Buying Property In Crete (Ultimate Guide 2025)

- Last Update Feb. 17, 2025

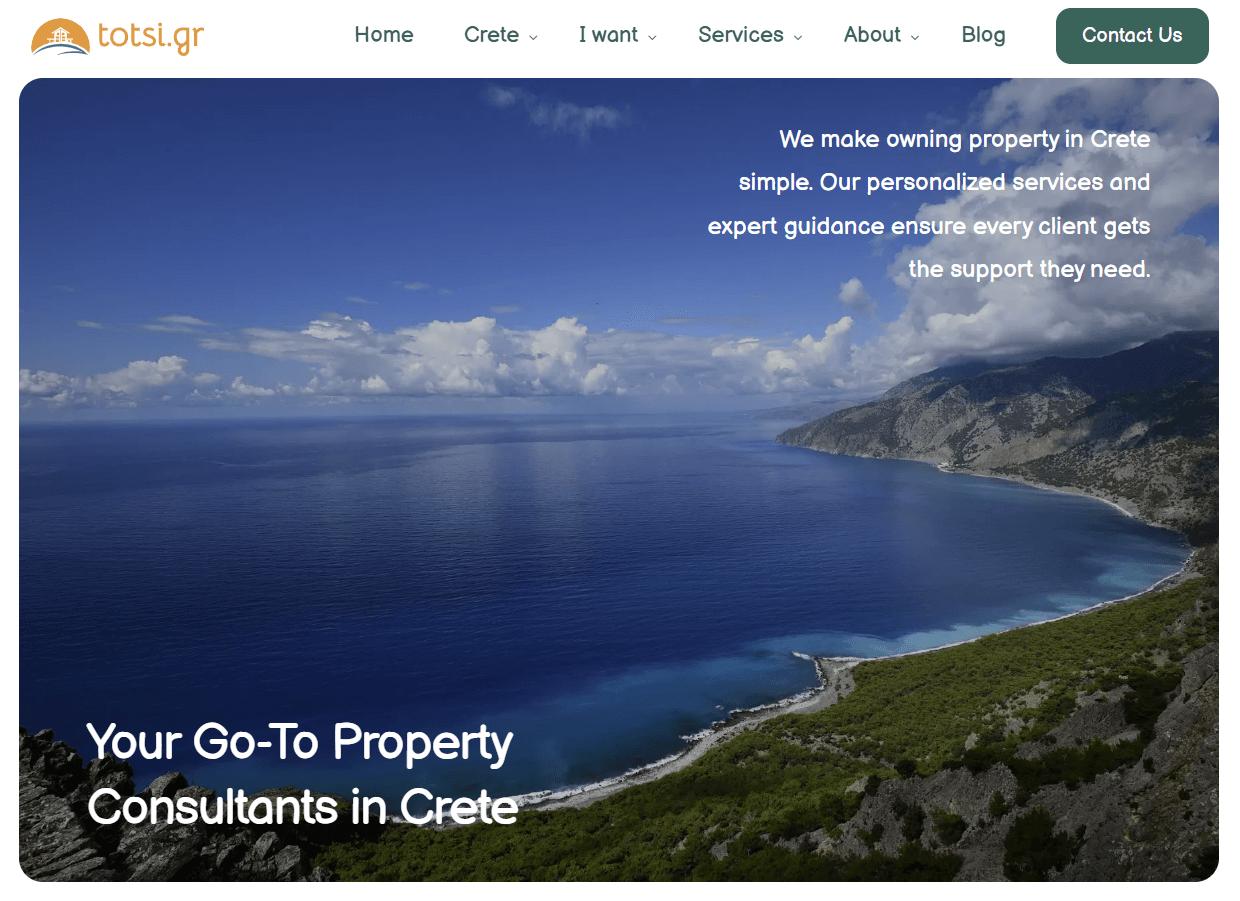

Imagine waking up to breathtaking sea views, enjoying your morning coffee on a sunny terrace, and knowing that your property in Crete isn’t just a beautiful place to live—it’s also a smart investment.

That’s why more and more people are buying property in Crete. Affordable homes, great rental demand, and a relaxed Mediterranean lifestyle make it one of the best places to invest in real estate.

But before you start, you probably have a few important questions:

- Is now a good time to buy?

- Can foreigners own property in Crete?

- What are the legal steps?

- How much does it cost?

The good news? You’re in the right place.

In this guide, you’ll learn everything—from how to find the best locations to understanding legal requirements, avoiding costly mistakes, and making sure your purchase goes smoothly.

Here’s what we’ll cover:

- Why Buy Property in Crete?

- Who’s Buying Property in Crete?

- Why Crete Is a Smart Investment

- How to Find a Property in Crete

- Where Are the Best Places to Buy in Crete?

- New Developments vs. Traditional Homes

- What to Look for When Choosing a Property

- How to find the right property in Crete

- Step-by-Step Process of Buying Property in Crete

- Legal Considerations

- Property Taxes

- Avoid Real Estate Scams

- Hidden Costs

- Property Management

Every section will give you clear, practical advice to help you buy property in Crete with confidence.

Let’s dive in.

Why Buy Property in Crete?

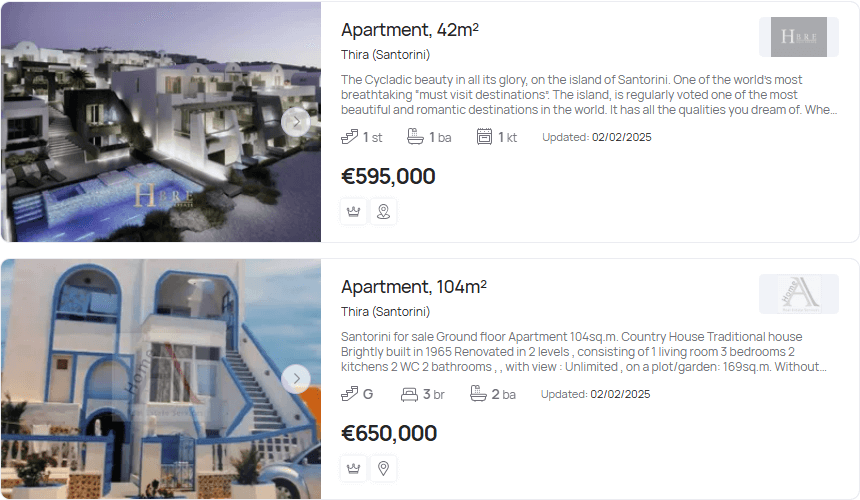

If you’ve ever thought about buying property in Greece, chances are you’ve looked at Santorini, Mykonos, or the French Riviera. And at first glance, they seem like great options.

But there’s a catch.

Prices in these locations have skyrocketed. A small one-bedroom apartment in Santorini’s Thira? That’ll set you back €500,000 or more. A luxury villa? Easily €2 million+.

That’s why savvy investors are turning to Crete instead.

1. Prices Are Rising—But Still Affordable

Right now, Crete is one of the last remaining places in the Mediterranean where you can still find affordable real estate.

A modern two-bedroom apartment in Chania or Rethymno goes for €150,000 – €250,000.

A private villa with a pool?

Somewhere between €350,000 – €600,000.

Even seafront luxury properties often stay under €1 million, which is a fraction of what you’d pay in Spain or Italy.

But here’s what makes this even more interesting.

Over the past five years, property values in Crete have increased 8-12% annually—and the trend isn’t slowing down.

More international buyers are moving in, which means prices will keep climbing.

That’s why many people are wondering if buying property in Crete is a good investment.

And based on the numbers?

It absolutely is.

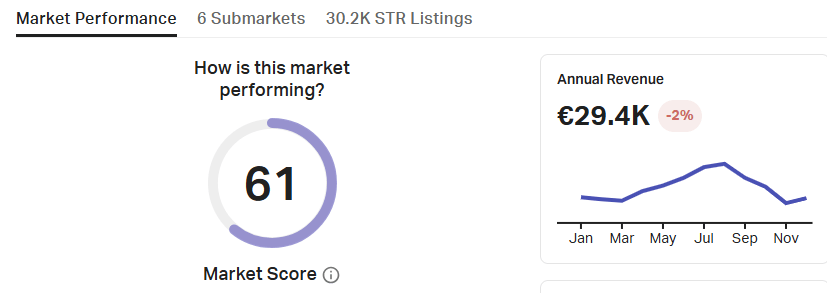

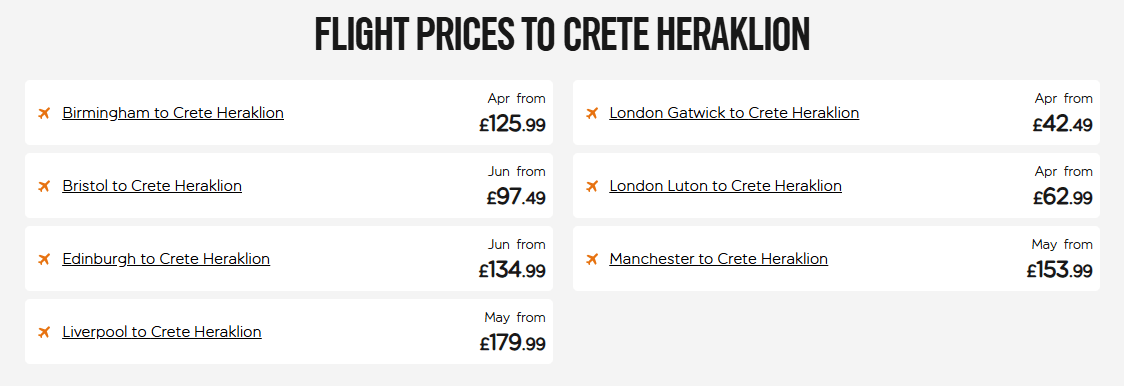

2. Crete’s Rental Market Is Booming

A lot of buyers in Crete aren’t just looking for a vacation home—they want a property that generates income.

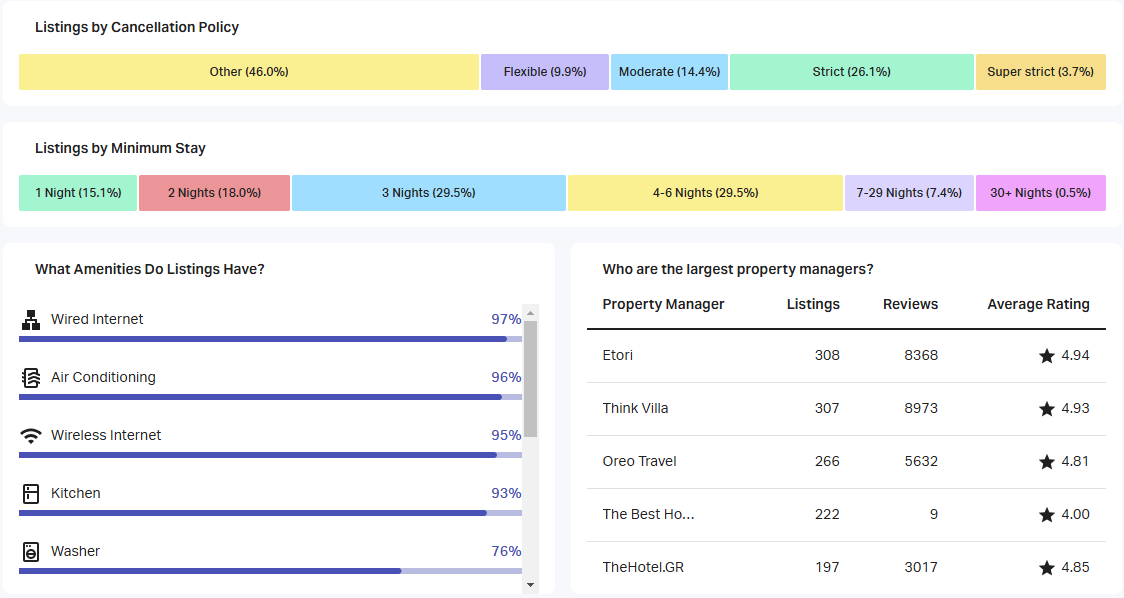

And Crete happens to be one of the strongest rental markets in Greece according to AirDNA.

