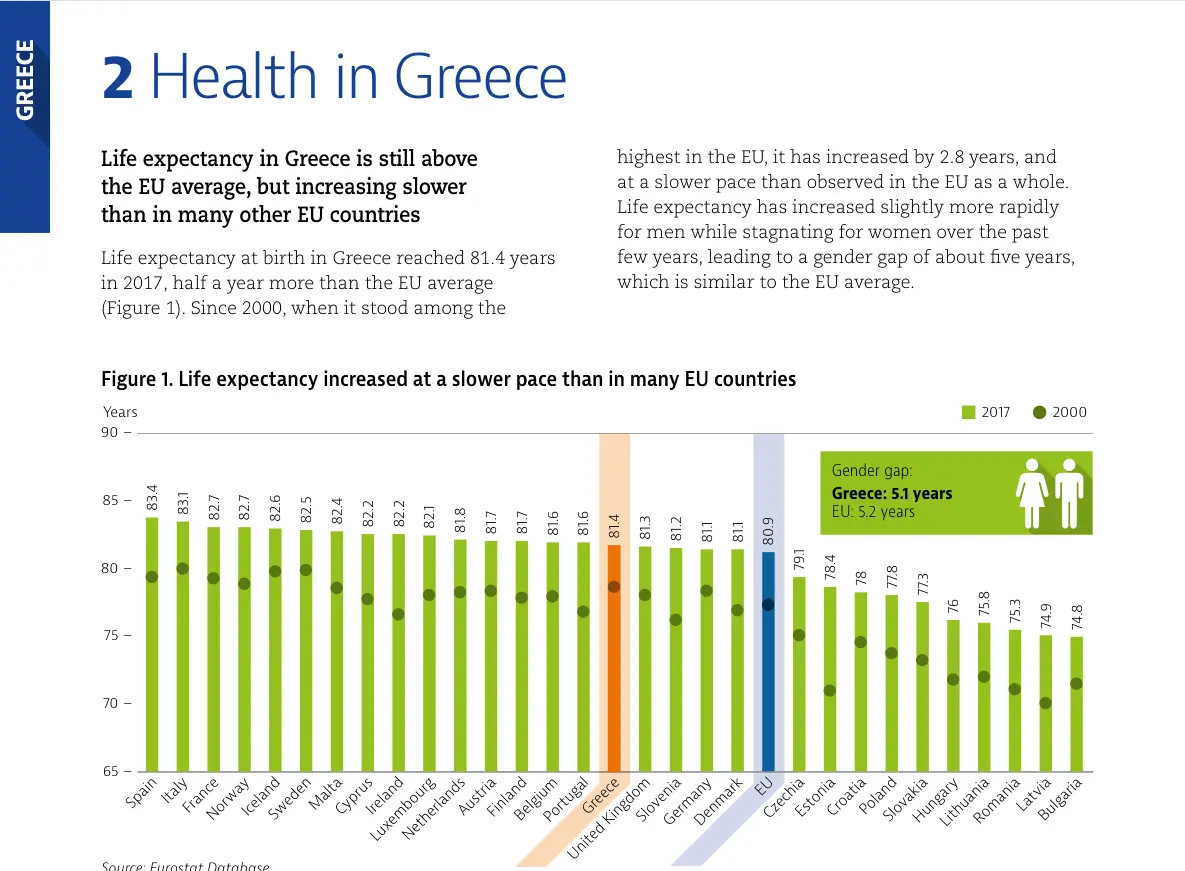

For years, Greece has been one of Europe’s best-kept secrets for retirees.

It offers a Mediterranean climate, stunning landscapes, and a lifestyle focused on relaxation and community.

But it’s not just about the scenery.

The cost of living is significantly lower compared to other European countries, making it an ideal place for those who want to stretch their retirement savings while enjoying a high quality of life.

The Greek government has recognized this and introduced a residency program that makes it easy for non-EU retirees to live here legally.

The Greek Retirement Visa, officially known as the Financially Independent Person (FIP) Visa, is designed for people who have the financial means to support themselves without needing to work.

Unlike other residency programs, this visa doesn’t require you to make a property investment or start a business.

Instead, it’s built for those who want to settle in Greece and enjoy life—whether that means spending afternoons by the sea, exploring ancient ruins, or simply embracing the laid-back Mediterranean lifestyle.

Over the years, more retirees have chosen Greece for its affordability, great healthcare, and friendly communities.

And with the recent changes in 2025, there’s never been a better time to consider making the move.

This guide will walk you through everything you need to know about retiring in Greece—who qualifies, how the application process works, what it costs, and what life is really like once you’re here.

By the end, you’ll have a clear plan on how to start your retirement journey in one of the most beautiful countries in the world.

Greece Is the Perfect Place to Retire—But Are You Eligible?

Retiring in Greece sounds like a dream—lower costs, better weather, and a relaxed lifestyle. But before you pack your bags, you need to make sure you qualify for the Greek Retirement Visa.

Many applicants assume they meet the requirements, only to face rejection due to financial proof errors or missing paperwork. Let’s review your eligibility and secure your approval from the start.

Check Your Eligibility NowWho Can Apply? (Eligibility & Requirements)

Retiring in Greece sounds like a dream, but not everyone qualifies for the Greek Retirement Visa.

The government has set clear rules on who can apply, mainly to ensure that retirees have enough financial stability to live comfortably without needing to work.

The key requirement?

You must prove that you can support yourself financially without relying on a job in Greece.

