Property Prices Crete: What You Need to Know in 2024

Crete’s real estate market has grown significantly over the past few years, positioning the island as a prime location for property investment.

In 2024, the demand for property in Crete remains high, fueled by both local and international interest.

This demand comes not only from those looking to settle or retire in Crete but also from investors recognizing the island’s appeal as a vacation rental hotspot.

For anyone interested in investing here, Crete offers diverse property types, from historic homes in Chania and Rethymno to modern apartments in Heraklion and luxurious villas in seaside towns.

This variety has made Crete’s real estate market accessible to all types of buyers, whether for short-term vacation rentals, long-term investments, or personal retreats.

If you’re considering purchasing property, exploring our Buying Property in Crete page can provide detailed insights and guidance to help make your investment successful.

Why Property Prices in Crete are on the Rise

Several factors contribute to the rising property prices in Crete.

Tourism is a major driver. In recent years, Crete has become one of Greece’s most popular destinations, attracting millions of visitors annually.

This tourism influx increases demand for vacation rentals, driving up property values, particularly in areas near beaches, historic sites, and popular towns.

Moreover, the Greek government’s Golden Visa Program, which offers residency permits to non-EU buyers investing in property, has significantly boosted interest in Crete’s real estate.

Investors from Europe, the US, and Asia see the visa program as an attractive opportunity for long-term investment with added lifestyle benefits, making Crete a competitive option among Mediterranean locations.

If you’re an investor looking to capitalize on Crete’s booming real estate market, our Crete Property Index page provides up-to-date data on price trends and market performance, allowing you to track property values and make data-driven decisions.

What Makes Crete a Top Choice for Property Investment?

Crete’s unique combination of natural beauty, rich cultural heritage, and steady tourism makes it a desirable location for property investment.

The island’s stable property market, combined with rising tourism and favorable government policies, contributes to a secure investment environment.

Not only do property owners benefit from potential value appreciation, but they can also earn significant rental income from short-term rentals during the high tourism season.

For landlords interested in maximizing their rental revenue, our Property Management for Landlords page outlines services that take the hassle out of property management, from guest handling to maintenance.

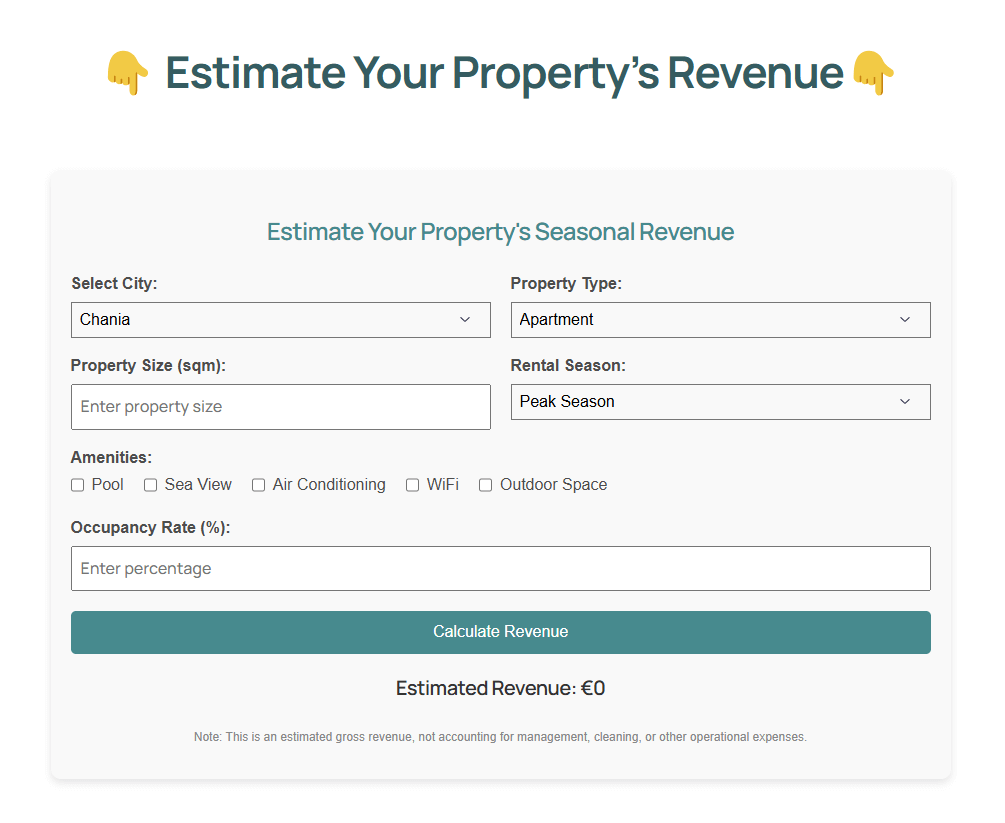

Additionally, our Property Revenue Calculator tool can give you a clear estimate of potential income based on Crete’s rental market, helping you assess your property’s earning potential.

Whether you’re considering a villa by the beach, an apartment in a bustling town, or a serene rural retreat, Crete offers options to suit every preference.

With increasing property values and a steady influx of visitors, Crete’s real estate market presents a compelling opportunity for both first-time buyers and seasoned investors.

Current Trends in Crete’s Property Market

How Have Property Prices in Crete Changed Over the Years?

Crete’s property market has shown steady growth over the past decade, with significant price increases, particularly in popular areas such as Chania, Heraklion, and Rethymno.

In recent years, the combination of increased demand and limited supply in prime locations has pushed prices higher, especially for properties near beaches and historical landmarks.

Despite global economic uncertainties, Crete’s property market has remained resilient, appealing to both foreign investors and locals who view real estate on the island as a reliable investment.

For those interested in a more data-driven understanding, our Crete Property Index offers insights into historical property prices, enabling you to track fluctuations and make informed decisions.