Over 6 million tourists visit Crete every year, making it one of the most visited destinations in the Mediterranean.

Airbnb properties are booked months in advance, with some earning €50,000+ per year. And unlike smaller islands that rely only on summer tourism, Crete has strong long-term rental demand too.

Expats. Digital nomads. Year-round residents.

That’s why more investors are realizing that a well-located property in Crete can generate rental income in both peak season and off-season.

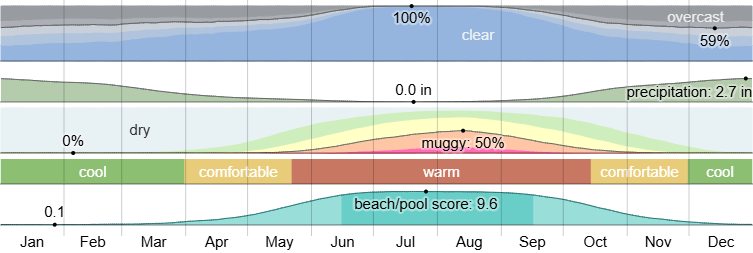

3. A Year-Round Destination (Unlike Other Greek Islands)

One of the biggest downsides of buying property in Mykonos or Santorini? It’s highly seasonal.

In the summer, tourists flood in. But once October rolls around, businesses shut down, and rental demand plummets.

Crete is different.

Cities like Chania, Heraklion, and Rethymno stay active year-round. Long-term rental demand remains strong because of expats, students, and remote workers who live in Crete full-time.

And winter tourism is on the rise, with hiking, historical sites, and a milder climate attracting visitors even in the off-season.

Translation?

If you own a property in Crete, you’re not just making money in the summer—you can rent it out year-round.

4. Mediterranean Lifestyle Without the High Cost

Let’s be real—one of the biggest reasons people move to Crete is the lifestyle.

Imagine starting your day with a morning swim in crystal-clear waters. Stopping at a local taverna for fresh Mediterranean food (for half the price of Spain or Italy).

And actually enjoying life, instead of rushing through it.

And here’s the best part.

Even though Crete offers one of the best qualities of life in Europe, it’s still incredibly affordable.

A seaside dinner for two? €30-40.

Monthly groceries for a couple? €300-400.

Property taxes? A fraction of what you’d pay in Spain or Italy.

For retirees, digital nomads, and lifestyle buyers, Crete is a dream destination that doesn’t break the bank.

Who’s Buying Property in Crete?

Crete’s real estate market isn’t just growing—it’s booming. And that’s not by accident.

More international buyers are entering the market than ever before.

Some are looking for a vacation home. Others want a strong investment. And for a growing number of people, Crete is becoming their full-time home.

European Buyers Looking for a Second Home or Retirement Villa

For years, buyers from the UK, Germany, and Scandinavia have been securing homes in Crete.

Some are retirees looking for a sunny escape.

Others want a second home they can use for part of the year.

The appeal?

- Lower property prices compared to Spain, France, or Italy

- Affordable cost of living with a high quality of life

- Mild winters and year-round sunshine

With property prices rising, more European buyers are getting in before Crete becomes as expensive as other Mediterranean hotspots.

Real Estate Investors Taking Advantage of High Rental Demand

Crete is one of Greece’s top-performing rental markets.

That’s why real estate investors—especially from the US, UK, and Europe—are entering the market in record numbers.

Some focus on short-term vacation rentals, earning high returns from Crete’s 6+ million annual tourists.

Others go for long-term rentals, targeting the island’s growing expat and remote worker community.

Either way, the numbers make sense. High rental demand, strong occupancy rates, and rising property values make Crete a prime location for real estate investment.

Digital Nomads and Expats Moving to Crete Full-Time

The rise of remote work has changed everything.

More people are realizing they don’t need to live in expensive cities like London, Berlin, or New York.

Instead, they’re choosing places where they can work from the beach, enjoy a relaxed lifestyle, and pay lower living costs.

And Crete checks all the boxes:

- Affordable housing compared to Western Europe

- A relaxed Mediterranean lifestyle with great food and culture

- Modern infrastructure and strong internet connectivity

That’s why Crete is quickly becoming one of the top destinations for digital nomads and full-time expats.

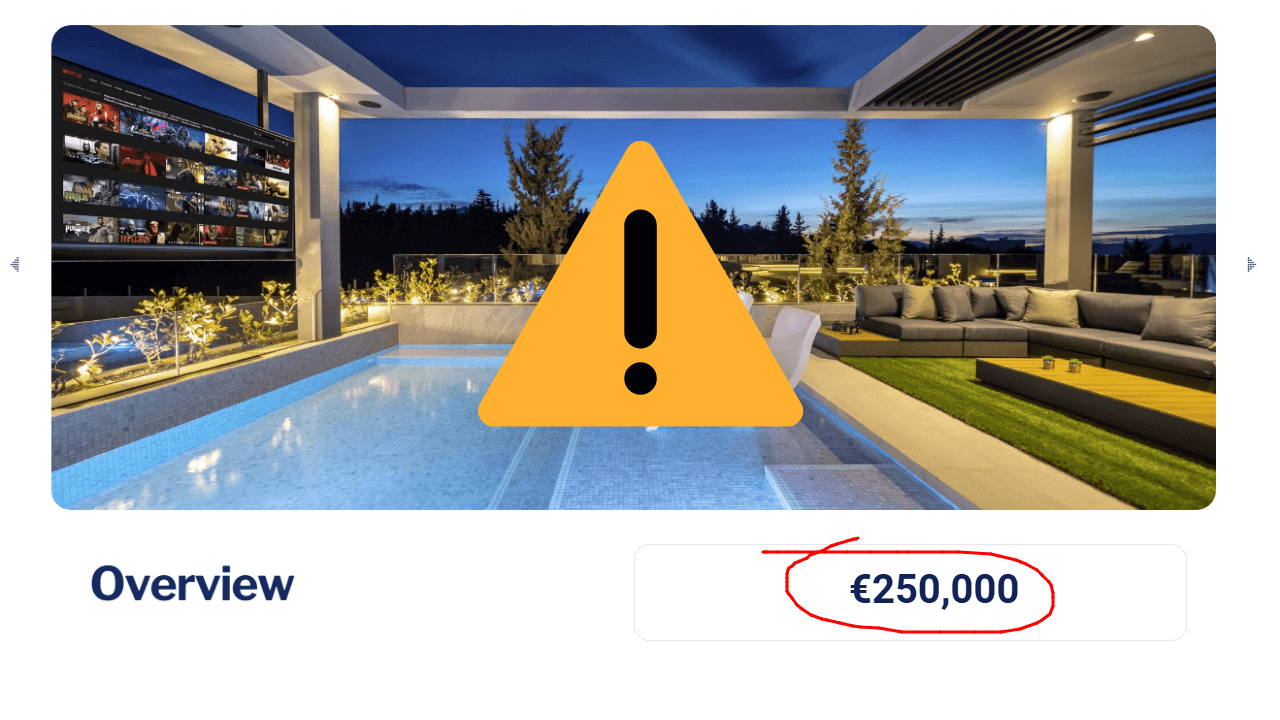

Non-EU Buyers Using the Golden Visa Program

For non-European buyers, Crete offers a huge bonus: EU residency.

With Greece’s Golden Visa program, non-EU citizens can get European residency by investing at least €250,000 in real estate.

Several changes came into effect in 2024, increasing the previous threshold of €250,000 in high-demand areas like Crete, but this treshold is still valid for commercial and historical properties. That’s why international buyers are rushing to purchase property before prices climb even higher.

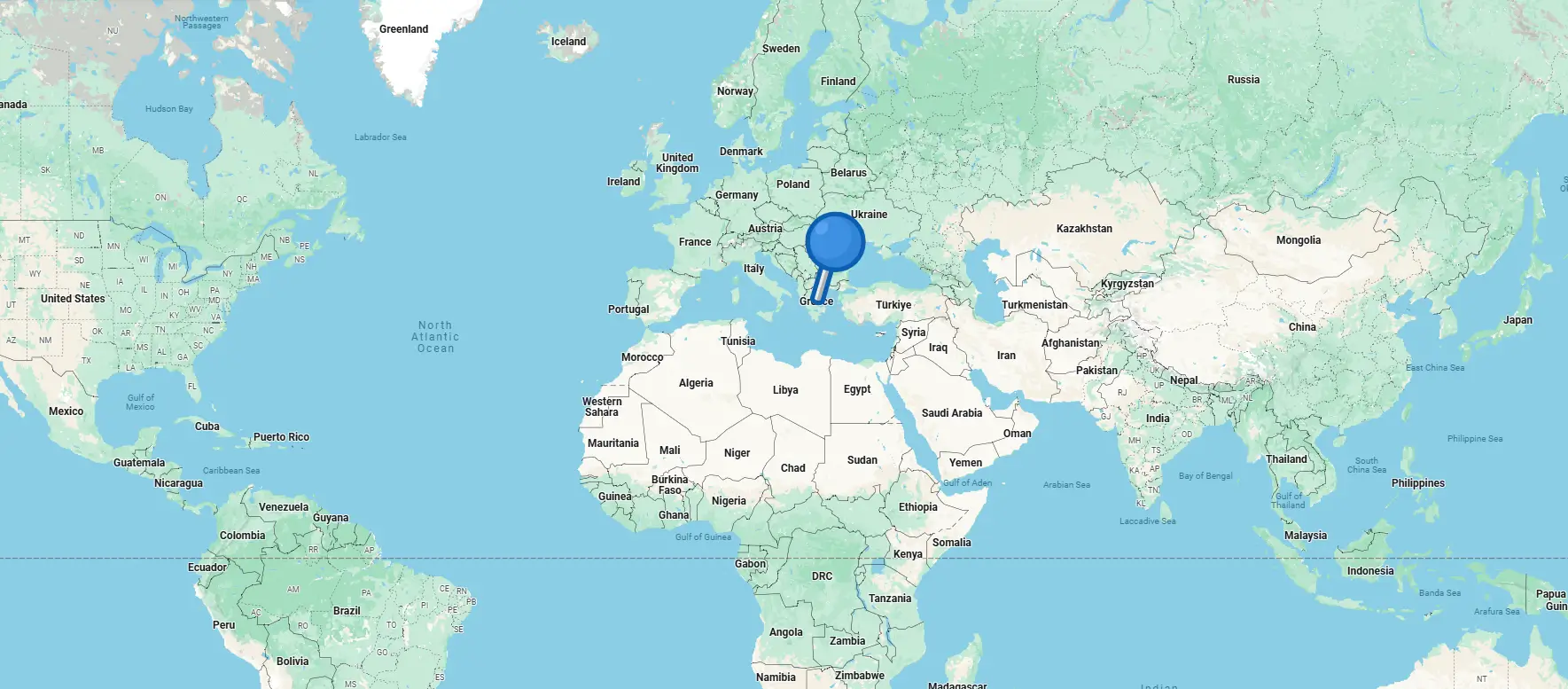

So, Why Crete Is a Smart Investment

Crete isn’t just another Greek island—it’s a rising real estate hotspot.