How Much Money Do You Need?

There are two ways to meet the financial requirements:

1. Passive Income Route

If you have a steady monthly income, such as a pension, rental income, or dividends, you need to show at least €3,500 per month.

If you’re applying with a spouse, this amount increases by 20%, meaning you’ll need €4,200 per month.

If you have dependent children, add 15% per child.

2. Savings Route (Alternative Option)

If you don’t have a steady monthly income but have significant savings, you can qualify by depositing at least €126,000 into a Greek bank account.

This amount increases by 20% for a spouse and 15% for each child.

This option provides flexibility for retirees who have accumulated savings but may not have a regular pension.

However, the Greek authorities may ask for proof that these funds will last for an extended period.

Health Insurance Requirement

Having health insurance is mandatory.

Since retirees do not qualify for Greece’s public healthcare system, you must have private health coverage that meets the government’s requirements.

The insurance must cover medical treatment, hospital stays, and emergencies in Greece.

Criminal Record Check

Before approving your application, Greek authorities will require a clean criminal record certificate from your home country.

This is a standard part of the process to ensure that applicants meet the country’s residency standards.

Do You Need to Stay in Greece Full-Time?

One of the most important things to keep in mind is that Greece requires retirees on this visa to spend at least 183 days per year in the country.

This means you’ll need to make Greece your primary residence, even though you can travel within the Schengen Zone without needing additional visas.

The government wants to ensure that those granted residency are actually living in Greece rather than using it as a travel loophole.

If you don’t meet the 183-day requirement, you could risk losing your residency status.

Application Process

Applying for the Greek Retirement Visa is a two-step process that starts in your home country and finishes in Greece.

Think You Qualify for the Greek Retirement Visa? Think Again.

Many retirees assume they meet the financial requirements—until their application gets rejected. The Greek government is strict about income sources, health insurance, and the 183-day residency rule.

Before you apply, make sure your financial proof is structured correctly. A small mistake could cost you months of delays—or even outright denial.

Get a Free Eligibility CheckWhile it’s not overly complicated, knowing exactly what to expect can help you avoid delays and mistakes.

Here’s how it works:

Step-by-Step Application Process

Applying for the Greek Retirement Visa is a two-step process that starts in your home country and finishes in Greece.

While it’s not overly complicated, knowing exactly what to expect can help you avoid delays and mistakes.

Here’s how it works:

Step 1: Apply for the Type D Visa (Before You Arrive in Greece)

The first step is applying for a Type D visa, which serves as your entry permit into Greece.

This must be done at the Greek consulate or embassy in your home country.

To apply, you’ll need to submit the following documents:

- Proof of income or savings to meet the visa’s financial requirements

- A valid health insurance policy that covers you in Greece

- A clean criminal record certificate from your home country

- Proof of accommodation in Greece, such as a rental agreement or property deed

- A completed visa application form and passport photos

Most applications are processed within a few weeks to a few months, depending on your country.

If approved, you’ll receive a Type D visa, which allows you to enter Greece and apply for your residence permit.

Important: The Type D visa is typically valid for one year, but you must apply for your residence permit before it expires.

Step 2: Apply for the Residence Permit (Once in Greece)

Once you arrive in Greece, you’ll need to submit your residence permit application at the local Aliens and Immigration Department in the region where you plan to live.

At this stage, Greek authorities will review your documents, take your fingerprints, and issue a temporary residence certificate while your application is being processed.

The waiting period for approval varies, but most retirees receive their residence permit within a few months.

Once approved, you’ll receive a three-year residence permit, allowing you to live legally in Greece.

What Happens After Approval?

Once you have your residence permit, you can:

✔ Legally reside in Greece

✔ Travel freely within the Schengen Zone

✔ Renew your permit every three years (as long as you meet the requirements)

However, to keep your visa active, you must spend at least 183 days per year in Greece.

If you don’t, you could risk losing your residency status.

How Much Does It Cost? (Full Cost Breakdown)

One of the biggest mistakes retirees make when planning their move to Greece is underestimating the total cost of obtaining and maintaining the Greek Retirement Visa.

While the government fees are relatively low compared to other visa programs, there are several hidden expenses that many applicants don’t consider upfront.

Let’s break it all down so you know exactly what to expect before making the move.

Government & Visa Application Fees

Every applicant must pay an official government application fee, which covers the processing of the residence permit.

- Type D Visa (Embassy Application): €180 per person

- Greek Residence Permit Application Fee: €1,000 per person

These fees are non-refundable, even if your application is denied.

Legal & Professional Fees

While hiring a lawyer isn’t required, many applicants choose to work with an immigration lawyer to handle the process.

A professional can prepare your documents, file applications, and handle translations—reducing the risk of delays or rejections.

- Legal Fees: €3,000 – €8,000 (depending on the complexity of your case)

If you’re buying property in Greece as part of your move, you’ll also need to account for:

- Notary & Registration Fees: 1.5% of the property price

- Real Estate Agency Fees: 2% of the property price

- Lawyer Fees for Property Purchase: 1.5% of the property price

Health Insurance Costs

Because non-EU retirees don’t qualify for Greece’s public healthcare system, you’ll need private health insurance.

The cost varies depending on your age, medical history, and level of coverage.

- Private Health Insurance: €1,500 – €3,000 per year

Some retirees prefer to self-insure, meaning they pay out of pocket for medical expenses instead of buying full-coverage insurance.

