Business In Crete (Ultimate Guide 2025)

- Last Update Feb. 17, 2025

- Why Crete is the Smartest Place to Start a Business

- Can Foreigners Open a Business in Crete?

- Choosing the Right Business Structure

- How to Legally Register Your Business in Crete

- Understanding Greek Taxes and Business Costs

- Finding the Right Location for Your Business

- Hiring Employees and Understanding Labor Laws

- Scaling Your Business for Long-Term Success

Why Crete is the Smartest Place to Start a Business in Greece

Some places are great for vacations but not for business.

They might look appealing at first, but once you start planning, you realize the costs are high, the market is too small, or the bureaucracy is impossible to navigate.

Crete is different.

It is not just a holiday destination.

It has a real economy that functions all year, an entrepreneurial scene that is growing fast, and a business environment that offers opportunities instead of obstacles.

Business Growth & Market Size in Crete

Crete’s economy isn’t just tourism—it’s a thriving, diverse business hub.

🏛 Crete’s Economy

Crete contributes 5.1% of Greece’s total GDP (€9.4 billion), fueled by tourism, agriculture, and services.

🚀 Startup Growth

Small businesses in Crete grew by 17% from 2016 to 2022, with tourism and hospitality leading the way.

🛒 E-commerce Boom

Online businesses in Greece saw 43% growth in 2023, with many targeting expats and digital nomads.

Unlike smaller islands that depend entirely on tourism, Crete has an economy that stays active throughout the year.

Even in the winter months, businesses remain open, locals continue spending, and there is no drastic seasonal drop that makes running a business unpredictable.

Affordability is another major advantage.

While cities like Athens and Thessaloniki have seen rising costs, Crete remains a cheaper and more sustainable place to launch a business.

Office space, rentals, and even operational expenses like salaries and utilities are significantly lower, allowing business owners to start with lower overhead and higher profit margins.

Beyond the financial benefits, Crete offers a lifestyle that makes business ownership feel sustainable.

Entrepreneurs here are not dealing with constant stress from traffic, high living expenses, or an overwhelming work environment.

The balance between work and life is natural, making it easier to stay productive without burnout.

For business owners looking for a place that combines opportunity with a high quality of life, Crete is one of the best locations in Greece.

Before setting up a business here, there is one essential question to answer.

Start Your Business in Crete with Confidence

Get expert assistance to navigate the process smoothly.Contact Us

Can Foreigners Open a Business in Crete?

Yes, and Greece actively encourages it.

Unlike some European countries that impose complex restrictions on foreign entrepreneurs, Greece has a clear and structured process for non-Greek citizens who want to start a business.