- Prices are still affordable but increasing fast.

- Rental demand is strong, offering high returns.

- It’s a year-round destination, perfect for both living and investing.

The smart investors? They’re buying now, before Crete reaches full market maturity.

What’s Next?

Now that you know why Crete is a great place to buy property, let’s talk about the how.

Where should you buy?

Should you go for a new development or a traditional home?

What should you look for when choosing a property?

Let’s break it all down in the next section.

How to Find a Property in Crete

So, you’ve decided that buying property in Crete is the right move.

You’re picturing the Mediterranean lifestyle, the investment potential, and the idea of owning a home in one of Europe’s most beautiful locations. But now comes the big question:

How do you actually find the right property?

Because let’s be real—there’s a big difference between buying a perfect home and making a costly mistake.

Some properties in Crete are incredible investments, while others come with hidden legal issues, inflated prices, or low appreciation potential.

That’s why this section is all about helping you make the right choice—so you end up with a property that fits your needs, holds its value, and delivers solid returns if you’re investing.

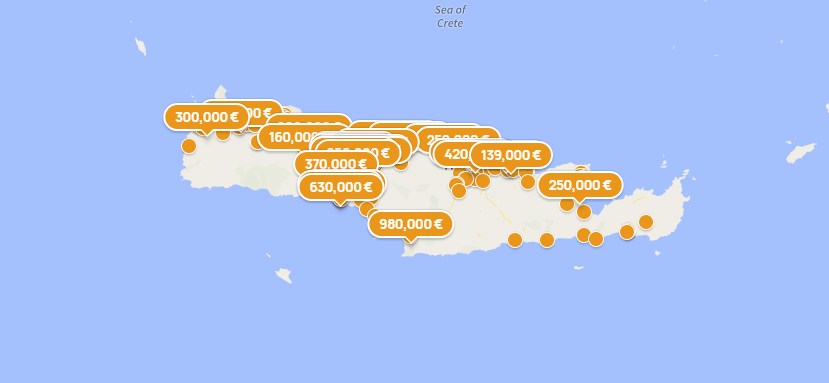

Where Are the Best Places to Buy in Crete?

Crete is huge—it’s the largest island in Greece. And that means not all locations offer the same benefits.

Some areas are perfect for short-term rentals. Others are better for long-term appreciation.

And some are ideal if you’re looking for a peaceful retirement home.

Let’s break down the top real estate markets in Crete—and which one is right for you.

Chania: The Most In-Demand Market for Expats & Investors

If there’s one place that’s always in demand, it’s Chania.

With its stunning Old Town, world-famous Venetian harbor, and some of the best beaches in Greece, it’s no surprise that Chania is one of the most profitable places for real estate.

And buyers are paying attention.

Property prices in Chania have been climbing 10-15% per year, and demand from international investors, expats, and retirees is at an all-time high.

If you’re looking for a location that’s perfect for Airbnb rentals, long-term appreciation, or a strong expat community, Chania is the place to be.

Who is buying here?

- Short-term rental investors – Airbnb demand is through the roof.

- Expats & retirees – Chania has a strong international community.

- Long-term investors – Property values are rising fast.

What’s the catch?

- Prices are higher than in other parts of Crete, but demand makes up for it.

- The Old Town is expensive, but nearby areas like Nea Chora and Kounoupidiana offer better value.

Rethymno: The Best Growth Market for Appreciation

If you’re looking for an up-and-coming market before prices peak, Rethymno should be on your radar.

It’s following the same pattern Chania did five years ago—strong tourism growth, increasing interest from foreign buyers, and rising property values.

But unlike Chania, Rethymno is still affordable, which means there’s room for even more appreciation.

Who is buying here?

- Investors looking for appreciation – Prices are climbing but still lower than Chania.

- Buyers who want a balance between city life and a relaxed lifestyle.

- Airbnb investors – The rental market is growing fast.

What’s the catch?

- Rethymno isn’t as developed as Chania yet, but that’s what makes it a great opportunity.

- The Old Town is getting expensive, so looking at nearby coastal areas offers better value.

Heraklion: The Best Place for Year-Round Rentals

Unlike Chania and Rethymno, Heraklion isn’t just a tourist destination—it’s also Crete’s economic hub.

That means rental demand is year-round, thanks to professionals, students, and expats who live in the city full-time.

If you’re looking for a stable, long-term investment with consistent rental income, Heraklion is a smart choice.

Who is buying here?

- Investors looking for steady, long-term rental income.

- Buyers who prefer a big city environment with modern infrastructure.

- People who want to be near hospitals, universities, and major businesses.

What’s the catch?

- Heraklion is a city, not a resort town, so it doesn’t have the same vacation vibe as Chania.

- The Old Town is great for rentals, but prices are rising fast.

Lasithi (Elounda & Agios Nikolaos): The Luxury Market

For high-end real estate, Lasithi is where luxury buyers and high-net-worth investors are putting their money.

Elounda, known as the Greek Riviera, is home to some of the most exclusive resorts and luxury villas in Greece.

And Agios Nikolaos offers a charming coastal town atmosphere with high-end real estate opportunities.

Who is buying here?

- Luxury investors – Elounda is one of Greece’s most prestigious locations.

- Buyers looking for long-term appreciation in high-end properties.

- People who want peace, exclusivity, and stunning beachfront locations.

What’s the catch?

- Prices are already high, so this market is best for long-term appreciation rather than quick gains.

Crete has something for everyone—whether you’re looking for a high-growth investment, a rental property, or a place to retire by the sea.

Now that you know where to buy, the next step is making sure you find the right property at the right price.

Let’s break that down in the next section.

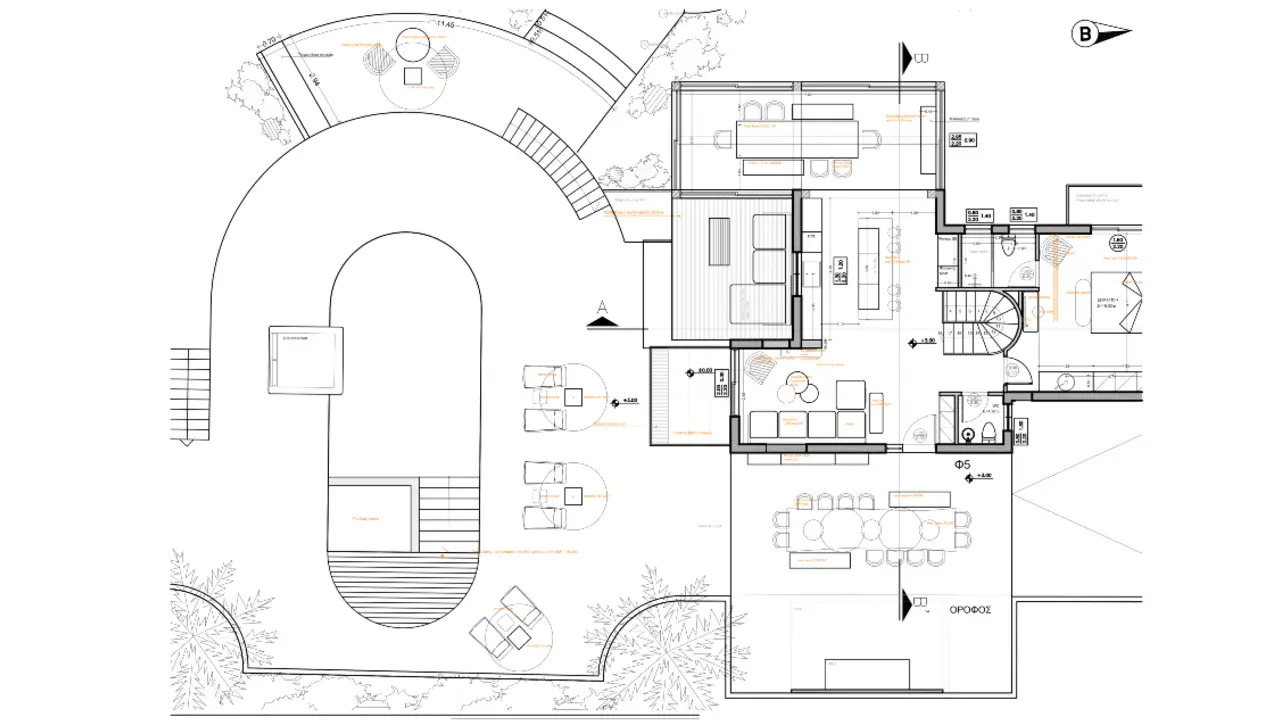

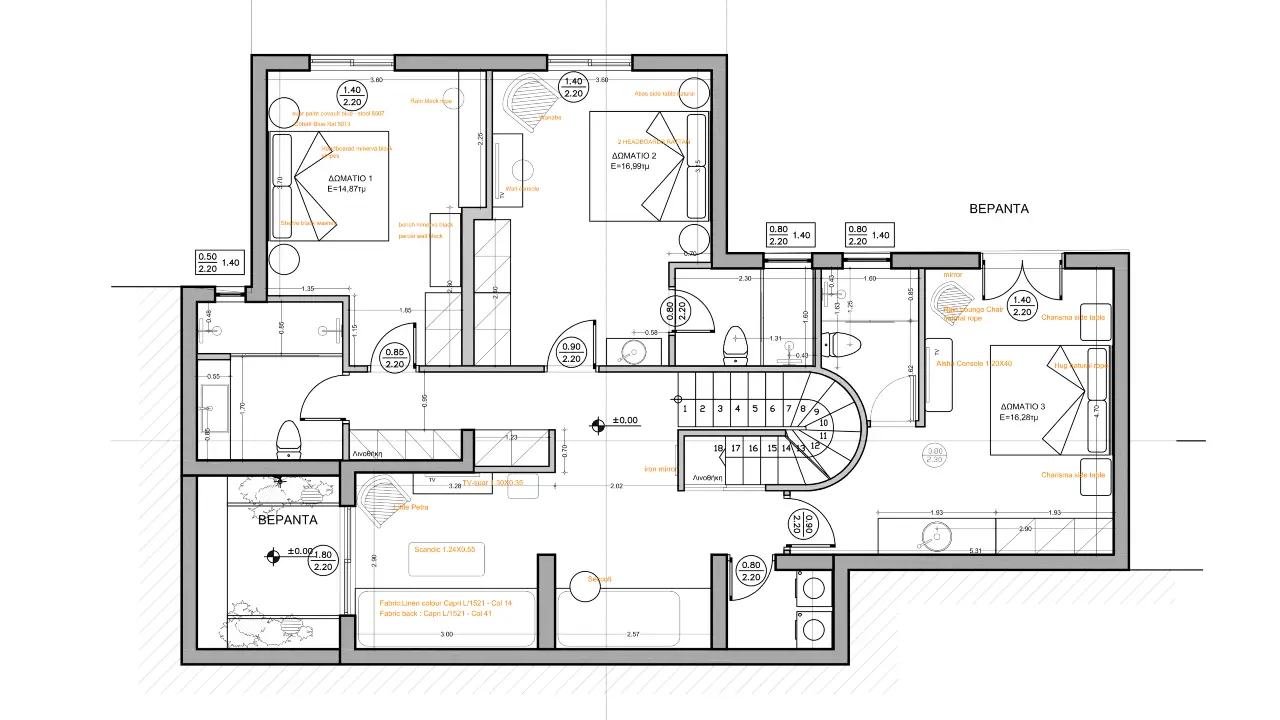

New Developments vs. Traditional Homes: Which One Is Better?