However, having at least a basic insurance plan is required for the visa application.

Housing Costs (Rent or Buy?)

Housing costs in Greece vary by location.

Popular destinations like Athens and Thessaloniki have higher rents, while smaller towns and islands offer more affordable options.

- Renting a 1-bedroom apartment: €500 – €900 per month (depending on location)

- Buying a property: Starts at €1,000 per square meter in major cities

If you’re renting, most landlords require a security deposit of at least two to three months’ rent upfront.

Ongoing Living Costs

Apart from visa fees and housing, you should also budget for monthly living expenses. Greece is cheaper than many Western countries, but the cost of living still depends on your lifestyle.

| Category | Athens (€) | Thessaloniki (€) | Crete (€) | Rhodes (€) |

|---|---|---|---|---|

| 🏡 Rent (1-Bedroom) | 600 - 900 | 500 - 800 | 400 - 700 | 500 - 750 |

| 💡 Utilities | 150 - 250 | 130 - 200 | 120 - 180 | 130 - 220 |

| 🛒 Groceries | 300 - 500 | 280 - 450 | 250 - 400 | 270 - 420 |

| 🏥 Healthcare | 100 - 250 | 100 - 250 | 80 - 200 | 90 - 220 |

| 🚗 Transport | 50 - 100 | 40 - 80 | 30 - 70 | 40 - 90 |

🏡 Rent (1-Bedroom)

Athens: €600 - €900

Thessaloniki: €500 - €800

Crete: €400 - €700

Rhodes: €500 - €750

💡 Utilities

Athens: €150 - €250

Thessaloniki: €130 - €200

Crete: €120 - €180

Rhodes: €130 - €220

🛒 Groceries

Athens: €300 - €500

Thessaloniki: €280 - €450

Crete: €250 - €400

Rhodes: €270 - €420

🏥 Healthcare

Athens: €100 - €250

Thessaloniki: €100 - €250

Crete: €80 - €200

Rhodes: €90 - €220

🚗 Transport

Athens: €50 - €100

Thessaloniki: €40 - €80

Crete: €30 - €70

Rhodes: €40 - €90

Hidden Costs Retirees Often Forget

Many retirees only budget for the application fees and rent, but forget about additional expenses like:

- Translation & Document Certification Costs

- Greek Bank Account Setup Fees

- Annual Residency Renewal Fees

- Taxes on Worldwide Income (if you become a tax resident in Greece)

Total Estimated Costs for the First Year

If you add up all the essential costs, here’s a realistic budget for a single retiree in their first year in Greece:

Important: If you’re moving with a spouse or dependents, these costs increase accordingly based on the visa rules.

How to Reduce Your Costs

For retirees on a budget, there are ways to lower these expenses:

- Live in a smaller town or island instead of Athens or Thessaloniki

- Choose a basic health insurance plan instead of a premium package

- Handle your visa application yourself instead of hiring a lawyer

- Look for long-term rental discounts instead of short-term leases

By planning ahead, you can make your retirement in Greece financially stress-free.

Next, we’ll explore what daily life is really like for retirees—including the best places to live, cost of living insights, and what to expect once you settle in.

Living in Greece as a Retiree

Making the move to Greece is one thing—actually settling into everyday life is another.

Some retirees imagine life will feel like a long vacation.

Others worry about adjusting to a new culture, dealing with bureaucracy, or even learning the language.

The reality? Life in Greece as a retiree is as easy or as complicated as you make it.

If you choose the right location, understand the local customs, and plan your finances wisely, it can be one of the most rewarding decisions you’ll ever make.

Where Are the Best Places to Retire in Greece?

Deciding where to live is just as important as getting the visa itself.

Greece offers a variety of choices, from bustling cities to quiet island villages. Each has its own advantages.

Many retirees choose Athens for its healthcare, transportation, and expat communities.

It’s easy to get around, and you’ll never run out of things to do.

But the capital is more expensive than other parts of Greece.

If you prefer something more relaxed, Crete is a popular choice.

The island offers great weather year-round, affordable housing, and a mix of locals and expats.

It’s one of the few places where you can enjoy small-town living without feeling isolated.

Some retirees are drawn to Thessaloniki, Greece’s second-largest city.

It’s cheaper than Athens but still offers great healthcare, culture, and food.

The city is known for its vibrant waterfront, rich history, and relaxed pace of life.

For those who dream of island life, places like Rhodes, Corfu, and Naxos offer stunning views, strong expat communities, and a slower, more peaceful lifestyle.

The only downside?

Living on an island means higher prices for certain goods and fewer healthcare options compared to the mainland.

How Affordable Is It to Live in Greece?

Greece is one of the most affordable places to retire in Europe, but how much you spend depends on your lifestyle.

Housing is usually the biggest expense. A one-bedroom apartment in Athens can cost anywhere between €500 and €900 per month, while in smaller towns, you can find rent for as low as €400 per month.

Food is surprisingly cheap if you shop at local markets and cook at home.

A weekly trip to the farmers’ market for fresh fruits, vegetables, and bread can cost as little as €30 to €40.

Eating out is also affordable—a traditional Greek meal at a taverna might cost €10-€15 per person.

Utilities and internet can add up, but they’re lower than in many other European countries.

A typical monthly bill for electricity, water, and internet is around €150 to €250.

Healthcare is another major factor.

The Application Process Seems Simple—Until It’s Not.