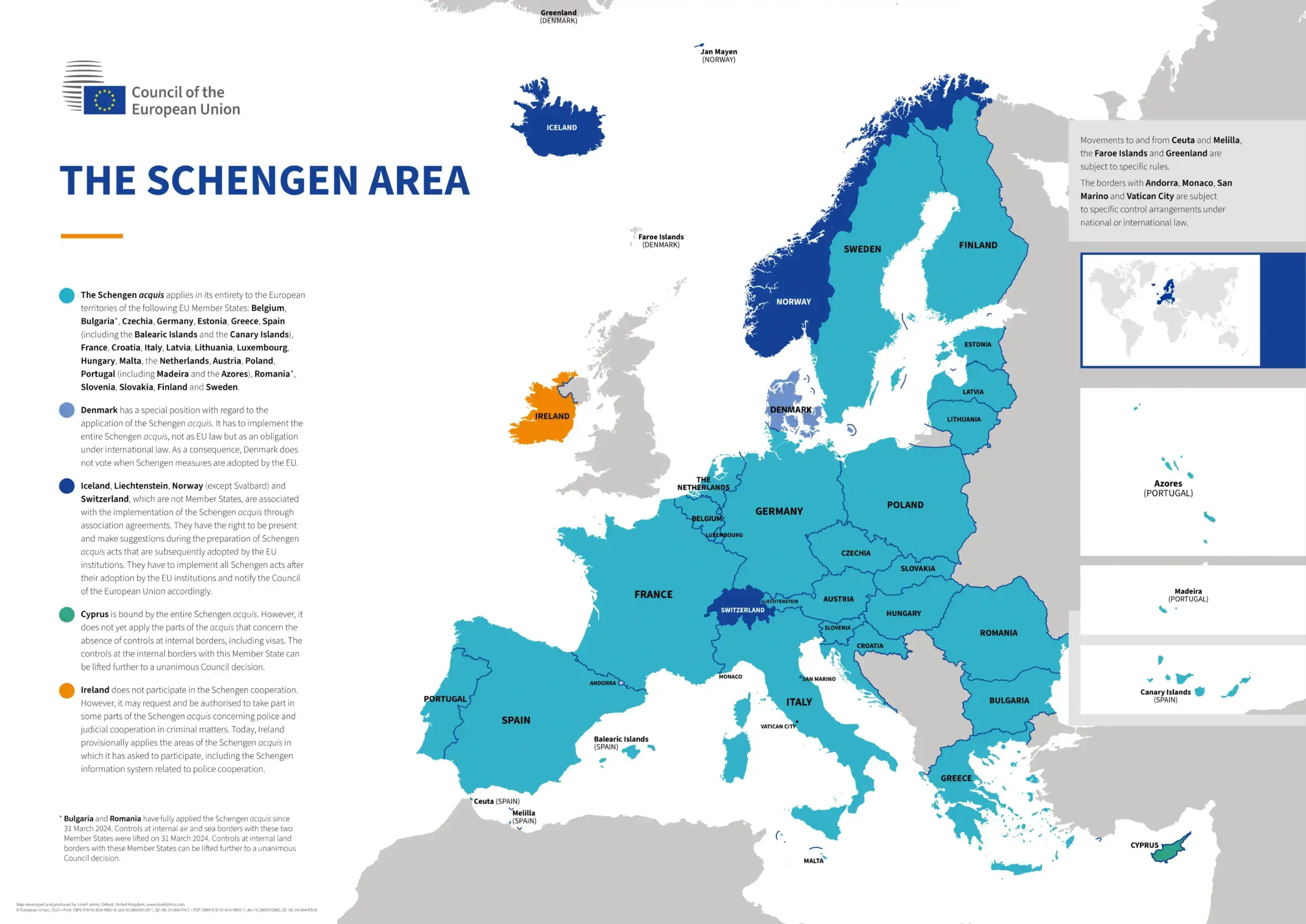

For EU and EEA citizens, the process is straightforward.

There are no special permits or visas required.

You can move to Crete, register a business, and start operating without needing additional approvals.

The only requirement is to follow the same registration steps as a Greek citizen.

For non-EU citizens, starting a business in Crete requires securing the right type of residence permit.

Greece offers several pathways that allow foreign entrepreneurs to establish and run businesses legally.

The most common options include the Greek Golden Visa, which is available to investors who purchase property or make qualifying business investments, and the Greek Financially Independent Person (FIP) Visa, which is suited for those who have a stable independent income and do not plan to take a local job.

How to Start a Business in Crete – Step by Step

Get a Greek Tax ID (AFM)

Before registering your business, you need an AFM tax number from the Greek tax office.

Choose a Business Structure

Most foreign entrepreneurs choose an IKE (Private Company) for low costs & tax efficiency.

Register Your Business with GEMI

The General Commercial Registry (GEMI) handles official business registration. This step takes 5-15 days.

Open a Greek Business Bank Account

Required for transactions, VAT, and payroll. A Greek IBAN is mandatory.

Register for VAT & Social Security

VAT registration depends on business type (24%, 13%, or 6%). Social security contributions are mandatory.

Start Operating!

Once all steps are complete, you can legally start your business in Crete.