Once you’ve picked a location, the next big decision is:

Do you go for a modern, newly built property, or do you invest in a traditional Cretan home with character?

Both have their advantages—and the right choice depends on what you’re looking for.

Option 1: New Developments & Modern Villas

If you want something move-in ready, with modern finishes and no renovation work, a new development or contemporary villa might be the best fit.

These properties are designed with energy efficiency, smart-home features, and open layouts—perfect for buyers who want comfort and convenience from day one.

New properties are also easier to rent out, especially if you’re targeting high-end vacation rentals.

Many tourists prefer modern villas with private pools, sea views, and sleek interiors over traditional village homes.

But there’s a trade-off.

Pros of Buying a New Development

- No renovation needed—move in immediately.

- Energy-efficient with smart-home features.

- Higher rental appeal for luxury vacation stays.

Cons of Buying a New Development

- More expensive than older homes.

- Lacks traditional charm compared to historic properties.

We’ve built a Construction Calculator to empower you to make smarter decisions.

By integrating data from multiple trusted sources, it offers a clear, comprehensive overview of the costs involved in new developments.

Option 2: Traditional Stone Houses & Village Homes

If you’re looking for authentic charm, Crete’s traditional stone houses offer a completely different experience.

These homes—often found in quiet villages or historic town centers—come with stone walls, wooden beams, and Mediterranean-style courtyards.

Many buyers love them for their unique character and timeless appeal.

They also tend to have lower purchase prices, but there’s a catch: renovation work. Some properties need major updates, and renovation costs can be unpredictable.

However, if you buy in an up-and-coming area, the appreciation potential is huge.

Boutique vacation rentals, especially in historic homes, can be highly profitable.

But, as with any older property, you need to do your research. Some traditional homes have legal issues, like unclear ownership records or zoning restrictions.

Pros of Buying a Traditional Home

- Lower purchase price (but renovation costs vary).

- Unique character—perfect for boutique vacation rentals.

- Strong appreciation potential in the right location.

Cons of Buying a Traditional Home

- Renovation work can be unpredictable.

- Some properties may have legal issues.

Which One Should You Choose?

If you want a hassle-free, modern home with high rental appeal, a new development is the best option.

But if you’re willing to invest time and money into renovations, a traditional home can offer more character, higher appreciation, and better long-term value.

Whichever route you choose, doing your due diligence is key.

That’s why the next section will cover how to avoid legal pitfalls and ensure your investment is protected.

What to Look for When Choosing a Property

Before making an offer, there are a few key factors you need to check.

A property might look perfect on the surface, but if you don’t do your due diligence, you could run into legal issues, slow appreciation, or rental struggles down the line.

Here’s what to look for.

1. Legal Status

This is non-negotiable.

Crete has many older homes that don’t have clear title deeds.

Some properties have been passed down through generations without proper documentation, which can lead to ownership disputes or legal complications.

Before committing to a purchase, always make sure:

- The property has a clear and verified title deed.

- There are no outstanding debts, liens, or zoning restrictions.

- You have a lawyer who specializes in Greek property law to review everything.

2. Location Growth & Appreciation Potential

Not all areas in Crete appreciate at the same rate.

Some locations are seeing huge demand and rising prices, while others are slower to develop.

Ask yourself:

- Are property values increasing?

- Are new developments happening nearby?

- Is tourism growing in the area?

For example, Chania and Rethymno have seen double-digit price growth in recent years, while more remote villages may take longer to gain value.

3. Rental Demand & Occupancy Rates

If you’re buying a rental property, you need to check if the area has consistent demand.

For short-term rentals, look at Airbnb occupancy rates.

Are properties booked out during peak season?

How competitive is the market?

For long-term rentals, check if there’s a steady stream of expats, students, or professionals who need housing.

Locations like Heraklion have strong year-round rental demand, while seasonal towns may slow down in the winter.

4. Future Infrastructure & Connectivity

A property’s long-term value is directly tied to its accessibility.

Check if the location has:

- Good road connections to highways and major cities.

- Proximity to an airport, especially if you plan to rent to international guests.

- Access to hospitals, schools, and shopping centers.

Future infrastructure projects—like new highways, airport expansions, or tourism developments—can significantly boost property values over time.

How to Find the Right Property in Crete

Buying property in Crete is an exciting opportunity.

But finding the right property?

That’s where things get tricky.

Because not every home on the market is a smart investment.

Some are overpriced.

Others come with legal headaches.

And some simply won’t give you the rental income or long-term appreciation you expect.

So how do you avoid making a bad deal?

Simple: You need to know where to buy, what to look for, and how to spot red flags before committing.

Let’s go step by step.

Start with Your Buying Goals

Before you even start looking at listings, you need to get clear on one thing: What do you want from this property?

Because different types of properties serve different purposes.

Are you looking for rental income? Then you’ll need a home in a tourist-heavy area with strong Airbnb demand.

Are you buying for long-term appreciation? Then you should focus on emerging areas where prices are rising but still affordable.

Are you looking for a personal home? Then lifestyle factors—like whether you prefer a quiet village, a bustling city, or a beachfront location—should guide your decision.

If you don’t define your end goal upfront, you could end up with a property that doesn’t fit your needs.

How to Spot a Good Deal (And Avoid Overpaying)

Crete’s real estate market isn’t always transparent. Some properties are fairly priced, while others are listed at 20-30% above market value—just to see if foreign buyers will bite.

How do you avoid overpaying?

- Look at recent sale prices—not just listing prices. A property sitting at €500,000 for a year doesn’t mean it’s worth €500,000.

- Work with a local real estate expert—someone who understands market pricing and can tell you when a listing is overpriced.

- Visit the property in person—some listings look amazing in photos but have road access issues, noise problems, or legal complications.

Finding the Right Property in Crete Takes Strategy

Buying property in Crete is an amazing opportunity—but only if you do it right.

The key? Know your goals, choose the right location, and make sure you’re paying the right price.

Because the best investments aren’t just about finding a property you like—they’re about finding the right property at the right price.

What’s Next?

Now that you know where to buy and how to find a great deal, let’s talk about how to legally buy property in Crete—step by step.

- What legal documents do you need?

- How do you make an offer and close the deal?

- What taxes and fees should you expect?

Let’s break it all down in the next section.

The Step-by-Step Process of Buying Property in Crete

Imagine this.

You’ve just found your dream property in Crete—a stunning villa with panoramic sea views, or maybe a cozy stone house tucked away in a charming village.

The price is right.

The location is perfect.

Now what?

Because while buying property in Crete is one of the best investments you can make, the process itself isn’t always simple.

Greek real estate laws? Different from what you’re used to.

Paperwork? Lots of it.

Delays? Very possible.

This is where most buyers get stuck. Not because they chose the wrong property—but because they weren’t prepared for what comes next.

But here’s the thing.

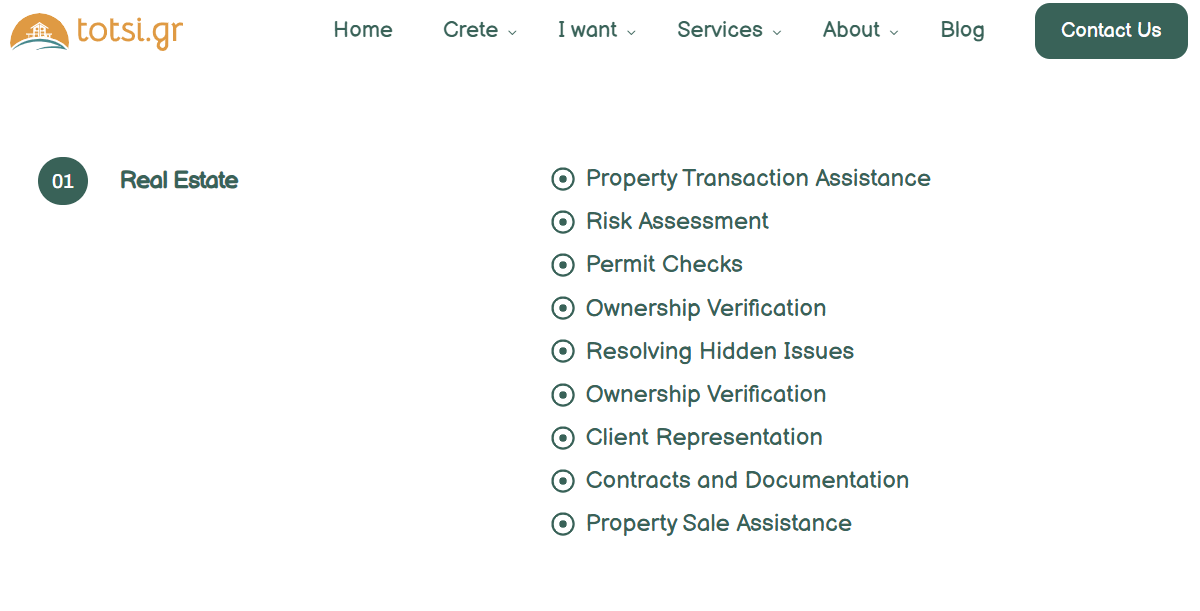

Totsi has already helped countless buyers navigate this process—handling everything from tax registration to final contracts.

If you want to avoid legal headaches, we take care of it for you.

Let’s break it all down.

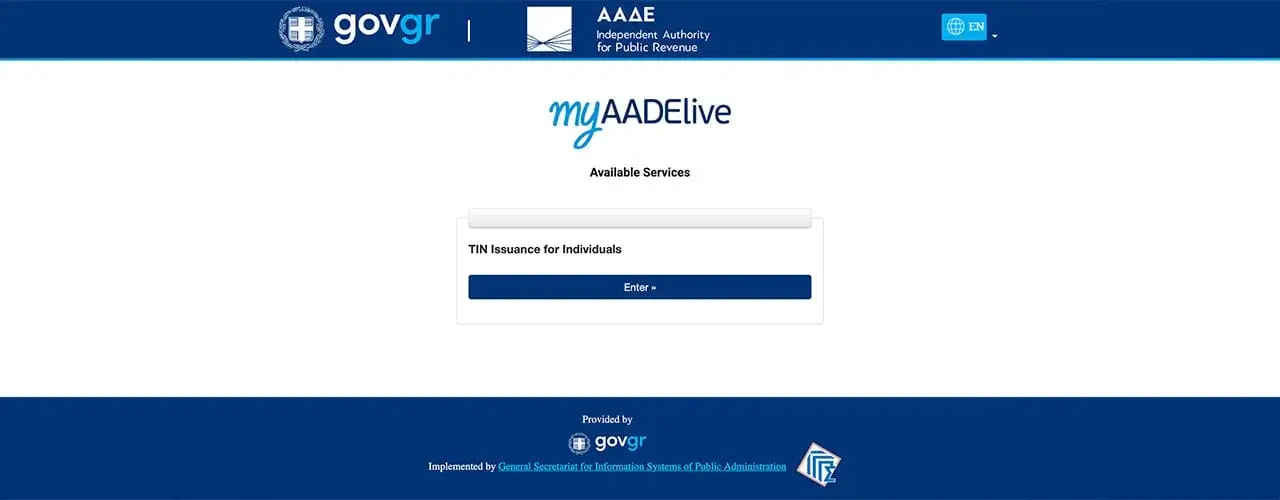

Step 1: Get Your Greek Tax Number (AFM)

Before you can legally buy property in Crete, you need a Greek tax number—the AFM (ΑΦΜ – Arithmos Forologikou Mitroou).