Many retirees think they can handle their visa application alone—until they face unexpected paperwork issues, long processing delays, or outright rejection due to minor mistakes.

Our team ensures your Type D visa and residence permit application are structured perfectly—so you don’t have to worry about missing details or costly errors.

Get Expert Help With Your ApplicationSince retirees don’t qualify for Greece’s public healthcare system, private health insurance is necessary.

A good plan can cost €1,500 to €3,000 per year, depending on your coverage.

Public transportation is cheap and reliable, especially in major cities.

A monthly metro pass in Athens costs around €30, and taxis are affordable compared to other European capitals.

What’s It Like to Adjust to Life in Greece?

For many retirees, the biggest challenge isn’t the cost—it’s adapting to the local way of life.

Greece operates on its own schedule.

Shops may close in the middle of the day for a few hours.

Restaurants stay open late, and people don’t seem to rush.

If you’re used to a structured routine, this can take some getting used to.

Language can also be a challenge, but English is widely spoken in major cities and tourist areas.

Learning some basic Greek phrases can make a huge difference in how locals interact with you.

Even a simple “Kalimera” (Good morning) can go a long way.

The bureaucracy in Greece is another thing to prepare for.

Paperwork can take longer than expected, and it’s common to visit multiple offices just to get one document processed.

Patience is key, but once you’re settled, these things become less stressful.

One of the biggest advantages of retiring in Greece is the sense of community.

Greeks are known for their warmth and hospitality, and once you integrate, you’ll find that neighbors look out for one another.

Living in Greece isn’t for everyone. If you need efficiency, structure, and fast-moving systems, the laid-back Mediterranean lifestyle might be frustrating at first.

But for those who embrace it, retirement here offers a level of relaxation and enjoyment that’s hard to find anywhere else.

Next, we’ll dive into how healthcare works for retirees, including the best private insurance options and how to access medical services in Greece.

Healthcare for Retirees in Greece

Moving to a new country is exciting, but for retirees, healthcare is one of the most important factors to consider.

While Greece has a high-quality medical system, understanding how it works—and how you can access care—will help you avoid unnecessary stress.

Unlike EU citizens, retirees on the Greek Retirement Visa are not eligible for public healthcare.

This means that to live in Greece legally, you must have private health insurance that covers your medical needs.

But what does this actually mean in practice?

Let’s break it down.

Can You Use Greece’s Public Healthcare System?

Greece has a public healthcare system called EOPYY, which provides free or low-cost medical care to Greek citizens and legal residents.

However, non-EU retirees do not qualify for EOPYY, unless they become permanent residents or citizens later on.

Because of this, most retirees rely on private healthcare for all medical needs.

The good news is that private healthcare in Greece is excellent and more affordable than in many Western countries.

How Do Private Healthcare & Insurance Work?

Since you can’t access public healthcare, you’ll need private health insurance to cover doctor visits, hospital stays, and emergencies.

The Greek government requires proof of health insurance as part of your visa application.

There are two main options:

- Greek Private Health Insurance – Local providers offer coverage that meets visa requirements and is tailored to Greece’s healthcare system.

- International Health Insurance – Some retirees prefer global health plans, which provide coverage in multiple countries, including Greece.

Most retirees opt for a local Greek provider because it’s cheaper than international plans and works seamlessly with local hospitals and clinics.

How Much Does Private Health Insurance Cost?

The cost of health insurance depends on your age, medical history, and level of coverage.

- A basic plan covering doctor visits and emergencies costs around €1,500 per year.

- A comprehensive plan with hospital stays, specialist care, and extra benefits can range from €2,500 to €3,000 per year.

For retirees with pre-existing conditions, some insurers may charge higher premiums or limit coverage for certain conditions.

It’s best to compare multiple providers before choosing a plan.

How Good Is Private Healthcare in Greece?

Greek private hospitals and clinics offer high-quality care, with shorter wait times and doctors who often speak English.

Some of the best private hospitals are located in Athens, Thessaloniki, and Crete, making these cities attractive for retirees who want easy access to top-tier medical care.

Many retirees choose private healthcare not just because it’s required for the visa, but because it offers:

✔ Faster access to doctors and specialists

✔ More modern facilities than public hospitals

✔ English-speaking medical staff in major cities

For routine check-ups, specialists, and emergency care, private hospitals in Greece are well-equipped and affordable compared to the US or UK.

Can You Keep Your Home Country’s Health Insurance?

Some retirees keep their home country’s insurance and only use private Greek insurance for visa purposes.

However, this doesn’t always work for long-term healthcare needs.

- If you plan to visit your home country often, you might be able to continue using its healthcare system.

- If you plan to live in Greece full-time, it’s better to switch to a Greek health plan that works within the country.

For retirees coming from countries with national health systems, check whether your government allows coverage for overseas residents.

What If You Need Emergency Medical Care?

Emergency care in Greece is available both at public and private hospitals.

If you have a life-threatening emergency, you can go to the nearest hospital, and they will treat you regardless of your insurance status.

However, without public healthcare access, you’ll need to pay for private hospital treatment if you don’t have a good insurance plan.

Ambulance services in Greece are fast and reliable, especially in cities.

In rural areas and islands, emergency response can take longer, which is something to consider when choosing where to live.

Is Greece a Good Place for Retirees with Medical Needs?

For retirees who need frequent medical care, Greece is a great option—as long as you choose the right location.

- Athens & Thessaloniki have the best private hospitals and specialists.

- Crete & Rhodes offer decent private healthcare, but complex cases may require travel to Athens.