The key advantage of starting a business in Crete is that the government actively supports foreign investment.

Various incentives exist for entrepreneurs, particularly in industries that boost the local economy.

Tourism-related businesses, tech startups, and eco-friendly enterprises are among the sectors that benefit the most from available support.

Aside from the legal framework, there is also a cultural aspect that makes doing business in Crete easier than in other countries.

Greek business culture is built on relationships, and once you establish trust within the community, running a business here becomes much smoother.

Local professionals, including accountants and legal advisors, specialize in assisting foreign entrepreneurs, making the transition seamless.

Setting up a business in Crete is entirely possible, but choosing the right business structure is just as important.

The next step is understanding which legal form best suits your needs.

Choosing the Right Business Structure

Not all businesses in Greece operate under the same legal framework.

Choosing the right structure is essential because it determines how your company will be taxed, how much liability you hold, and what kind of paperwork you need to file.

For small businesses, the simplest option is a sole proprietorship.

This is the easiest way to register and start operating quickly, but it comes with one major downside.

The business owner is personally liable for all debts, meaning that if the business runs into financial trouble, personal assets could be at risk.

For those looking for a more structured and secure option, the IKE, or Private Company, is one of the most popular choices among entrepreneurs in Crete.

It functions similarly to a Limited Liability Company (LLC) in other countries, which means that the owner’s liability is limited to the company’s assets rather than their personal wealth.

Choose the Best Business Structure

Get expert advice to select the right setup for your business.Contact Us

It also offers flexibility in taxation, and the setup process is relatively straightforward.

Larger businesses that require multiple shareholders often opt for the SA, or Société Anonyme, which is the equivalent of a corporation.

This structure is ideal for those planning to raise capital through investors or operate at a significant scale, but it requires more administrative oversight and higher initial capital.

Partnerships are also an option.

If two or more people want to go into business together, they can form either an OE (General Partnership) or an EE (Limited Partnership).

The difference is that in a General Partnership, all partners are personally liable for business debts, while in a Limited Partnership, at least one partner has limited liability.

Most expats and small business owners in Crete choose either a sole proprietorship or an IKE because these structures offer the best balance between simplicity and legal protection.

Once the right business structure is chosen, the next step is officially registering the company and ensuring all legal requirements are met.

How to Legally Register Your Business in Crete

Registering a business in Crete is a structured process, but it requires careful attention to detail.

The Greek government has modernized business registration in recent years, making it more efficient than before, but missing a step can still cause unnecessary delays.

The first requirement for all business owners, whether Greek or foreign, is obtaining a Tax Identification Number (AFM).

This number is issued by the Greek tax office and serves as your official business ID for all financial and legal transactions.

Without it, you cannot legally operate or open a business bank account.

Once you have a tax number, the next step is registering the business with the General Commercial Registry (GEMI).

This is where the company becomes officially recognized, allowing it to enter into contracts, issue invoices, and conduct financial transactions.

The registration process varies depending on the business structure, with sole proprietorships requiring the least paperwork and corporations requiring more detailed documentation.

Navigate Greek Business Bureaucracy with Ease

We handle paperwork and compliance so you can focus on growth.Contact Us

Opening a Greek business bank account is another crucial step.

Many international entrepreneurs assume they can use their existing bank accounts to operate a business in Greece, but local regulations require all companies to have a Greek IBAN for tax compliance.

Some foreign banks operate in Greece, but a local account is essential for payroll, expenses, and VAT payments.

After the business is officially registered, enrolling in the Greek social security system (EFKA) is mandatory.

Every business owner must contribute to EFKA, and the amount depends on income levels and business structure.

These contributions go toward public healthcare, pensions, and other social benefits, and failing to register can result in penalties.

Depending on the type of business, additional permits or licenses may be required.

Restaurants, hotels, and tourism-related businesses must obtain health and safety certifications, while retail businesses need special approvals for product sales.