Without this number, you can’t sign contracts, pay property taxes, or even open a Greek bank account.

Now, here’s where it gets tricky.

If you’re not in Greece, getting an AFM means going to a local tax office (Eforia), dealing with bureaucracy, and handling Greek paperwork.

Or, you can skip all that.

At Totsi, we handle the entire process for you. We apply for your AFM remotely through a Power of Attorney (PoA), so you don’t even have to leave your home country.

Step 2: Hire a Real Estate Lawyer (Or Let Us Handle It)

This is where things can go very wrong.

Greek real estate law is not like in other countries. There are properties with unclear ownership, unpaid debts, and missing permits.

Some even have multiple owners who don’t fully agree to sell.

Without a specialized real estate lawyer, you could unknowingly buy a property with legal problems that take years to fix.

That’s why we only work with the best real estate lawyers in Crete—experts who check every single legal detail before you sign anything.

- They verify the title deed to make sure the seller actually owns the property.

- They check for outstanding taxes, debts, or hidden claims.

- They confirm that all necessary building permits are in place.

If there’s a problem? You’ll know about it before you buy—not after.

Step 3: Open a Greek Bank Account (If You Want to Avoid Delays)

You will need a Greek bank account to buy property.

It takes time to open one, so you have to plan accordingly.

Here’s the reality:

Most international buyers who delay this step end up wishing they hadn’t.

Opening a bank account in Greece means you’ll need:

✔ Your passport

✔ Your AFM (Greek tax number)

✔ Proof of address (like a utility bill)

✔ A source of income statement (to comply with Greek financial laws)

And yes, we handle this for our clients too.

Our team walks you through the process, making sure everything is set up before you transfer a single euro.

Step 4: Make an Offer & Negotiate Like a Local

If you’re new to Crete’s real estate market, here’s something you need to know:

Property prices are almost always negotiable.

The problem? Sellers know that international buyers are willing to pay more.

And if you don’t know the market, you could end up overpaying by tens of thousands of euros.

That’s why negotiation is key.

At Totsi, we use our local expertise to:

✔ Research comparable properties, so you know what’s fair.

✔ Negotiate on your behalf—so you don’t have to worry about price games.

✔ Ensure your offer is competitive, while still getting you the best deal.

Once you and the seller agree on a price, the next step is locking in the deal legally.

Step 5: Sign the Preliminary Agreement & Begin Due Diligence

This is the moment when a lot of buyers make the biggest mistake of the entire process.

They get excited. They rush. They sign too soon.

Here’s how we do it differently.

Before you sign the final purchase contract, we arrange a Preliminary Agreement (Pro-Symfono Agoras).

Think of this as a safety net—a legal document that:

- Locks in the price while due diligence is completed.

- Gives you time to verify every legal aspect of the property.

- Prevents the seller from backing out or selling to someone else.

During this stage, our lawyers conduct:

✔ Title deed verification—ensuring the seller is the true owner.

✔ A full legal audit—checking for unpaid taxes, debts, or disputes.

✔ Permit confirmation—making sure the property meets all legal requirements.

This process can take a few weeks to a couple of months—but that’s a small price to pay to avoid costly surprises.

Step 6: Sign the Final Contract & Transfer Ownership

Once every legal check is complete, it’s time for the final signing.

This happens at a Greek notary’s office, where everything is officially recorded.

At this stage, you will:

- Pay the property transfer tax (3,09% of the purchase price).

- Sign the final contract in front of the notary.

- Transfer the remaining balance to the seller.

And just like that—the property is yours.

The notary registers the property under your name at the Greek Land Registry, and you receive the official title deed.

Buying in Crete is Easy—If You Have the Right Team

Buying property in Crete doesn’t have to be complicated—but it does require the right process, the right experts, and the right strategy.

If you go in alone? You’ll deal with endless paperwork, legal risks, and negotiation challenges.

If you rush through the steps? You could end up overpaying or buying a property with legal issues.

If you work with Totsi? We handle everything for you—from start to finish.

✔ We secure your Greek tax number.

✔ We have our lawyers to protect your investment.

✔ We negotiate to get you the best price.

✔ We make sure your property is legally clear before you buy.

So when you finally step into your new home in Crete, you know it was done the right way—without stress, without surprises, and with full confidence in your investment.

What’s Next?

Now that you own property in Crete, what happens next?

- What taxes and fees do you need to pay?

- How do you legally register your property?

- What common legal pitfalls should you watch out for?

Let’s break it all down in the next section.

Legal Considerations & Avoiding Common Pitfalls

You’ve signed the contract. The property is officially yours. Time to celebrate, right?

Not so fast.

Because here’s something most buyers don’t realize until it’s too late—owning a property in Crete comes with legal responsibilities, tax obligations, and potential risks if you’re not careful.

Greek real estate law is complicated.

And if you skip important legal checks? It could cost you thousands.

We’ve seen it all—hidden debts, missing permits, legal disputes, and properties that weren’t even properly registered.

That’s why we handle everything for our clients, making sure their purchase is 100% legal, clear, and risk-free before they sign a single document.

Let’s go over what you need to check to protect your investment.

Title Deeds & Ownership Verification

Here’s something that happens way too often:

A buyer finds the perfect home. The price is great. The seller seems trustworthy.

But after signing, they find out the property wasn’t even legally owned by the seller—or worse, there were multiple heirs fighting over ownership.

Sound crazy? But It happens.

That’s why checking the title deed is the first and most important legal step.

We never let a client move forward until we’ve confirmed:

✔ Who actually owns the property—because sometimes, the seller isn’t the only owner.

✔ If there are unpaid loans, mortgages, or legal claims attached to the property.

✔ That the property is properly registered in the Greek Land Registry (Ktimatologio).

If there’s any uncertainty, we tell our clients to walk away.

Because in Crete, there’s always another great property waiting—and you don’t need to take unnecessary risks.

Property Taxes & Fees When Buying in Crete

Nobody likes paying taxes. But when you’re buying property in Crete, knowing what to expect upfront can save you from unexpected costs later.

A lot of buyers focus only on the purchase price, forgetting that there are legal and administrative fees that come with every real estate transaction.

And while Crete offers some of the lowest property taxes in Europe, there are still a few costs you need to account for.

So let’s break it down.

How Much Will You Pay in Fees?

When you buy property in Crete, you’ll need to budget for taxes, legal fees, and registration costs.

Here’s what that looks like:

- Property Transfer Tax (3,09%) – This is the biggest tax you’ll pay upfront. It’s based on the official assessed value of the property (which is often lower than the actual sale price).

- Notary Fees (1% – 1.5%) – The notary is a legal requirement in Greece. They oversee and register the sale to make it official.

- Legal Fees (1.5% – 2%) – Your lawyer handles all the legal paperwork, ensures the property has a clear title, and makes sure you’re not buying into a legal mess.

- Real Estate Agent Fees (2% – 3%) – If you use an agent, expect to pay a commission (sometimes split between buyer and seller).

- Land Registry Fees (0.6%) – This covers the official registration of the property in your name at the Greek Land Registry.

In total, you should budget around 8% – 10% of the purchase price for these costs.

Example: How Much Do These Fees Add Up To?

Let’s say you’re buying a property for €250,000.

Your total additional costs will be around €17,500 – €20,000.

This means if your budget is €250,000, you should actually be looking at properties in the €230,000 range to leave room for taxes and fees.

And here’s where buyers make a mistake:

Many forget about these costs until the last minute, which can put a deal at risk.

That’s why Totsi walks every client through these numbers upfront—so there are no surprises when it’s time to finalize the deal.

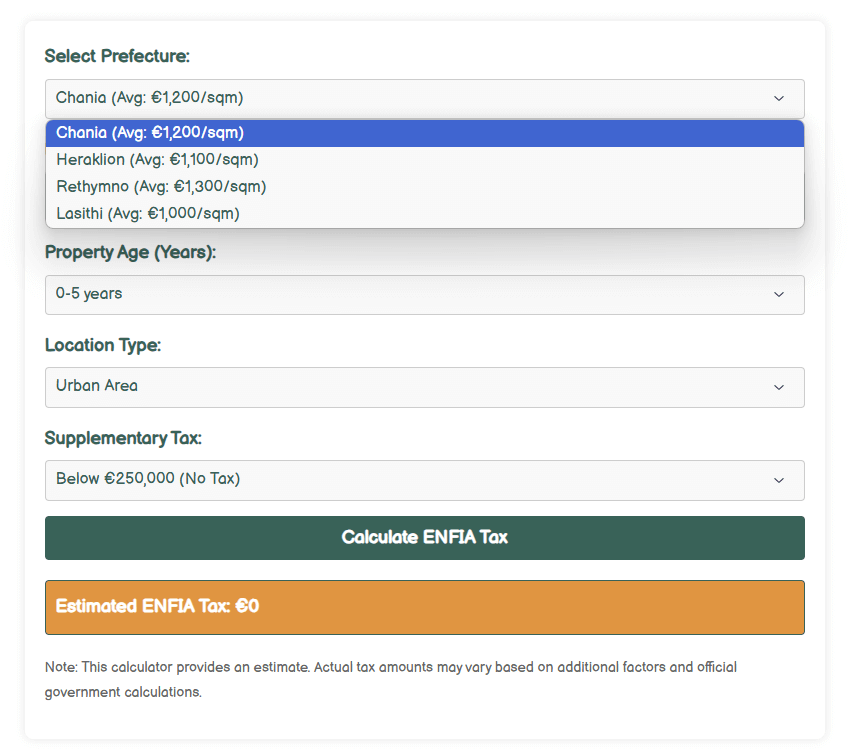

Our team has created a Property Tax calculator to have an idea about Property Taxes in Crete.

Building Permits & Illegal Constructions: What You Need to Know

Here’s where things can get tricky.

In Crete, many older properties—especially village homes and rural villas—were built before modern zoning laws existed.

Some have unauthorized extensions, unregistered rooms, or even entire floors that were never legally approved.

And while these properties might look charming, they can cause major headaches for buyers.

Why This Matters

If you buy a property without checking its legal status, you could face unexpected fines or—worse—you might be forced to remove illegal parts of the home.

Greek authorities have been cracking down on unauthorized constructions, and while some issues can be resolved with legalization fees, others might be impossible to fix.

How to Protect Yourself

Before signing anything, your lawyer should:

- Request an official building permit check to verify that everything is legally registered.

- Confirm that any renovations or additions were approved by local authorities.

- Check if the property is in a protected zone (such as a historical district or an environmental conservation area).