- Small islands and rural areas have limited medical facilities, so retirees with ongoing health issues should think carefully before moving there.

| Rank | Location | Avg Rent (1-Bedroom, €) | Healthcare Access | Expat Community |

|---|---|---|---|---|

| 1️⃣ | Athens | €600 - €900 | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| 2️⃣ | Thessaloniki | €500 - €800 | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| 3️⃣ | Crete | €400 - €700 | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| 4️⃣ | Rhodes | €500 - €750 | ⭐⭐⭐ | ⭐⭐⭐⭐ |

| 5️⃣ | Corfu | €500 - €800 | ⭐⭐⭐⭐ | ⭐⭐⭐ |

1️⃣ Athens

Avg Rent: €600 - €900

Healthcare Access: ⭐⭐⭐⭐⭐

Expat Community: ⭐⭐⭐⭐⭐

2️⃣ Thessaloniki

Avg Rent: €500 - €800

Healthcare Access: ⭐⭐⭐⭐

Expat Community: ⭐⭐⭐⭐

3️⃣ Crete

Avg Rent: €400 - €700

Healthcare Access: ⭐⭐⭐⭐

Expat Community: ⭐⭐⭐⭐⭐

4️⃣ Rhodes

Avg Rent: €500 - €750

Healthcare Access: ⭐⭐⭐

Expat Community: ⭐⭐⭐⭐

5️⃣ Corfu

Avg Rent: €500 - €800

Healthcare Access: ⭐⭐⭐⭐

Expat Community: ⭐⭐⭐

Greece is a fantastic place to retire, but it’s important to have a healthcare plan in place before you arrive.

The last thing you want is to face medical issues without proper coverage.

Understanding healthcare is just one part of retirement planning.

Next, we’ll go over how taxes work for retirees in Greece—including whether you need to pay Greek taxes and how the 7% flat tax benefit works.

Tax Benefits & Financial Considerations

Retiring in Greece isn’t just about the sunshine and lifestyle—it also comes with one of the most attractive tax benefits for retirees in Europe.

If planned correctly, you could significantly reduce your tax burden while enjoying all the benefits of living in Greece.

But taxes can be confusing, especially when moving to a new country.

Do you need to pay Greek taxes on your pension?

What if you have rental income or investments abroad?

Let’s break it all down.

Do You Have to Pay Taxes in Greece as a Retiree?

This depends on one thing: your tax residency status.

If you spend more than 183 days per year in Greece, you automatically become a Greek tax resident.

That means Greece will expect you to declare and pay taxes on your worldwide income—including pensions, rental income, and investments.

But before you panic, Greece offers a huge tax incentive for retirees: a flat 7% tax rate on all foreign income.

How Does the 7% Flat Tax Work?

Greece introduced the 7% tax regime to attract retirees from abroad.

| Country | Pension Tax Rate | Investment Tax | Tax on Foreign Income |

|---|---|---|---|

| 🇬🇷 Greece | 7% (Flat Rate) | 7% | 7% |

| 🇬🇧 UK | 20-45% | 20% | Worldwide Taxed |

| 🇺🇸 USA | 10-37% | 15-20% | Worldwide Taxed |

| 🇪🇸 Spain | 19-47% | 19-26% | Worldwide Taxed |

| 🇵🇹 Portugal | 10% (NHR Program) | 28% | Some Exemptions |

🇬🇷 Greece

Pension Tax Rate: 7% (Flat Rate)

Investment Tax: 7%

Tax on Foreign Income: 7%

🇬🇧 UK

Pension Tax Rate: 20-45%

Investment Tax: 20%

Tax on Foreign Income: Worldwide Taxed

🇺🇸 USA

Pension Tax Rate: 10-37%

Investment Tax: 15-20%

Tax on Foreign Income: Worldwide Taxed

🇪🇸 Spain

Pension Tax Rate: 19-47%

Investment Tax: 19-26%

Tax on Foreign Income: Worldwide Taxed

🇵🇹 Portugal

Pension Tax Rate: 10% (NHR Program)

Investment Tax: 28%

Tax on Foreign Income: Some Exemptions

If you qualify, you’ll only pay 7% tax on your foreign income—no matter how high it is.

The best part?

This tax rate is locked in for 15 years.

To apply, you must:

- Be a new tax resident in Greece (you can’t have been a tax resident there for at least five of the last six years).

- Receive pension income from abroad.

- Move your tax residency to Greece and commit to staying for at least 183 days per year.

For most retirees, this is a huge tax advantage compared to the higher tax rates in countries like the US, UK, or Germany.

What Happens if You Keep Your Tax Residency in Your Home Country?

If you don’t become a Greek tax resident (meaning you spend less than 183 days per year in Greece), then you’ll continue paying taxes in your home country as usual.

Some retirees choose to keep their tax residency in their home country while living in Greece part-time.

However, this means they won’t qualify for Greece’s 7% tax benefit.

It’s worth consulting a tax professional before making a final decision, as tax treaties between Greece and other countries can affect how much you owe.

What If You Have Rental Income or Investments?

If you earn money from renting out a property, dividends, or other investments, Greece will still tax that income at the 7% rate—as long as you qualify for the flat tax regime.

However, if you buy property in Greece and decide to rent it out, that income is taxed under the Greek tax system, which has different rates depending on the amount you earn.

Do You Need to File a Greek Tax Return?