This resource is particularly valuable for investors looking to analyze property value trends and identify optimal investment timing.

Key Trends in Crete’s Real Estate Market in 2024

In 2024, several key trends are shaping Crete’s real estate market.

Firstly, demand for short-term rentals is rising, driven by tourists seeking authentic stays in villas, apartments, and traditional Cretan homes.

With the increase in remote work, many visitors are opting for extended stays, which adds further demand in the rental sector.

Secondly, there is a strong interest in sustainable and eco-friendly properties. Buyers are increasingly looking for energy-efficient homes that align with Crete’s natural beauty and commitment to sustainable development.

Moreover, there is a noticeable shift toward high-end properties, with luxury villas in areas like Elounda and Agios Nikolaos becoming highly sought-after.

This growing interest in premium properties has spurred more development, creating opportunities for investors to enter the market while demand is robust.

If you own a property and want to capitalize on these trends, our Vacation Rental Management services can help streamline your property’s listing, maintenance, and guest management, maximizing your property’s appeal and rental revenue.

Tourism and Its Impact on Crete’s Real Estate Market

Tourism is one of the most significant influences on Crete’s real estate market. As Greece’s largest island,

Crete attracts millions of visitors each year, drawn to its Mediterranean climate, beautiful beaches, and rich history.

This high volume of tourists drives demand for short-term rentals, especially in regions with easy access to popular attractions. As a result, property owners can earn lucrative rental income, particularly during peak tourist seasons from May to October.

The thriving tourism sector has led many property owners to list their homes on platforms like Airbnb and Booking.com.

If you’re considering renting your property, our Airbnb Management and Booking.com Management services provide the support you need to ensure a seamless rental experience, from booking management to guest communication.

Regional Breakdown of Property Prices

Property prices vary significantly across Crete, depending on the location, property type, and proximity to popular attractions. Here’s a quick overview of the key regions:

- Chania: Known for its Venetian harbor and charming Old Town, Chania attracts both tourists and long-term residents. Property prices here are among the highest on the island, with beachfront villas and historic homes in the Old Town commanding premium prices.

- Heraklion: As Crete’s capital and largest city, Heraklion offers a mix of affordable apartments and more upscale housing options. Properties here are popular among locals and those looking for a blend of city life and cultural heritage.

- Rethymno: With its scenic coastline and historical architecture, Rethymno is a sought-after location for buyers seeking a balance between coastal and cultural living. Prices here are generally mid-range but rising, especially for homes near the coast.

- Agios Nikolaos and Elounda: These eastern towns are known for luxury villas and high-end resorts, making them ideal for investors targeting the premium property market. The area’s serene environment and beautiful beaches make it popular with affluent international buyers.

For a more detailed look at property prices in these regions, the Crete Property Index provides updated information, allowing you to compare property values by area and make data-backed investment decisions.

Regional Breakdown of Property Prices in Crete

Property Prices in Chania: A Hotspot for Investment

Chania stands out as one of the most desirable and highest-priced areas in Crete for property investment.

Known for its stunning Venetian harbor, charming Old Town, and beautiful beaches, Chania attracts both short-term vacationers and long-term residents.

The growing interest from international buyers has pushed up property values, particularly for villas and homes near the coast or in the Old Town.

Investing in Chania offers an appealing blend of lifestyle and financial return.

Not only do property values here show steady appreciation, but short-term rental demand remains high, especially during the tourist season.

If you’re looking to leverage this demand, our Airbnb Management services can help you manage bookings, guest experiences, and maximize occupancy rates.

Exploring Property Prices in Heraklion: Affordable Options and Rising Demand

Heraklion, Crete’s bustling capital and largest city, offers a more affordable entry point into the island’s property market while still providing substantial growth potential.

Unlike Chania, Heraklion appeals more to year-round residents and local professionals, with a variety of apartment options, suburban homes, and a growing number of newly constructed properties.

Its mix of urban life, cultural sites, and proximity to the airport makes it a convenient choice for buyers seeking both lifestyle and investment.

The demand for property in Heraklion is rising, and prices are following suit, especially in up-and-coming neighborhoods and areas close to the city center.

For investors considering long-term rental options, Heraklion is a strategic choice, offering both stable demand and lower property prices than tourist hotspots.

To simplify management, our Property Management for Landlords page details how we handle tenant screening, rent collection, and property maintenance, ensuring your investment remains hassle-free.

Property Market Insights: Rethymno and Agios Nikolaos

Rethymno and Agios Nikolaos each bring unique qualities to Crete’s property market.

- Rethymno: With its charming blend of Venetian and Ottoman architecture, Rethymno draws a mix of tourists and expats looking for authentic Cretan culture. Property prices here are mid-range but climbing steadily, particularly for homes close to the historic Old Town and along the coast. Rethymno’s demand for short-term rentals makes it attractive to vacation rental investors, while its appealing community and scenic surroundings are ideal for those seeking a permanent residence.

- Agios Nikolaos: Known for luxury, Agios Nikolaos and the nearby Elounda area are popular with high-end international buyers. This region has some of the island’s most exclusive and expensive properties, particularly villas with sea views and proximity to top resorts. Agios Nikolaos is ideal for buyers looking for high-end properties with strong value appreciation potential.

Our Crete Property Index provides a breakdown of property trends in these areas, helping investors compare values across the island and make informed choices.

Comparing Coastal vs. Inland Property Prices in Crete

In Crete, coastal properties are generally more expensive than inland properties due to their prime locations, access to beaches, and higher demand from tourists and expats.

Coastal areas like Chania, Rethymno, and Agios Nikolaos command premium prices, particularly for properties with sea views or direct beach access.

These properties are ideal for vacation rentals, with rental yields peaking during the high tourism season.

Inland areas, while more affordable, offer a different appeal. They attract buyers looking for a quieter, more traditional Cretan lifestyle.

Inland properties are popular with those interested in agricultural land or restoring historic village homes, and prices tend to be more stable here.