Red Flag Warning

If a seller tells you:

“Don’t worry, no one checks these things…”

That’s your alarm to run the other way.

Because when it comes to property laws in Greece, ignorance isn’t an excuse.

If something is illegal, it becomes your problem the moment you buy the property.

That’s why Totsi.gr ensures every property is fully legal and compliant before our clients move forward.

We don’t just find properties—we make sure they’re safe investments with no legal surprises.

How to Avoid Real Estate Scams in Crete

Crete is one of the safest places in Europe to buy property.

But let’s be real—wherever there’s real estate, there are also people looking to take advantage of buyers who don’t know the system.

Most sellers are honest.

Most agents are professional.

But every now and then, you’ll come across a deal that looks a little too good to be true—and that’s when you need to step back and ask the right questions.

We’ve seen it all—fake owners, illegal sales, and overpriced properties designed to trick foreign buyers into overpaying.

That’s why we handle all legal checks upfront, so our clients don’t fall into these traps.

Here’s what to watch out for—and how to make sure you don’t get scammed.

The “Too Good to Be True” Price

Imagine this: You’re browsing properties online and you see a stunning villa with a sea view for half the price of everything else nearby.

What’s the first thought that comes to mind?

“This is an amazing deal! I need to act fast before someone else takes it.”

That’s exactly what the seller wants you to think.

The truth? There’s always a reason for an unusually low price.

It could be:

- The property has legal issues (like unclear ownership or unpaid taxes).

- The house was built without proper permits, making it illegal to sell.

- There are major structural problems, and fixing them could cost more than the house itself.

How to Avoid It:

Never buy a property in Crete without a full legal and structural check. Before you pay a deposit, your lawyer should:

✔ Verify the title deed to make sure ownership is clear.

✔ Check the Land Registry records for debts, disputes, or legal claims.

✔ Confirm that all building permits are valid and up to date.

We investigate every property before recommending it to clients. If the price seems too good to be true, we find out why—so you don’t get caught in a bad deal.

The Fake Owner Scam

This one is more common than you’d think.

You find a beautiful traditional stone house in a village.

The seller is friendly, speaks perfect English, and offers you an amazing price.

You’re excited.

But then, your lawyer does a title search and discovers:

The person selling the property doesn’t actually own it.

How does this happen?

Many homes in Crete are inherited, and in some cases, a property is technically owned by multiple family members—some of whom may not even know the house is being sold.

So if you pay a deposit to a fake or partial owner, you could lose your money and never legally own the property.

How to Avoid It:

✔ Your lawyer should always verify the full list of legal owners at the Greek Land Registry.

✔ If there are multiple heirs, every single one must agree to the sale in writing.

✔ Never pay a deposit until you have written confirmation that the seller has full legal ownership.

We handle this verification before any deal moves forward—because the last thing you want is to spend months negotiating, only to find out later that the seller didn’t even have the right to sell the property.

The “Verbal Agreement” Trick

A seller tells you, “We don’t need to go through lawyers. Let’s just sign a private agreement and keep it simple.”

🚩 Red flag. Huge red flag.

In Greece, a verbal agreement is not legally binding, and even a private written contract is worthless unless the sale is officially signed in front of a Greek notary and registered at the Land Registry.

Here’s what happens if you skip the legal process:

- You don’t legally own the property, even if you paid for it.

- The seller could sell the property again to someone else—leaving you with nothing.

- You could discover hidden debts, unpaid taxes, or legal disputes tied to the property after you’ve already paid for it.

How to Avoid It:

✔ Always work with a qualified real estate lawyer.

✔ Never hand over money without a formal sales contract signed before a notary.

✔ Make sure the property is officially registered in your name at the Land Registry.

We ensure that every transaction is fully legal and documented—so you don’t get trapped in a bad deal.

Avoiding Legal Pitfalls Is Simple—If You Do Your Homework

Buying property in Crete should be an exciting and rewarding experience—but only if you take the right precautions from the start.

Because let’s be honest—the Greek real estate system isn’t designed for foreigners. The paperwork is in Greek, the legal processes are different from what you may be used to, and if you don’t check everything carefully, you could run into serious problems down the line.

But here’s the good news:

Most real estate transactions in Crete are completely legal and safe.

You just need to make sure you’re buying smart.

The Simple Formula for a Risk-Free Purchase

1️⃣ Work with a qualified real estate lawyer

- They’ll check the title deed, confirm ownership, and make sure the property has no hidden debts or legal claims.

- Totsi.gr handles all legal checks for our clients, so you never have to worry about unexpected surprises.

2️⃣ Check all property documents before signing anything

- Never take the seller’s word for it—verbal agreements mean nothing in Greece.

- The sale is only legally valid if it’s signed in front of a notary and registered at the Land Registry.

3️⃣ Make sure all taxes and fees are paid before you buy

- Unpaid property taxes, utility bills, or municipal fees from the previous owner can become your responsibility once you take ownership.

- Our team ensures that every property we recommend is fully cleared of outstanding debts before you sign a contract.

If you follow these three steps, you can buy property in Crete with total confidence—without stress, without legal headaches, and without worrying about hidden risks.

What’s Next?

Now that you understand the legal side of buying property in Crete, let’s talk about something just as important—how to finance your purchase.

- Can foreigners get a mortgage in Greece?

- Is it better to pay in cash or take out a loan?

- What hidden costs should buyers expect when financing a property?

Let’s break it all down in the next section.

Buying with a Mortgage or Cash?

So, you’ve found the perfect property in Crete.

The location is ideal, the legal checks are done, and you’re ready to make your move.

Now comes the big question: How do you actually pay for it?

If you’re buying in cash, things are simple.

You transfer the money through the bank, sign the contract, and congratulations—you’re a property owner in Greece.

But if you’re considering financing your purchase with a mortgage?

That’s where things get a little more complicated.

At Totsi.gr, we help buyers understand their financing options before they commit—because in Greece, getting a mortgage isn’t as easy as it might be in other countries.

Let’s break down your options and what you need to watch out for.

Should You Get a Mortgage or Pay via Bank Transfer?

This is the big decision, right? Should you finance your purchase, or transfer the full amount from your bank upfront?

In Greece, cash payments for real estate transactions are not legally allowed.

Every property purchase must go through a bank account to ensure full transparency and compliance with tax regulations.

So, whether you’re financing the purchase with a mortgage or transferring the full amount from your savings, the key question is: Which option is right for you?

Let’s break it down.

Option 1: Transferring the Full Amount via Bank Transfer

If you have the funds available, this is by far the fastest and simplest way to buy property in Crete.

Why?

- No need to deal with Greek banks for a mortgage—which can be slow and complicated.

- You can finalize the deal much faster—mortgage approvals can take months.

- Sellers prefer buyers with immediate funds—this gives you better negotiation power.

However, it’s important to plan your bank transfer carefully.

- The Greek government requires proof that the money comes from a legal, declared source to prevent tax issues.

- You’ll need to get a Tax Clearance Certificate to confirm that the funds used for the purchase are fully accounted for.

This is why working with a lawyer and real estate consultant is essential.

We ensure that every financial step is handled correctly, so you don’t run into tax or banking issues.

Option 2: Getting a Mortgage in Greece

If you prefer to finance your purchase rather than transfer the full amount at once, a Greek mortgage is an option—but it’s not the easiest route.

Here’s why:

- Large deposit required—Greek banks typically require a 30-40% down payment.

- Strict lending requirements—Most banks prefer lending to buyers with income in Greece.

- Higher interest rates—Compared to other European countries, Greek mortgage rates can be less competitive.

- Slow approval process—Getting approved can take several months, especially if you don’t bank with a Greek institution.

That said, if you qualify for a Greek mortgage, it can allow you to spread out your payments and keep more liquidity for other investments.

We guide buyers through the mortgage process, helping them understand the best options for their financial situation.

Option 3: Getting a Mortgage from Your Home Country

A popular alternative? Financing your property purchase with a mortgage from your home country.

Many international buyers choose this option because:

✔ It’s often faster and easier than applying for a Greek mortgage.

✔ Interest rates may be lower depending on your home country’s lending market.

✔ You avoid the strict lending rules of Greek banks and can finance the purchase on better terms.

Some buyers also use home equity loans from properties they already own to finance their real estate purchase in Crete.

If you’re considering this approach, it’s important to check international transfer requirements—since all property transactions in Greece must be processed through a Greek or EU-recognized bank account.

Hidden Costs Buyers Should Know About

Buying property in Crete isn’t just about the price you see on the listing.

There are extra costs that can catch buyers off guard if they’re not prepared.

At Totsi.gr, we always make sure our clients know exactly what to expect—so there are no surprises after the purchase.

Let’s go over some of the most common hidden costs.

1. Currency Exchange Fees

If you’re transferring money from another country, currency exchange fees can add up fast.

Banks and traditional exchange services take a percentage of every transaction, and even small rate differences can cost you thousands when transferring large amounts for a property purchase.

To minimize losses, many buyers use services like Wise (formerly TransferWise) or Revolut, which offer better exchange rates and lower transfer fees than traditional banks.

We guide buyers through the best ways to transfer funds, ensuring they don’t lose money unnecessarily on hidden bank fees.

2. Annual Property Taxes

Property taxes in Greece are relatively low compared to other European countries, but they do exist—so you need to budget for them.

The main one? ENFIA (Greek Property Tax).

This is an annual tax based on the size, value, and location of your property.

On average, expect to pay:

- €3 – €6 per square meter per year for most properties.

- Higher rates for luxury properties and homes in prime locations.

For example, if you own a 100m² apartment, your annual ENFIA tax could range between €300 – €600.

While this is a small amount compared to property taxes in other countries, it’s still an expense that many foreign buyers don’t factor in.

We calculate all tax obligations upfront—so you’ll know exactly what to expect before you buy.

3. Utility & Maintenance Costs

Owning a home means ongoing expenses like electricity, water, internet, and maintenance.

These costs depend on the type of property you buy:

- Apartments & gated communities—Often come with monthly maintenance fees for shared amenities and upkeep.

- Villas with pools or large gardens—Require extra maintenance, which can add up quickly. Pool cleaning, landscaping, and general upkeep should be considered in your budget.

Before buying, we help clients estimate these costs based on their property type—so they’re never caught off guard.

So, what’s the Best Way to Finance Your Property?

Here’s the bottom line—if you can transfer the full amount from your bank account, that’s the easiest and fastest way to buy property in Crete.

You’ll avoid the hassle of dealing with Greek banks, close the deal much faster, and have more negotiation power with the seller.

But if you need financing, there are smarter alternatives than relying on Greek mortgages.

Better Financing Options to Consider

✔ Look into international banks—Many buyers secure financing in their home country, where the process is often easier, interest rates are lower, and approval times are faster.

✔ Explore home equity loans—If you already own property, refinancing an existing asset may be a more cost-effective way to finance your Crete purchase.

✔ Work with a financial advisor—The best financing option depends on your personal situation, so it’s worth getting expert advice before making a decision.

No matter which route you take, the key is to know exactly what you’re signing up for.

Because nothing takes the excitement out of buying a home in Crete like unexpected financial surprises.

What’s Next?

Now that you understand how to finance your property, let’s talk about what happens after you own it.

- How do you rent out your property for income?

- What’s the difference between short-term and long-term rentals?

- Should you hire a property manager or handle everything yourself?

Let’s break it all down in the next section.