If you’re a Greek tax resident, yes—you’ll need to file a tax return every year, even if all your income comes from abroad.

The Greek tax year runs from January to December, and tax returns are usually due in June of the following year.

Most retirees hire a local accountant to handle tax filings, as the system can be complex for newcomers.

Is Greece a Tax-Friendly Country for Retirees?

For many retirees, yes—especially if you take advantage of the 7% tax regime.

- If you qualify, you’ll only pay 7% tax on your foreign income, which is lower than in most Western countries.

- If you keep your tax residency elsewhere, you might avoid Greek taxes completely—but you won’t get the benefits of the low tax rate.

With careful planning, retiring in Greece can be just as financially smart as it is enjoyable.

Taxes are just one piece of the puzzle.

Next, we’ll go over how to maintain and renew your visa, so you can stay in Greece legally for the long term.

How to Maintain & Renew the Greek Retirement Visa

Getting the Greek Retirement Visa is one thing—keeping it active is another.

Like most residency permits, this visa isn’t permanent at first.

To continue living in Greece, you’ll need to renew it every three years and meet certain requirements.

For some retirees, this process is simple.

For others, a small mistake—like spending too much time outside Greece—can cause problems when it’s time to renew.

Let’s go over exactly what you need to do to keep your visa valid and avoid issues.

How Long Is the Greek Retirement Visa Valid?

The initial residence permit is valid for three years.

After that, you must renew it every three years as long as you still meet the eligibility requirements.

This means you must:

- Continue meeting the financial income or savings threshold.

- Maintain valid private health insurance.

- Spend at least 183 days per year in Greece.

What Happens If You Don’t Spend Enough Time in Greece?

The 183-day rule is one of the most common reasons for visa issues.

If you fail to meet this requirement, the Greek authorities can reject your renewal application—meaning you’d have to start over from scratch.

This rule exists to ensure that the visa is used by actual residents, not just people looking for an EU travel loophole.

If you plan to travel frequently, it’s important to track your days in Greece to avoid falling short.

How to Renew Your Residence Permit

The renewal process is similar to the initial application, but there’s one key difference: you apply from inside Greece rather than at a Greek consulate abroad.

Here’s how it works:

1️⃣ Start the renewal process at least 60 days before your permit expires.

2️⃣ Submit your renewal application to the Aliens and Immigration Department in the region where you live.

3️⃣ Provide updated documents, including:

- Proof of continued financial stability (bank statements or pension statements).

- A valid private health insurance policy.

- Proof that you’ve spent at least 183 days per year in Greece.

4️⃣ Once approved, your permit is extended for another three years.

What If You Miss the Renewal Deadline?

If you fail to renew your permit on time, you could lose your residency status.

This would mean having to restart the visa process from the beginning, which could include leaving Greece and applying for a new Type D visa from your home country.

Greek authorities may allow a grace period in some cases, but it’s best not to risk it.

Keeping track of your renewal dates is crucial if you want to stay in Greece long-term.

Can You Lose Your Visa for Other Reasons?

Besides missing the 183-day residency rule, there are a few other ways you could lose your visa status:

- Failing to maintain your financial requirements—If your income drops below €3,500 per month, or you no longer have enough savings to qualify, your renewal could be denied.

- Losing health insurance coverage—Your permit renewal requires proof of a valid private health insurance plan.

- Criminal activity—If you commit a crime in Greece or another country, Greek authorities can revoke your residency permit.

What If You Want to Upgrade to Permanent Residency?

After five continuous years of living in Greece, you may qualify for a permanent residence permit, which comes with fewer renewal requirements.

To qualify for permanent residency, you must:

- Have legally resided in Greece for five consecutive years without leaving for extended periods.

- Show proof of financial stability and a valid health insurance plan.

Permanent residency means you no longer have to renew every three years and can stay in Greece indefinitely—though you’ll still need to follow Greek residency laws.

Does the Greek Retirement Visa Lead to Citizenship?

Yes, but it takes time.

If you’ve lived in Greece for seven years, you can apply for Greek citizenship.

However, this process requires more than just living in the country—you’ll also need to:

- Pass a Greek language and culture test.

- Prove that you have integrated into Greek society.

For some retirees, citizenship isn’t necessary since the retirement visa and permanent residency already provide long-term stability.

But for those who want a Greek passport and full EU rights, it’s an option to consider.

Final Thoughts on Maintaining Your Residency

The Greek Retirement Visa is one of the best options in Europe for non-EU retirees, but keeping it active requires careful planning.

The biggest thing to remember?

Stay on top of your renewals and make sure you meet the 183-day rule.

As long as you follow the guidelines, you can enjoy stress-free retirement in Greece without worrying about visa complications.

Now that we’ve covered visa maintenance, next we’ll look at common mistakes retirees make when applying—and how to avoid them.

Common Mistakes & How to Avoid Them

Applying for the Greek Retirement Visa isn’t complicated, but it’s easy to make small mistakes that can lead to delays—or worse, a rejected application.

For some retirees, these mistakes happen because they don’t fully understand the financial requirements.

Others run into trouble with missing paperwork, insurance issues, or misunderstandings about tax residency.

The good news? Most of these mistakes are avoidable if you plan ahead.

Let’s go over the biggest ones so you don’t fall into the same traps.

Mistake #1: Miscalculating Your Financial Requirements

One of the most common reasons for visa rejections is failing to meet the income or savings requirements.

Some retirees assume that a pension or small rental income will be enough, only to find out that their total monthly amount is too low.