If you’re interested in calculating potential revenue from short-term or long-term rentals, our Property Revenue Calculator tool provides an easy way to assess income based on property location and market trends.

Factors Influencing Property Prices in Crete

Several factors contribute to Crete’s property prices in 2024:

- Tourism Growth: With Crete remaining one of Greece’s top travel destinations, the demand for vacation rentals has increased, raising property prices in popular tourist areas.

- Foreign Investment and the Golden Visa: The Greece Golden Visa program has made Crete especially appealing to non-EU investors. The minimum property investment threshold of €800,000 provides residency rights, which boosts demand for properties in areas like Chania and Agios Nikolaos.

- Limited Supply in Prime Locations: Properties in premium coastal areas are limited, driving prices up in these sought-after regions.

- Economic Factors: The Greek economy’s recovery and rising property values across Greece have positively impacted Crete’s real estate market, making it an attractive option for those looking for stable, long-term investments.

Understanding these factors is essential for anyone interested in Crete’s real estate market.

Whether you’re looking at a vacation rental or a long-term investment, our Real Estate & Property Management Partners can guide you through the process, ensuring you maximize the potential of your investment.

Factors Influencing Property Prices in Crete

Top Factors Driving Property Prices in Crete

Several key factors contribute to the rising property prices in Crete, making it a highly attractive market for investors and buyers alike.

Firstly, the island’s booming tourism industry plays a major role. Crete remains a top destination in Greece, with its scenic beaches, historic sites, and year-round appeal.

As tourism continues to grow, so does the demand for vacation rentals, driving up property values in popular areas like Chania, Rethymno, and Agios Nikolaos.

Additionally, Crete’s unique lifestyle and relatively affordable prices compared to other Mediterranean regions have increased interest among expatriates and retirees looking for a peaceful place to settle.

This demand, combined with limited availability in prime coastal areas, pushes property prices even higher.

If you’re interested in tapping into this demand, our Vacation Rentals Management services make it easy to manage short-term rentals, ensuring you maximize rental income while meeting guest expectations.

How Local Policies and Government Incentives Impact Prices

Local policies and government incentives play a significant role in shaping Crete’s real estate market.

One of the most influential programs is the Greece Golden Visa, which offers residency to non-EU nationals who invest a minimum of €800,000 in Greek property.

This program has been especially popular in Crete, attracting investors from Europe, the Middle East, and Asia.

The demand generated by the Golden Visa program has raised property prices, particularly in attractive areas like Chania and Elounda, where luxury villas and beachfront properties are in high demand.

In addition to the Golden Visa, the Greek government has introduced tax incentives and property transfer tax reductions to stimulate real estate investments.

These incentives appeal to both local and foreign buyers, leading to an upward trend in property values. For buyers interested in understanding the financial aspects of purchasing property in Crete, our Buying Property in Crete page provides essential information on local policies, tax implications, and investment benefits.

The Role of Foreign Investment in Crete’s Real Estate Market

Foreign investment has been a substantial driver of Crete’s real estate market growth.

The Greek Golden Visa program is one catalyst, but Crete also attracts investors due to its stable economy, favorable investment environment, and relatively low entry cost compared to other European destinations. Investors from countries like Germany, the UK, the US, and Israel are drawn to the island’s high-quality lifestyle, favorable climate, and investment potential.

The rise of remote work has also encouraged more international buyers to consider Crete for long-term stays, often investing in properties suited for both personal use and rental income.

The demand from foreign buyers has driven up prices, especially in popular areas close to beaches and tourist attractions.

If you’re considering buying property as an international investor, our Crete Property Index provides market data that can help you understand price trends across different regions.

Additionally, our Airbnb Management services can support you in converting your investment property into a high-yield rental, offering a seamless experience for both owners and guests.

Property Types and Pricing

Crete’s diverse real estate market offers various property types, each with its pricing structure depending on location, amenities, and demand. Here’s a breakdown of the main property types and their pricing trends in 2024:

- Villas: Luxury villas in Crete, particularly in prime locations like Chania, Elounda, and Agios Nikolaos, attract high-end buyers and investors. Prices for these properties often start at €500,000 and can go up to several million for exclusive, sea-facing properties. Villas are popular among both vacationers and long-term expatriates, making them a profitable choice for rental income.

- Apartments: Apartments are a more affordable option, commonly found in urban centers like Heraklion and Chania. Prices typically range from €100,000 to €300,000, depending on location and proximity to amenities. Apartments attract both long-term renters and local buyers, providing a steady income stream for investors focused on urban areas.

- Traditional Homes: Many investors seek traditional Cretan homes in villages or rural areas. These properties often need renovation but offer a unique charm and are typically priced lower than coastal properties. Buyers interested in a traditional lifestyle or restoration project can find properties in the €50,000–€150,000 range.

- Commercial Properties: Crete’s thriving tourism industry makes commercial properties, such as hotels, shops, and restaurants, attractive investments. Prices vary widely, but prime commercial spaces in high-traffic tourist areas come at a premium. For those interested in commercial investment, our Landlord Services provide end-to-end management, ensuring that your commercial property remains a profitable venture.

Each property type offers unique benefits and challenges, and understanding these distinctions is crucial for making a well-informed investment.

Whether you’re looking for a vacation home, a rental property, or a business investment, Crete’s real estate market caters to a wide range of needs and budgets.

Property Types and Pricing

Villa Prices in Crete: What to Expect

In 2024, villa prices in Crete are highly varied, reflecting the diverse appeal and locations across the island.

Coastal areas like Elounda, Agios Nikolaos, and Chania host some of Crete’s most luxurious villas, with prices ranging from €500,000 to upwards of €3 million, particularly for properties with beachfront views, private pools, and high-end finishes.

Villas in these sought-after locations are popular among international buyers and short-term rental investors, thanks to the high demand for premium vacation accommodations.