How to Handle Property Management & Rentals After Purchase

So, you’ve bought your property in Crete. The paperwork is done, the keys are in your hand, and now comes the next big question—what’s next?

Is this going to be your private escape, or do you want to turn it into a profitable rental investment?

Will you handle everything yourself, or does it make more sense to have someone manage it for you?

And most importantly—how do you ensure your investment actually pays off?

This is where smart property management makes all the difference.

Because whether you’re planning to list your home on Airbnb, rent it out to long-term tenants, or simply keep it as a vacation retreat, the way it’s managed determines whether it becomes a hassle or a hands-free investment.

Some owners prefer the DIY approach, handling everything from guest bookings and maintenance to legal requirements themselves.

Others outsource the work, ensuring that everything—from marketing and guest management to upkeep and tax compliance—is handled professionally.

The best approach?

It depends on your goals.

But making the right choice early on will save you time, money, and stress in the long run.

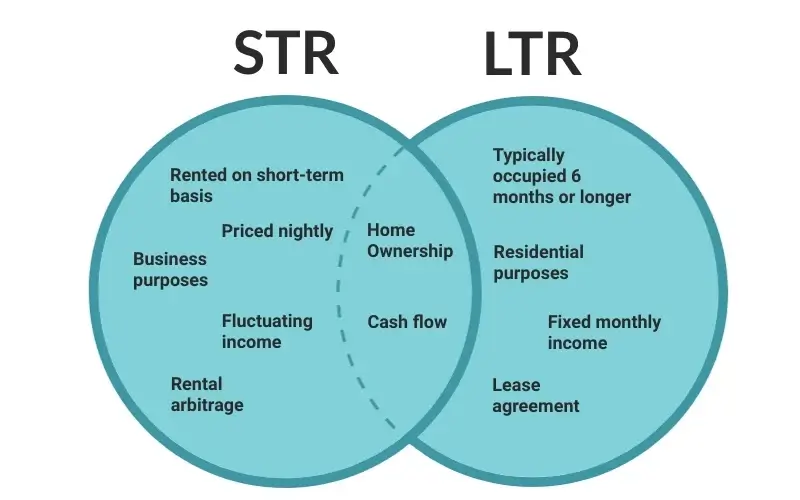

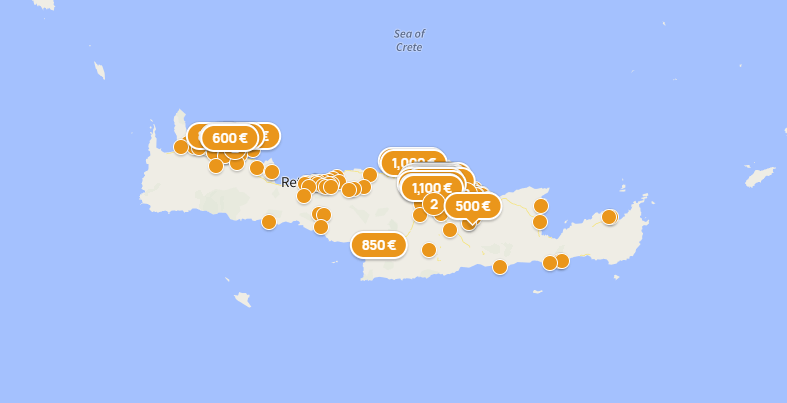

Short-Term vs. Long-Term Rentals: Which is Better?

Before making any decisions, it’s important to define how you want to use the property.

Are you looking for high seasonal income from tourists, or do you prefer stable, year-round rental income?

Both have their advantages—but they require very different management styles.

Option 1: Short-Term Rentals (Airbnb, Booking.com, VRBO, etc.)

Crete’s booming tourism industry makes short-term vacation rentals one of the most profitable real estate investments on the island.

Why?

- Tourists are willing to pay premium prices for great locations.

- Occupancy rates during peak season (May–October) often exceed 85%.

- A well-managed Airbnb property can generate €30,000 – €80,000 per year, depending on location, size, and amenities.

But here’s the catch:

Short-term rentals require constant attention.

From guest check-ins and cleanings to marketing and maintenance, running a short-term rental means active involvement—or hiring someone to manage it for you.

Is Short-Term Renting Right for You?

✔ Best for: Properties in tourist-heavy areas like Chania, Rethymno, Heraklion, and Elounda.

✔ Best if you want: Higher income potential, especially during summer.

✔ Best if you can: Handle guest bookings, turnovers, and maintenance—or hire a local property manager to do it for you.

Option 2: Long-Term Rentals (12-Month Leases to Expats & Locals)

If dealing with weekly guest check-ins, seasonal fluctuations, and high-maintenance turnover sounds exhausting, then a long-term rental might be a better option.

Why?

- More expats, remote workers, and retirees are moving to Crete permanently.

- There’s a growing demand for year-round rentals in cities like Heraklion, Chania, and Rethymno.

- You get consistent income every month, without worrying about tourist seasons.

But there’s a trade-off: long-term rental income is typically lower than short-term vacation rentals.

Is Long-Term Renting Right for You?

✔ Best for: Properties in cities and suburban areas where long-term rental demand is steady.

✔ Best if you want: Reliable, low-maintenance income without seasonal fluctuations.

✔ Best if you prefer: A hands-off investment—long-term tenants typically require less management than short-term guests.

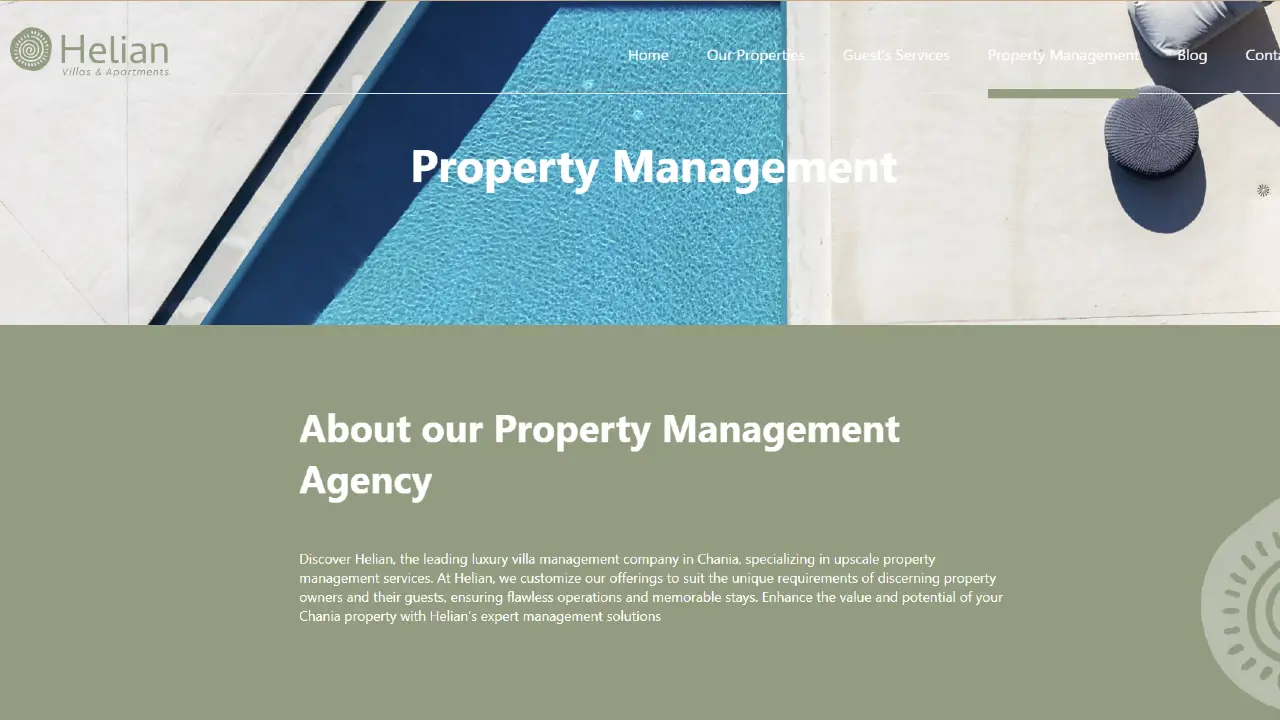

Should You Hire a Property Management Company?

This is one of the biggest decisions you’ll make after buying.

Many buyers start with the idea: “I’ll just manage everything myself.”

And while that’s possible, it’s not always practical—especially if you don’t live in Crete full-time or don’t want to deal with the day-to-day logistics of renting and maintaining a property.

A good property management company can take care of everything for you, making your investment truly hands-off.

What Does a Property Management Company Handle?

- Guest check-ins & check-outs (for short-term rentals).

- Cleaning, maintenance, and repairs—so your property stays in top condition.

- Handling rental payments and tenant issues—so you don’t have to chase after late payments.

- Marketing & listing management—keeping your property visible and booked on platforms like Airbnb, Booking.com, and VRBO.

For short-term rentals, hiring a property manager is almost a must—unless you live in Crete full-time and can personally handle guest turnover, maintenance, and bookings.

For long-term rentals, it depends. Some landlords manage everything themselves, while others prefer to hire a company to handle tenant relations, maintenance, and rent collection—freeing up their time and ensuring everything runs smoothly.

Ultimately, the right choice depends on how involved you want to be. A self-managed property can save on management fees, but a professionally managed rental ensures higher occupancy, fewer headaches, and a fully optimized rental income.

How Much Can You Make from Renting Out Your Property?

Now for the fun part—how much income can you actually generate from your property in Crete?

The answer depends on a few key factors:

- Location – Coastal areas and city hotspots earn more than rural villages.

- Property size & condition – Modern, well-maintained homes command higher rental prices.

- Management quality – A well-run property with professional management attracts more bookings and higher-paying tenants.

Let’s break down what you can expect to earn.

Short-Term Rental Income (Airbnb, VRBO, etc.)

Short-term rentals in Crete generate significantly higher returns compared to long-term leases—especially in tourist-heavy locations.

Here’s an estimate of nightly rates for different property types:

- Luxury Villas: €500 – €1,500 per night

- Seafront Apartments: €100 – €300 per night

- City Apartments: €60 – €150 per night

A well-managed Airbnb property can bring in €30,000 – €80,000 per year, depending on occupancy rates, location, and seasonality.

But there’s a trade-off: short-term rentals require constant management—handling guest check-ins, cleaning, and marketing to keep occupancy high.

Long-Term Rental Income (12-Month Leases)

Long-term rentals offer steady, predictable income with less day-to-day involvement.

Here’s what monthly rental rates look like in Crete’s key areas:

- One-Bedroom Apartment in Heraklion or Chania: €600 – €1,200 per month

- Three-Bedroom Villa in a Coastal Area: €1,200 – €2,500 per month

While long-term rentals generate lower annual income than short-term rentals, they require far less hands-on management. You won’t need to worry about guest turnover, frequent maintenance, or seasonal fluctuations.

Which Option Is More Profitable?

Short-term rentals can generate 2-3x more income than long-term rentals, but they require active management.

Long-term rentals offer lower returns but more stability, making them ideal for owners who want a hands-off investment.

The best approach? It depends on your lifestyle and goals. If you want higher returns and don’t mind the extra work (or hiring a property manager), short-term rentals can be a great investment. If you prefer consistent income with minimal involvement, long-term rentals offer a stress-free solution.