Remember, you need to show at least €3,500 per month in passive income.

If applying with a spouse, this increases by 20%, and if you have dependent children, another 15% per child.

If your income doesn’t meet this threshold, the alternative is proving you have at least €126,000 in savings, plus additional amounts for family members.

How to avoid this mistake:

- Before applying, double-check your financial documents to ensure you meet the requirements.

- If your income is slightly below the threshold, consider increasing it through additional investment dividends or rental income.

- If relying on savings, make sure the amount is held in a Greek bank account as required by the authorities.

Mistake #2: Assuming You Can Use Public Healthcare

Some retirees move to Greece expecting to use the country’s public healthcare system, only to find out that it’s not available to them.

The Greek government requires all non-EU retirees to have private health insurance, and this is a mandatory condition for the visa.

Without it, your application won’t be approved.

How to avoid this mistake:

- Purchase a comprehensive private health insurance plan that covers you in Greece.

- Make sure your policy meets the visa requirements, especially if using an international provider.

- Don’t assume that a travel insurance policy will work—it won’t. You need full medical coverage.

Mistake #3: Not Spending Enough Time in Greece

This is one of the easiest ways to lose your visa status.

The Greek Retirement Visa requires you to spend at least 183 days per year in the country.

Some retirees treat it like a part-time residency, spending more time traveling or living elsewhere, and then run into problems at renewal.

When the Greek authorities check your renewal application, they will look at your time spent in Greece. If you haven’t met the requirement, your visa may not be renewed.

How to avoid this mistake:

- Keep track of your time in Greece each year to ensure you stay at least 183 days.

- If you travel frequently, make sure your Greek residence remains your primary home.

- Don’t assume the rule isn’t enforced—Greek immigration takes this seriously.

Mistake #4: Waiting Too Long to Renew Your Visa

Your first residence permit is valid for three years, but renewals aren’t automatic.

You must apply for renewal before your permit expires, and waiting until the last minute can lead to unnecessary stress—or even loss of residency.

How to avoid this mistake:

- Start the renewal process at least 60 days before your permit expires.

- Make sure all your financial documents, insurance, and tax filings are up to date.

- Don’t assume the renewal is just a formality—you still need to prove that you qualify.

Mistake #5: Not Understanding Greek Tax Residency

Becoming a Greek tax resident means you may have to pay taxes in Greece.

Some retirees move without considering whether they should transfer their tax residency, leading to unexpected tax obligations later on.

If you spend more than 183 days per year in Greece, you automatically become a tax resident.

But if you don’t plan correctly, you could miss out on Greece’s 7% flat tax benefit and end up paying higher taxes than necessary.

How to avoid this mistake:

- Before moving, consult with a tax expert who understands Greek and international tax laws.

- If you want to qualify for Greece’s 7% flat tax on foreign income, make sure you apply for it properly.

- Understand the tax treaties between Greece and your home country to avoid double taxation.

Mistake #6: Underestimating Greek Bureaucracy

Greece is a beautiful country, but its bureaucracy is not for the impatient.

| Year | Type D Visa Processing Time | Residence Permit Approval Time |

|---|---|---|

| 2019 | 2-3 months | 2-4 months |

| 2020 | 3-6 months (COVID delays) | 4-7 months |

| 2021 | 2-4 months | 3-5 months |

| 2022 | 1-3 months | 2-4 months |

| 2023 | 1-2 months | 2-4 months |

| 2024 | 1-2 months | 5-8 months |

2019

Type D Visa: 2-3 months

Residence Permit: 2-4 months

2020

Type D Visa: 3-6 months (COVID delays)

Residence Permit: 4-7 months

2021

Type D Visa: 2-4 months

Residence Permit: 3-5 months

2022

Type D Visa: 1-3 months

Residence Permit: 2-4 months

2023

Type D Visa: 1-2 months

Residence Permit: 3-6 months

2024

Type D Visa: 1-2 months

Residence Permit: 4-8 months

Processing times for visa approvals, renewals, and tax documents can be slower than expected.

Many retirees assume they’ll receive fast approvals, only to find themselves waiting weeks or months for paperwork.

This is just how things work in Greece.

Offices may have limited working hours, staff may direct you to multiple locations for a single document, and some paperwork requires official translations.

How to avoid this mistake:

- Expect delays and start all processes early.

- If you don’t speak Greek, hire an immigration lawyer or consultant to handle paperwork for you.

- Be patient—bureaucracy moves at its own pace, but everything eventually gets done.

Final Thoughts on Avoiding These Mistakes

Applying for the Greek Retirement Visa isn’t difficult, but small mistakes can cause big delays.

By understanding the requirements in advance, keeping track of deadlines, and ensuring your finances and health insurance are in order, you’ll make the process smooth and stress-free.

For most retirees, these are just small hurdles on the way to enjoying life in Greece without complications.

Next, we’ll cover frequently asked questions to clear up any remaining doubts.

Let me know if this section looks good before we continue!

Frequently Asked Questions (FAQs)

Moving to a new country comes with a lot of questions, especially when dealing with visas, taxes, and everyday life.

Some retirees worry about how long the process takes, while others want to know whether they can work, buy property, or even bring their pets.

Let’s go over the most common questions people ask about the Greek Retirement Visa—so you have clear answers before making your move.

How long does it take to get the Greek Retirement Visa?

The process varies depending on your country of application and how well-prepared your documents are.