For potential villa investors, renting out these properties can yield excellent returns during Crete’s peak tourist seasons.

Our Airbnb Management services ensure that each villa achieves optimal occupancy, with professional guest handling and rental optimization to maximize income potential.

For a full breakdown of property values across Crete’s regions, consult our Crete Property Index, which offers up-to-date market data.

Cost of Apartments in Crete’s Popular Areas

Apartments are a more budget-friendly option in Crete’s real estate market, especially in urban centers like Heraklion and Chania.

In popular areas, apartment prices typically range from €100,000 to €300,000. Proximity to local amenities, the city center, and the beach impacts pricing, with prime locations commanding higher costs.

Investing in apartments is appealing for those interested in steady, long-term rental income, particularly as the demand for affordable city housing rises.

For apartment owners looking to generate rental income, our Booking.com Management services can help you streamline bookings, handle guest communication, and maximize occupancy rates year-round.

Pricing for Commercial Properties in Crete: A 2024 Guide

Commercial properties in Crete are highly sought after, especially in tourist-heavy areas such as Chania, Rethymno, and Agios Nikolaos.

Hotels, cafes, and retail spaces in these locations attract both local business owners and international investors, with prices varying based on the property size, foot traffic, and distance to key attractions.

For example, a small retail space in a prime tourist spot can start around €800,000, while larger properties, like boutique hotels, often exceed €1 million.

With Crete’s tourism sector experiencing strong growth, commercial properties offer promising returns. However, managing a commercial space can be demanding.

Our Landlord Services include end-to-end management, ensuring smooth operations, tenant handling, and property maintenance so your investment remains profitable.

For investors looking for broader market insights, the Hellenic Statistical Authority provides data on economic indicators relevant to Greece’s property market.

Rural and Agricultural Property Prices in Crete

Rural and agricultural properties in Crete offer a unique investment opportunity, particularly for those interested in traditional lifestyles or agricultural ventures.

Properties in inland villages or agricultural areas are more affordable, with prices for plots or old stone houses ranging from €50,000 to €150,000, depending on the location and property condition.

In villages located farther from tourist areas, investors can find traditional homes with land, ideal for renovation projects or private retreats.

Agricultural land near olive groves, vineyards, or other fertile areas provides an opportunity to join Crete’s renowned agricultural sector.

Crete’s favorable climate supports olive oil production, winemaking, and other crops, making this a popular choice for buyers with a passion for farming or eco-tourism.

For those interested in maximizing revenue from rural properties, our Property Management for Landlords services cover tenant management, maintenance, and operational logistics to keep your investment secure.

Market Data and Statistics

Staying informed on the latest market data is essential for making wise property investments in Crete.

Here are some key statistics for 2024:

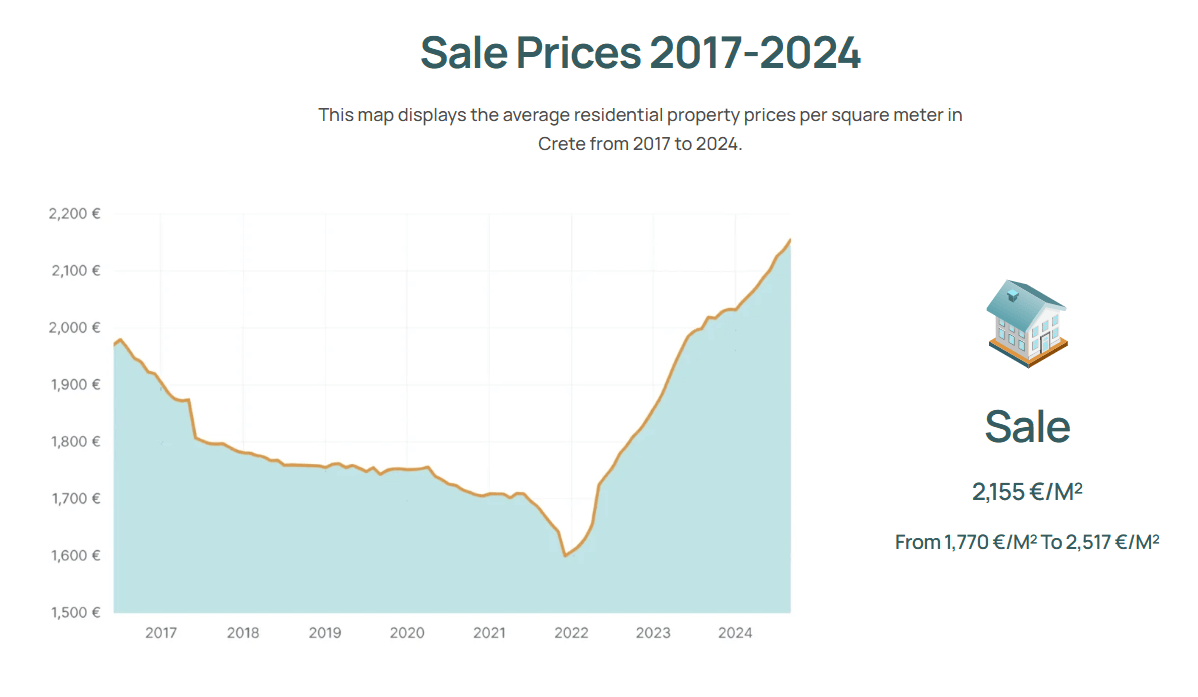

- Average Property Prices: According to recent data, the average price per square meter for residential properties in Crete is around €2,154, with Chania and Rethymno seeing the highest values. For a detailed view, our Crete Property Index offers region-specific data that helps investors identify the best-value areas.

- Rental Market Data: Rental prices across Crete remain strong, particularly in tourist-favored areas. Current average rental rates are approximately €8.85 per square meter, reflecting the ongoing demand for both long-term and short-term rentals.