Managing Your Property from Abroad: What You Need to Know

If you don’t live in Crete full-time, you’ll need a solid plan to manage your property remotely—otherwise, what should be a stress-free investment can turn into a constant hassle.

Most foreign owners set up systems that allow them to oversee everything from afar, while ensuring their property is well-maintained and generating income.

Here’s how they do it:

✔ Hire a local property manager – The easiest and most hassle-free option. A good property manager handles rentals, maintenance, and guest management, so you don’t have to.

✔ Use smart home technology – Security cameras, remote-controlled locks, and energy monitoring help you keep an eye on things from anywhere in the world.

✔ Set up a Greek bank account – This makes it easier to receive rental payments, pay utility bills, and handle local expenses without complications.

✔ Have a reliable local contact – Whether it’s a friend, neighbor, or property manager, having someone on the ground ensures your property is regularly checked and any issues are handled quickly.

The key is to set up a system that works for you—so that your property remains a great investment, not a source of stress.

Making the Most of Your Property After Buying

Buying a home in Crete is just the first step—how you manage it afterward determines whether it becomes a smart investment or a missed opportunity.

- If you want higher profits, short-term rentals are the best option—but they require active management.

- If you prefer a passive, hands-off investment, long-term rentals provide stable income with less hassle.

- If the property is just for personal use, consider hiring a maintenance service to keep it in top condition, even when you’re not there.

And if dealing with guest check-ins, repairs, and tenant issues isn’t your thing, outsourcing everything to a property management company can make your life a whole lot easier.

What’s Next?

Now that we’ve covered how to manage your property efficiently, let’s look at some real success stories.

- Who’s making the most money from rental properties in Crete?

- What kind of returns are investors actually getting?

- Is flipping properties in Crete a smart strategy?

Let’s dive into real-world case studies in the next section.

Real Buyers Who Made Smart Investments in Crete

So, you’re probably wondering—what does a successful property investment in Crete actually look like?

Are buyers really making money from rentals?

Are people flipping properties for profit?

And most importantly—what kind of returns can you expect?

The best way to answer these questions? Real-world examples.

Let’s take a look at some actual buyers who made smart moves in Crete’s real estate market—what they bought, how much they paid, and what their results were.

Case Study #1: The Digital Nomad Who Turned a City Apartment into a Passive Income Machine

📍 Location: Chania (City Center)

💰 Purchase Price: €180,000

📊 Strategy: Airbnb & Mid-Term Rentals

🏡 Property Type: 2-Bedroom Apartment

Meet Daniel, a 36-year-old digital nomad from Germany.

He originally came to Crete for a few months, fell in love with the lifestyle, and decided to buy an apartment in Chania’s city center—right next to cafés, co-working spaces, and the Venetian harbor.

His plan was simple:

- Use the apartment as his base when he stays in Crete.

- Rent it out on Airbnb during the high season.

- Switch to mid-term digital nomad rentals in the off-season.

Results?

✅ During the tourist season (May–October), his place rents for €120 per night.

✅ In the off-season, he switches to mid-term rentals at €1,200 per month.

✅ After covering management and maintenance costs, his net income is €26,000 per year—enough to completely cover his living expenses whenever he’s in Crete.

Daniel didn’t just buy a home—he created a property that pays for itself.

Case Study #2: The Couple Who Bought a Seafront Villa and Doubled Their Investment

📍 Location: Elounda

💰 Purchase Price: €450,000

📊 Strategy: High-End Vacation Rentals

🏡 Property Type: 3-Bedroom Luxury Villa

Sophie and Mark, a couple from the UK, were looking for a long-term investment—something they could use as a vacation home now and sell for a profit later.

They purchased a modern villa in Elounda—a prime area for luxury tourism. The villa had a private pool, panoramic sea views, and high-end interiors—perfect for attracting high-paying travelers.

Results?

✅ Their villa rents for €750 per night in peak season.

✅ Even with a 50% occupancy rate, they generate over €100,000 per year in rental income.

✅ Since buying in 2019, property prices in Elounda have risen by 40%, meaning their home is now worth over €650,000.

They’re in no rush to sell, but if they do, they’ll walk away with a six-figure profit—all while enjoying luxury vacations in their own property.

The Investor Who Bought, Renovated, and Flipped for Profit

📍 Location: Rethymno (Old Town)

💰 Purchase Price: €120,000

🔨 Renovation Costs: €40,000

📊 Strategy: Fix & Flip

🏡 Property Type: 2-Bedroom Traditional Home

Michael, an investor from the Netherlands, wasn’t looking for a rental. He wanted to buy, renovate, and sell for a quick profit.

He found a traditional stone house in Rethymno’s Old Town—slightly run-down but in a prime location for buyers looking for authentic Greek charm.

Here’s what he did:

✅ Restored the original stone walls and added modern finishes.

✅ Installed a small rooftop terrace (a huge selling point in Old Town).

✅ Furnished it with stylish but affordable decor to increase market appeal.

Results?

✅ Within eight months, he sold the home for €225,000—a €65,000 profit after renovation costs.

✅ His total return on investment (ROI) was nearly 40% in under a year.

✅ He’s now looking for his next flip project in Crete.

Not bad for less than a year’s work, right?

What Can We Learn from These Investors?

Each of these success stories highlights different ways to profit from Crete’s real estate market:

🏡 Short-Term Rentals: Daniel’s Airbnb strategy generates steady passive income, covering his living expenses.

🏡 Luxury Vacation Rentals: Sophie and Mark’s villa earns high returns while appreciating in value.

🏡 Fix & Flip: Michael bought, renovated, and sold for a fast profit in under a year.

The key takeaway? Crete offers multiple paths to real estate success—whether you’re looking for passive rental income, long-term appreciation, or high-yield flips.

What’s Next?

Now that we’ve seen real buyers making smart investments in Crete, let’s look at the bigger picture:

- What are the best real estate trends in Crete right now?

- Is now the right time to buy—or should you wait?

- Where is the market heading in the next few years?

Let’s break it all down in the next section.

What These Success Stories Teach Us

These aren’t just random success stories. They’re proof that investing in Crete can be a smart move—if you have a strategy.

Every successful buyer followed a specific approach that helped them turn a simple real estate purchase into a profitable investment.

What do these buyers have in common?

1️⃣ They bought in high-demand areas.

They didn’t just buy anywhere—they chose locations with strong demand and long-term potential:

✔ City center apartments—Ideal for digital nomads and mid-term renters.

✔ Luxury villas in prime tourism locations—Attracting high-paying short-term guests.

✔ Old town homes with renovation potential—Perfect for resale at a premium.

Location is everything when it comes to real estate, and these investors made sure they bought where demand is high and property values are increasing.

2️⃣ They had a clear investment goal from the start.

They didn’t just buy for the sake of buying. They had a clear strategy in mind before making their purchase:

✔ Daniel wanted an income-generating home he could rent out when not in Crete.

✔ Sophie & Mark wanted luxury tourism cash flow plus long-term appreciation.

✔ Michael wanted a fast profit from flipping—buying low, renovating, and selling high.

A successful real estate investment starts with knowing what you want—whether it’s rental income, capital appreciation, or a mix of both.

3️⃣ They did their homework.

None of these buyers rushed into a deal without doing their due diligence. They:

✔ Researched the market—understanding property trends and rental demand.

✔ Didn’t overpay—negotiating smartly and choosing properties with strong ROI potential.

✔ Worked with local experts—lawyers, real estate consultants, and property managers to avoid costly mistakes.

They treated their investment like a business, ensuring every decision was backed by solid research and local expertise.

Can You Do the Same?

Absolutely.

The key to making a smart property investment in Crete is having a clear strategy from day one.

Before you even start looking at listings, ask yourself:

- Do I want to live in the property, or is this purely an investment?

- Am I looking for quick profits (flipping) or long-term appreciation?

- What type of rental strategy fits my lifestyle—Airbnb, digital nomads, or long-term tenants?

Once you have your answers, the next step is finding the right property—one that fits your goals and offers a strong return on investment.

And if you do it right? You could be the next success story.

What’s Next?

Now that you’ve seen real-life examples of smart investments, let’s bring it all together with a step-by-step action plan to help you get started.

- Is now really the right time to buy?

- How do you find the best investment deals before the market peaks?

- What are the exact next steps if you’re ready to invest?

Let’s break it all down in the final section.

Is Now the Right Time to Buy in Crete?

By now, you know why Crete is one of the most promising real estate markets in Europe.

You’ve seen how smart investors are making serious returns, whether through vacation rentals, long-term leases, or strategic property flips.

And most importantly, you understand the buying process, the legal side, and what mistakes to avoid.

But let’s get real—are you going to act on this opportunity, or will you wait until prices rise even further?

Because here’s the truth: the best time to buy in Crete was five years ago.

The second-best time is right now.

Why Buying Now Makes Sense

If you’ve been watching Crete’s real estate market, you already know what’s happening.

📈 Prices are climbing—fast. Investors who bought just a few years ago are already seeing double-digit appreciation on their properties. The longer you wait, the more you’ll pay for the same home.

✈ Tourism is booming. Over 6 million visitors come to Crete every year, creating a huge demand for vacation rentals. Properties in key locations can bring in €30,000 – €80,000 per year in rental income.

🏗 New infrastructure projects are reshaping the market. The new Kasteli International Airport, expanding road networks, and luxury developments are driving prices higher, especially in high-demand areas.

🛂 Golden Visa rules could change soon. Greece still offers residency to non-EU investors for just €250,000, but if the government raises this threshold—like Portugal and Spain have already done—you could miss your chance to secure a visa at today’s lower price.

So let’s be honest—waiting isn’t going to make things cheaper. It’s only going to make buying harder and more expensive.

What Type of Buyer Are You?

Everyone’s goals are different.

But what matters is that you take the right next step for your situation.

✔ Do you want a vacation home that pays for itself? We can help you find high-demand properties in Chania, Rethymno, or Elounda that generate top-tier Airbnb income.

✔ Are you investing for long-term appreciation? We’ll help you spot undervalued areas, ensuring you buy before prices surge.

✔ Looking to flip a property for profit? Our team knows where to find historic homes, village houses, and overlooked properties that can be transformed into high-value assets.

How We Help You Get the Best Deals

Buying property in Crete isn’t just about scrolling through listings.

The best investment opportunities never even hit the public market—they’re sold through trusted networks before most buyers even know they exist.

That’s why working with the right team is crucial.

At Totsi, we help clients:

- Find properties at the right price—so you don’t overpay.

- Handle the legal and tax process—so you avoid costly mistakes.

- Secure off-market deals—before they’re available to the public.

- Maximize rental returns—with expert property management and Airbnb strategies.

We don’t just help you buy a home. We help you make a smart investment.

What’s Next? Let’s Make It Happen.

You’ve already taken the first step by reading this guide. But knowledge alone won’t create results—you need to take action.

📞 Get in touch today—Let’s talk about your investment goals and how we can help you secure the best property before prices rise.

🔍 Browse exclusive listings—Get access to high-potential properties before they hit the open market.

🚀 Start the buying process—Our team will handle everything from legal paperwork to finding the best mortgage or tax setup for your needs.

The opportunity is here.

The only question is—will you take it before the market moves without you?

Find Your Perfect Property

We’re Here to Answer All Your Questions About Buying Property in Crete

Start Your Property Journey

- STAY CONNECTED

Subscribe to Our Newsletter

Members