- Type D Visa (Step 1): Usually takes 1 to 3 months for approval from the Greek consulate.

- Residence Permit (Step 2): Once in Greece, expect another 2 to 6 months for your residency application to be processed.

Life in Greece Is Beautiful—But It Comes With Challenges.

Adjusting to a new country isn’t just about sunshine and good food. Bureaucracy, cultural differences, and healthcare access can be overwhelming—especially if you don’t know what to expect.

We help retirees transition smoothly by handling residency, tax planning, and local setup—so you can focus on enjoying your new life in Greece.

Get Help With Your Move to GreeceIf your paperwork is complete, the process is much faster.

Delays happen when documents are missing, improperly translated, or not certified correctly.

Can I work in Greece on this visa?

No. The Greek Retirement Visa does not allow you to work in Greece.

It’s strictly for financially independent individuals who can support themselves without needing employment.

However, if you earn money from abroad—such as a pension, rental income, or investments—you can still receive that income while living in Greece.

If you want to work legally in Greece, you’d need to switch to a different type of visa or residency permit.

Can I buy property in Greece with this visa?

Yes! You don’t need a visa to buy property in Greece, and many retirees choose to purchase a home instead of renting.

However, owning property does not automatically give you residency.

If you’re considering investing, you may also want to explore the Greek Golden Visa, which offers residency through property investment.

Can I bring my spouse and children with me?

Yes, your spouse and dependent children can be included in your application, but you’ll need to prove you can financially support them.

For a spouse, you must show an extra 20% in income or savings.

For children, you must show 15% extra per child.

Family members will receive residence permits linked to yours and must also meet visa requirements, such as having private health insurance.

What happens if I don’t spend enough time in Greece?

The Greek Retirement Visa requires you to stay at least 183 days per year in Greece.

If you fail to meet this requirement, you could lose your residency permit when it’s time to renew.

If you plan to travel frequently or live part-time in another country, make sure you keep track of your days to avoid problems at renewal.

Do I have to pay taxes in Greece?

If you spend more than 183 days per year in Greece, you become a tax resident and must declare your worldwide income.

The good news?

Greece offers a 7% flat tax rate for retirees on foreign income, making it one of the most tax-friendly places in Europe.

If you spend less than 183 days per year in Greece, you won’t be considered a tax resident and can keep paying taxes in your home country.

Can I use Greece’s public healthcare system?

No, non-EU retirees cannot use Greece’s public healthcare system.

To apply for the visa, you must have private health insurance that covers medical expenses in Greece.

Most retirees choose private hospitals and clinics, which offer excellent care and English-speaking doctors in major cities.

Can I get permanent residency or citizenship later?

Yes, but it takes time.

- Permanent Residency – After five years of continuous residence, you can apply for permanent residency, which removes the need for renewals.

- Greek Citizenship – After seven years of continuous residence, you can apply for citizenship—but you must pass a Greek language and culture test.

For many retirees, permanent residency is sufficient and doesn’t require full citizenship.

What happens if my visa renewal is denied?

If you fail to meet the visa requirements—such as not spending enough time in Greece, losing financial stability, or not having valid health insurance—your renewal may be denied.

If this happens, you may need to leave Greece and reapply from your home country.

This is why it’s important to stay on top of renewal deadlines and requirements.

Can I bring my pet with me to Greece?

Yes! Greece allows pets to travel and live with you, as long as they have:

- A pet passport (for EU pet travel)

- A microchip

- Up-to-date vaccinations (including rabies)

If coming from outside the EU, you may also need a health certificate from an approved vet before travel.

Is the Greek Retirement Visa Worth It?

For retirees looking for warm weather, a relaxed lifestyle, and a lower cost of living, the Greek Retirement Visa is one of the best residency options in Europe.

As long as you meet the financial requirements, secure private health insurance, and plan for taxes, it’s a straightforward process that offers long-term residency without the need to invest in property.

If you’re ready to start your retirement journey in Greece, the next step is beginning the application process and preparing your documents.

🌍 Full Assistance for Your Greek Retirement Visa

Let us handle everything so you can enjoy a stress-free move to Greece.

📜 Visa Application & Approval

- ✔ Complete guidance through the Greek Retirement Visa process

- ✔ Preparation & submission of all required documents

- ✔ Booking & scheduling of migration appointments

- ✔ Assistance with biometric registration & permit collection

🏦 Administrative Support

- ✔ Help with obtaining your Greek tax number (AFM)

- ✔ Assistance in opening a Greek bank account

- ✔ Ensuring all paperwork meets official requirements

🏠 Settling in Greece

- ✔ Finding long-term rental properties in safe, comfortable areas

- ✔ Connecting you with healthcare & insurance providers

- ✔ Advising on daily life needs (utilities, transportation, etc.)

🛡️ Ongoing Support & Extra Services

- ✔ Greek tax & residency compliance support

- ✔ Legal guidance for visa renewals

- ✔ Discounted accommodation & car rentals for your visits

- ✔ If you decide to buy a property, we assist with legal & financial steps

💡 Get full assistance for your Greek Retirement Visa and start your new life in Greece stress-free.

📩 Get Full AssistanceContact Us to Apply for the Greek Retirement Visa

Let us know your situation, and we’ll assist you in obtaining your Greek Retirement Visa.

Urgent?

+30 698 3200 953

Find Your Perfect Property

Start Your Property Journey

- STAY CONNECTED

Subscribe to Our Newsletter

Members