- Investment Yields: Properties in Crete yield attractive returns, especially in tourist hotspots. The annual rental yield varies by region and property type, but areas like Chania and Agios Nikolaos offer some of the highest returns for short-term rentals. To get an idea of your property’s potential income, use our Property Revenue Calculator for accurate rental projections.

Whether you’re interested in a luxury villa, a city apartment, or agricultural land, understanding Crete’s market data and pricing is crucial to your investment success.

Combining this data with resources from both our Crete Property Index and external sources like Bank of Greece for economic trends allows investors to make well-informed, strategic property choices in Crete’s competitive real estate market.

Market Data and Investment Insights for Crete

Average Property Prices per Square Meter in Crete

As of 2024, Crete’s real estate market has experienced steady growth, with the average property price per square meter reaching approximately €2,154.

Prices vary significantly depending on the region, with hotspots like Chania and Rethymno often exceeding €2,500 per square meter, especially in areas near beaches and popular tourist attractions.

Conversely, inland regions and smaller towns offer more affordable options, making Crete accessible for a range of budgets.

Investors interested in exploring different regions can refer to our Crete Property Index for a breakdown of current prices across the island.

This tool is invaluable for understanding pricing trends and identifying investment opportunities in both high-demand and emerging areas.

Analyzing Crete’s Property Market Data: 2017–2024

From 2017 to 2024, property values in Crete have shown consistent growth, driven by factors like increased tourism, foreign investment, and government incentives such as the Golden Visa Program.

Since 2017, the island has become a preferred destination for buyers seeking vacation homes or investment properties, with prices in some areas rising by up to 20% over the period.

Economic resilience and infrastructure development on the island have contributed to this positive trend, allowing property owners to benefit from strong appreciation.

For investors looking to understand the long-term trajectory of Crete’s property market, exploring additional data from the Hellenic Statistical Authority can provide a macroeconomic context that complements our localized data on the Crete Property Index.

Rental Prices in Crete: Short-Term vs. Long-Term

Rental prices in Crete continue to rise, particularly for short-term rentals.

Properties in popular tourist areas like Chania, Heraklion, and Agios Nikolaos command the highest short-term rental rates, especially during peak season.

On average, rental prices for short-term vacation rentals are around €8.85 per square meter, but prime locations can see rates much higher, making them ideal for Airbnb and other vacation rental platforms.

Long-term rentals, while priced slightly lower, still provide steady returns, especially in urban areas where there is consistent demand from residents and expats.

For investors or homeowners interested in maximizing rental income, our Airbnb Management and Booking.com Management services streamline the rental process, from guest management to maintenance, ensuring optimal occupancy and guest satisfaction.

The Bank of Greece offers a broader perspective on rental and property trends, and consulting sources like the Bank of Greece Real Estate Data can help investors understand rental yield patterns and potential revenue across the country.

Buying Property in Crete as a Foreigner

For foreign investors, Crete offers numerous advantages, including a favorable investment climate, relatively affordable prices compared to other Mediterranean regions, and the opportunity to obtain Greek residency through the Golden Visa Program.

Buying property in Crete as a foreigner is a straightforward process, although understanding the legal and tax implications is essential.

The Greece Golden Visa Program is a popular incentive for non-EU buyers, granting residency to those who invest at least €800,000 in Greek real estate.

This program makes it easier for foreign investors to enter the market, especially in tourist-heavy areas where rental income potential is high.

However, purchasing property as a foreigner requires compliance with Greek legal processes, including obtaining a Greek tax number (AFM) and working with a lawyer to oversee contracts and due diligence.

To support international buyers, our Buying Property in Crete guide provides an overview of these steps, ensuring a smooth purchasing experience from start to finish.

Additionally, consulting with legal and financial advisors familiar with Greek property laws is highly recommended, and resources like Invest Greece provide further guidance on foreign investments in the country.

For those interested in calculating potential returns on a property investment, our Property Revenue Calculator offers an easy way to assess rental income based on property type, location, and occupancy rates, helping you make an informed investment choice.

Buying Property in Crete as a Foreign Investor

What Foreign Investors Need to Know About Buying Property in Crete

Crete has become a popular destination for foreign investors due to its blend of lifestyle appeal, investment potential, and relatively affordable property prices compared to other European Mediterranean islands.

For international buyers, there are a few key points to understand before making a purchase in Crete.

First, buyers will need to obtain a Greek tax number (AFM), which is required for property transactions in Greece.

Additionally, working with a local attorney to oversee the purchase process is recommended, as Greek property laws may differ significantly from those in other countries.

The property purchase process is generally straightforward, but it’s essential to be aware of the associated taxes and fees, including the property transfer tax, which typically ranges from 3% to 5% of the sale price.

For those considering rental income from their investment, our Airbnb Management and Booking.com Management services can streamline the process, from managing bookings to ensuring a smooth guest experience.

How Crete’s Golden Visa Program Impacts Property Prices

The Greece Golden Visa Program has had a substantial impact on property prices in Crete, particularly in high-demand areas.

By investing at least €800,000 in Greek real estate, non-EU nationals can obtain Greek residency, making the island a favorable option for those looking to establish a presence in Europe.

This program has increased demand from international buyers, particularly in popular areas like Chania, Rethymno, and Heraklion.

As foreign interest has risen due to the Golden Visa, property prices have naturally followed suit, especially for properties near tourist attractions, beaches, and urban centers.

The program has led to price growth in luxury villas and high-end properties that appeal to foreign buyers, adding value to properties across the island.

This residency incentive makes Crete a competitive destination for property investment, and for those interested in exploring properties that meet Golden Visa requirements, our Buying Property in Crete guide provides helpful information on finding and securing eligible properties.

Legal Considerations for Foreign Buyers in Crete’s Real Estate Market

Foreign buyers in Crete should be mindful of several legal requirements and considerations.

Beyond obtaining an AFM (Greek tax identification number), it is essential to work with a Greek lawyer to review the purchase contract, conduct property checks, and ensure clear title to the property.

Your lawyer will also help navigate any property restrictions that may apply to foreign buyers, especially in areas near national borders, where special permissions may be required.

Additionally, foreign buyers should understand the applicable property taxes.

In Greece, annual property taxes are calculated based on property value, location, and other factors, so it’s vital to factor these into your investment budget.

For assistance with managing your property post-purchase, our Landlord Services offer comprehensive support, from tenant management to property maintenance, ensuring that your investment is protected and hassle-free.

For more in-depth information, resources like the Greek Ministry of Foreign Affairs provide official guidelines on property ownership and legal considerations for foreign nationals, making it easier for international buyers to understand their rights and obligations.

Investment Potential and ROI

Crete’s property market presents a strong investment potential, particularly for those targeting rental income or long-term capital appreciation.

The island’s appeal as a tourist destination has created a lucrative market for short-term rentals, with properties in prime locations like Chania and Agios Nikolaos generating significant rental income, especially during the peak tourism season from May to October.

Investors can expect attractive rental yields, especially in coastal areas popular with tourists.

For instance, properties that cater to short-term rentals often yield higher returns than long-term leases, given the premium tourists are willing to pay for vacation accommodations.

Our Property Revenue Calculator provides a quick estimate of potential earnings based on property type, location, and occupancy rate, helping investors assess potential ROI.

In addition to rental income, Crete’s property values have shown steady growth, especially in tourist-heavy areas and areas targeted by the Golden Visa program.

With the right property and professional management, Crete offers a solid opportunity for long-term value appreciation, particularly for investors looking to diversify their portfolios in a stable, attractive market.

For a deeper understanding of Greece’s economic indicators that influence the property market, resources like the OECD Economic Surveys of Greece provide valuable context, highlighting trends and factors that shape property values across the country.

Whether you’re interested in a vacation home or a high-yield investment property, Crete’s combination of rental income potential and steady property appreciation offers investors multiple pathways to success.

Investment Potential and Market Forecast for Crete’s Real Estate

Is Buying Property in Crete a Good Investment in 2024?

Buying property in Crete continues to be a promising investment opportunity in 2024.

The island’s unique appeal—a blend of beautiful landscapes, historical charm, and Mediterranean lifestyle—draws both tourists and long-term residents, creating consistent demand for rental properties and personal residences.

Property values have shown steady appreciation over the past few years, particularly in popular areas like Chania, Heraklion, and Rethymno.

This growth is largely supported by Crete’s strong tourism sector, favorable climate, and government incentives like the Greece Golden Visa Program, which allows foreign investors to gain residency through property purchases.

For investors looking to capitalize on Crete’s booming real estate market, property prices remain relatively affordable compared to other Mediterranean destinations.

Whether you’re interested in short-term rentals or long-term capital appreciation, Crete offers a stable and attractive market for real estate investment.

To understand property trends across different regions, explore our Crete Property Index for the latest data and insights on property values.

Calculating Return on Investment for Properties in Crete

Calculating the return on investment (ROI) for properties in Crete depends on several factors, including purchase price, rental income, and ongoing expenses like property management and maintenance.

Investors can calculate ROI by estimating annual rental income, subtracting expenses, and dividing by the total property investment.

ROI varies widely based on location, with high-demand areas like Chania and Agios Nikolaos often providing stronger returns due to high tourist traffic and premium rental rates.

For a simplified approach to estimating potential income, our Property Revenue Calculator helps investors forecast short-term rental earnings based on property type and occupancy rates.

By leveraging accurate revenue projections and assessing expenses, investors can make well-informed decisions that maximize profitability.

Understanding Rental Yields: Crete’s Potential for Short-Term and Long-Term Rentals

Rental yields in Crete vary significantly depending on whether the property is used for short-term vacation rentals or long-term leases.

Short-term rentals, especially in tourist hotspots like Chania, Rethymno, and Heraklion, can generate attractive yields, often surpassing those from long-term rentals due to the high demand during peak tourism season.

Properties with sea views, proximity to attractions, or luxury amenities are particularly appealing to short-term renters, commanding higher nightly rates and boosting returns.

Long-term rentals, on the other hand, provide stable, year-round income, which is especially advantageous in urban centers like Heraklion.

With a growing expat community and increased interest from digital nomads, long-term rentals have become a viable alternative for those seeking reliable cash flow.

For property owners interested in maximizing rental income, our Airbnb Management and Booking.com Management services simplify the rental process, from booking management to guest communication, making it easy to capture Crete’s rental market potential.

If you’re interested in analyzing broader rental market trends, the Hellenic Statistical Authority offers data on rental rates and occupancy trends across Greece, providing valuable insights for both short- and long-term rental strategies.

Market Predictions and Future Outlook

Looking ahead, Crete’s real estate market is projected to remain strong, with moderate growth in property values, especially in high-demand coastal regions.

The Greek economy’s recovery, combined with increased interest from foreign buyers seeking lifestyle investments, supports continued demand for properties.

Additionally, Crete’s established tourism sector and favorable government policies, like the Golden Visa program, add stability to the market.

Although property prices may experience slight moderation, particularly in response to global economic factors, experts anticipate steady demand driven by tourism and international investment.

For those considering property in Crete, now is an advantageous time to enter the market, as property values are expected to appreciate in the long run.

Whether you’re planning to invest in a vacation rental, a long-term residence, or a high-end villa, Crete’s real estate market offers opportunities for growth and steady returns.

For current market insights and guidance on choosing the right property type, our Buying Property in Crete page provides essential information, ensuring that you make the most informed decision for your investment in Crete.

Crete Property Market Forecast and Future Considerations

Property Market Forecast for Crete: 2024 and Beyond

Looking ahead, Crete’s real estate market is poised for sustained growth.

Demand from international buyers, combined with local interest, suggests a steady upward trajectory in property values, particularly in areas like Chania, Heraklion, and Agios Nikolaos.

With Crete’s ongoing popularity as a top Mediterranean destination, demand for both residential and vacation rental properties is expected to remain strong.

Coastal areas will likely see the most significant appreciation, driven by limited supply and high demand from those looking for beachfront or sea-view properties.

This positive outlook makes now an ideal time to explore investment opportunities in Crete.

For the latest data on property trends and price fluctuations, our Crete Property Index is a valuable resource for tracking market dynamics and staying informed on property values across different regions.

Will Property Prices in Crete Continue to Rise?

Crete’s property prices have shown consistent growth over recent years, and experts predict this trend will continue, albeit at a more moderate pace.

Key factors driving this rise include increased tourism, foreign investment, and government incentives like the Golden Visa Program, which attracts non-EU buyers with residency benefits.

Furthermore, Crete’s strong rental market fuels demand for properties, as investors seek to capitalize on high short-term rental yields in tourist hotspots.

While the market remains strong, the pace of price increases may vary by region. Coastal and highly developed areas are expected to see higher appreciation rates, whereas more rural locations may experience slower growth.

For those interested in entering Crete’s property market, understanding regional trends can help maximize investment returns.

Our Buying Property in Crete guide provides further insight into high-demand areas and strategic investment locations.

How Economic Factors Could Influence Crete’s Real Estate Market in the Future

Several economic factors could impact Crete’s real estate market in the coming years.

Greece’s overall economic health, including inflation rates and economic policies, will play a role in shaping property prices.

While Crete’s property market has proven resilient, global economic trends, interest rates, and tourism levels are all likely to influence demand and property values.

As the Greek government continues to support real estate investments through incentives and tax reliefs, the market outlook remains stable.

However, changes in global tourism trends or economic conditions could influence foreign investment levels.

To gain a broader perspective on Greece’s economic landscape, consulting resources like the OECD Economic Outlook for Greece can provide insights into how external economic factors may affect Crete’s real estate market.

Additional Costs and Considerations

When buying property in Crete, investors should account for additional costs beyond the purchase price.

These expenses include:

- Property Transfer Tax: Typically ranging from 3% to 5% of the property’s sale price, this tax is payable upon purchase and varies depending on the property type and location.

- Legal and Notary Fees: Hiring a lawyer and notary is essential to oversee the transaction, verify property titles, and manage contract formalities. These fees generally amount to around 1.5% to 2% of the purchase price.

- Annual Property Taxes: Once the property is acquired, annual property taxes (ENFIA) apply, calculated based on property value, size, and location. This tax ensures compliance with Greek property ownership regulations.

- Maintenance and Management Costs: For investors planning to rent out their property, maintenance, and management fees should be factored into the budget. Our Property Management for Landlords services cover everything from routine maintenance to guest handling, offering hassle-free management options for investors.

- Insurance: Property insurance is not mandatory but is highly recommended to protect your investment from potential risks like natural disasters, theft, or damage.

For a smooth purchasing process and accurate financial planning, it’s advisable to work with a financial advisor and real estate expert familiar with the Greek market.

Proper planning ensures a transparent and cost-effective investment, allowing you to fully enjoy the benefits of owning property in Crete.

These forecasts and considerations provide a clear roadmap for investors looking to navigate Crete’s real estate market effectively in 2024 and beyond.

With steady growth expected and high rental demand, Crete remains a promising choice for those seeking both lifestyle and investment value.

Essential Considerations for Property Buyers in Crete

Hidden Costs of Buying Property in Crete

While the purchase price is the primary expense when buying property in Crete, several hidden costs can add up, especially for first-time buyers.

These include:

- Due Diligence Costs: Fees for conducting property inspections, verifying property boundaries, and checking for any outstanding debts or encumbrances can add to your initial expenses. Hiring a reputable lawyer or property expert is essential to ensure the property’s legal and structural soundness.

- Agency Fees: Real estate agents in Crete typically charge a commission, usually around 2% to 5% of the property price, payable by the buyer. Make sure to clarify the agent’s fee structure upfront to avoid surprises.

- Utility Connection Fees: Setting up utilities, especially for newly constructed properties, can incur fees for connecting water, electricity, and internet services. These costs vary depending on location and service providers.

Planning for these additional costs ensures a smoother purchase process.

Our Buying Property in Crete guide provides insights into all potential costs, helping buyers avoid unexpected financial burdens.

Legal and Tax Considerations for Property Buyers

Navigating legal and tax requirements is crucial when buying property in Crete.

Here are key considerations:

- Property Transfer Tax: This tax is generally between 3% and 5% of the purchase price and is a one-time cost paid upon property acquisition. Buyers should calculate this into their budget, as it significantly impacts the total cost.

- Annual Property Tax (ENFIA): Once you own property in Greece, you are responsible for annual property taxes based on property size, value, and location. This recurring cost is calculated yearly by the tax authorities and varies depending on the property’s market value.

- Legal Requirements: Working with a Greek lawyer is essential to ensure the transaction complies with local laws. Your lawyer will conduct due diligence, ensure clear property titles, and oversee contract execution to protect your interests.

- Capital Gains Tax: If you plan to sell your property in the future, keep in mind that a capital gains tax may apply. Consulting a financial advisor familiar with Greek property law can help you understand how capital gains tax could impact your investment returns.

For more comprehensive information, resources like the Greek Ministry of Finance provide detailed guidelines on property tax obligations in Greece.

Additionally, our Landlord Services offer ongoing support to ensure property tax compliance and management, making ownership easier for international investors.

Understanding Maintenance and Management Costs for Properties in Crete

Maintaining a property in Crete requires regular attention, especially if you plan to rent it out to generate income.

Here are the main costs associated with property upkeep:

- Routine Maintenance: Regular upkeep, including cleaning, landscaping, and minor repairs, ensures your property remains attractive to tenants or guests. For vacation rentals, more frequent cleaning and property checks may be needed.

- Property Management Fees: Many investors prefer hiring a management service to handle guest relations, bookings, and maintenance. Property management fees typically range from 10% to 20% of rental income, depending on the level of service.

- Insurance: While not mandatory, property insurance is highly recommended. Policies cover damages from natural disasters, theft, or accidents, protecting your investment. The cost of insurance varies by provider and coverage level but is an essential expense.

- Repairs and Renovations: Periodic repairs are necessary, especially for older properties or vacation rentals that experience high guest turnover. Setting aside funds for repairs helps maintain the property’s value over time.

To simplify property maintenance, our Landlord Services provide end-to-end management, ensuring that all upkeep and operational tasks are handled efficiently, keeping your property in optimal condition year-round.

Tips for Buying Property in Crete

Purchasing property in Crete can be a rewarding investment, but knowing the local market and procedures is essential. Here are some practical tips:

- Research the Market Thoroughly: Start by understanding property trends, popular locations, and pricing differences. Use our Crete Property Index to identify high-demand areas and assess property values in different regions.

- Work with Local Experts: Enlist the help of a Greek real estate agent and lawyer to guide you through the purchase process. Local professionals can provide valuable insights and help navigate legal requirements specific to Crete.

- Clarify Ownership Details: Ensure clear ownership rights by verifying property titles, checking boundaries, and understanding any building restrictions. Due diligence is vital for avoiding potential disputes or restrictions on the property.

- Factor in All Costs: Beyond the purchase price, account for additional expenses like taxes, agency fees, and maintenance costs. Using our Property Revenue Calculator can also help project income for rental properties, providing a complete view of potential returns.

- Consider Rental Potential: If you’re buying property as an investment, research the rental market. Properties in tourist-frequented areas yield high returns, particularly during peak season. For those considering vacation rentals, our Airbnb Management service can help optimize bookings and enhance guest satisfaction.

- Plan for Long-Term Ownership: Real estate in Crete offers both lifestyle and financial rewards, making it suitable for long-term investments. Whether you plan to use the property as a vacation home or rental, a long-term perspective helps maximize ROI and appreciation.

How to Choose the Right Property in Crete for Your Needs

Choosing the right property in Crete involves aligning your goals with the island’s unique offerings. Consider these factors to make the best choice:

- Purpose of the Property: Determine if the property will be a vacation home, long-term residence, or investment. Vacation rentals near the coast yield high returns, while residential homes inland may offer a quieter lifestyle and more affordable prices.

- Location and Accessibility: Coastal properties appeal to tourists and offer higher rental income, whereas inland areas provide more privacy and authentic Cretan experiences. Think about accessibility to airports, amenities, and attractions, depending on your intended use of the property.

- Property Type and Condition: From modern apartments in Heraklion to traditional village homes, Crete has a range of property types. If you’re interested in a historic home, factor in potential renovation costs. For an estimate of potential rental income, try our Property Revenue Calculator to see how different property types perform in Crete’s rental market.

Mistakes to Avoid When Investing in Crete’s Real Estate Market

While Crete’s real estate market holds promise, there are common pitfalls to avoid. Here are some key mistakes to watch out for:

- Neglecting Due Diligence: Always verify property titles, boundaries, and any outstanding debts. Due diligence is essential to avoid unexpected issues and ensure a secure investment.

- Underestimating Additional Costs: From legal fees to annual taxes, additional expenses can add up quickly. Be sure to budget for these to avoid surprises after purchase. Our Buying Property in Crete guide outlines all potential costs to consider.

- Overlooking Rental Demand: If you’re buying with the intention of renting, thoroughly research demand in your target area. Properties in popular tourist spots generally perform better as short-term rentals, especially if supported by Airbnb Management services that help optimize bookings and maximize returns.

- Choosing the Wrong Location: Buying in a location that doesn’t align with your goals can impact satisfaction and profitability. For example, a remote property might appeal to retirees seeking tranquility, but investors looking for rental income should focus on areas with high tourist traffic.

- Professional Management: Managing a rental property remotely can be challenging. Property management ensures your investment is maintained and generates income. Our Landlord Services handle everything from maintenance to guest relations, making it easier to invest with peace of mind.

With these tips, you’ll be well-prepared to navigate Crete’s real estate market effectively.

From selecting the right property to avoiding common pitfalls, a thoughtful approach ensures your investment in Crete meets your expectations and goals.

Final Thoughts: Is Now the Time to Invest in Crete?

With a stable and growing real estate market, favorable government incentives, and consistent demand from tourists and expatriates, now is an opportune time to invest in Crete.

The combination of rising property values, a steady flow of foreign interest through programs like the Golden Visa, and Crete’s appeal as a year-round destination makes the island a strategic choice for those seeking long-term appreciation or rental income.

Investors can benefit from Crete’s high season for tourism, which drives short-term rental yields and provides a reliable revenue stream for vacation rentals.

For those aiming to leverage this demand, our Vacation Rentals Management services ensure properties are well-maintained and marketed, allowing you to capture maximum rental income without the hassle of day-to-day management.

What Does the Future Hold for Crete’s Property Market?

The outlook for Crete’s property market remains optimistic.

Economic growth, rising tourism numbers, and supportive policies are likely to keep demand steady, particularly in popular locations like Chania, Heraklion, and Agios Nikolaos.

Although property prices are expected to rise gradually, factors like global economic trends and regional policies may influence market conditions.

For investors with a long-term perspective, Crete offers an appealing mix of lifestyle benefits and financial returns.

Real estate here is not only a valuable asset but also an investment in one of Greece’s most beloved regions.

To stay updated on market trends and make informed decisions, visit our Crete Property Index for the latest data and insights on Crete’s dynamic real estate landscape.

In summary, Crete presents a balanced investment opportunity with strong potential for capital appreciation, rental income, and an enriching ownership experience.

With thoughtful planning and professional support, investing in Crete could be a rewarding addition to any real estate portfolio.