Understanding the licensing process before launching ensures that the business can operate without legal complications.

Once all these steps are completed, the business is fully legal and ready to operate.

The next challenge is understanding how Greek taxes and business costs impact profitability.

Understanding Greek Taxes and Business Costs

One of the biggest concerns for entrepreneurs starting a business in Crete is understanding how taxation works.

Cost of Starting & Running a Business in Crete

Running a business in Crete is 15-20% cheaper than in Athens or Thessaloniki.

🏢 Office Rental

Co-working spaces: €120–€250/month

Private offices: €400–€800/month

💼 Business Setup

Sole Proprietorship: €1,000–€2,000

LLC (IKE): €2,500–€5,000

Corporation (SA): €10,000+

📊 Tax & Compliance

Corporate Tax: 22% (one of the lowest in Southern Europe)

Annual Compliance: €1,000–€2,000

💰 VAT Rates (ΦΠΑ)

24% Standard (services, goods)

13% Reduced (food, tourism)

6% Super-reduced (books, medicines)

Greece has made significant changes to its tax system in recent years, improving transparency and reducing corporate tax rates, but it is still essential to plan carefully to avoid unexpected costs.

The corporate tax rate in Greece is currently 22%, making it one of the more competitive rates in Europe.

This flat rate applies to business profits, but tax planning strategies can help minimize the total amount owed.

Business expenses, including rent, payroll, and operational costs, are deductible, so keeping accurate records is essential.

VAT, or value-added tax, is another key consideration.

The standard VAT rate in Greece is 24%, but some businesses qualify for reduced rates.

Tourism-related businesses, food services, and certain goods benefit from a 13% VAT rate, while essential products such as pharmaceuticals have a 6% VAT rate.

Businesses that earn under a certain threshold may also be eligible for VAT exemptions, making it important to work with an accountant who understands local tax laws.

Social security contributions are mandatory for all business owners and employees.

Get Business Tax & Compliance Assistance

We simplify Greek tax laws so your business stays compliant.Contact Us

For independent business owners, contributions to EFKA (the Greek social security system) typically amount to around 20% of declared income.

Employers hiring staff must also contribute to employee social security, which increases the overall labor cost.

Beyond taxes, operational costs vary depending on location and industry.

Renting a commercial space in a major city like Heraklion or Chania costs more than operating in a smaller town, but even in larger urban areas, rental costs remain significantly lower than in cities like Athens.

Electricity, internet, and other utilities also remain affordable compared to most Western European business hubs.

Accounting and legal services should also be factored into the budget.

Most foreign business owners work with Greek accountants to handle tax filings, payroll, and financial compliance, which typically costs between €1,000 and €2,000 per year, depending on the complexity of the business.

Legal fees for business registration and licensing vary but are a necessary expense for ensuring compliance with Greek business laws.

Understanding these costs upfront helps entrepreneurs plan effectively and avoid cash flow problems.

With taxation and financial planning covered, the next step is choosing the right location for a business in Crete.

Finding the Right Location for Your Business

The success of a business in Crete depends not just on the idea behind it but also on where it operates.

Choosing the right location is about more than just finding an affordable rental space—it’s about ensuring access to the right customers, suppliers, and business infrastructure.

Which Crete Business Location Fits You?

Find the perfect business spot based on costs, demand, and opportunity.

Chania

🏝️ High-end tourism & digital nomads

💰 Avg. Rent: €12–€20/m²

Best for: Luxury tourism, boutique hotels, co-working spaces

Heraklion

🏙️ Year-round economy & logistics

💰 Avg. Rent: €10–€18/m²

Best for: Tech startups, retail, corporate services

Rethymno

🏛️ Mid-tier tourism & university town

💰 Avg. Rent: €8–€15/m²

Best for: Cafés, expat services, education

Agios Nikolaos

🌿 Luxury tourism & wellness

💰 Avg. Rent: €10–€20/m²

Best for: High-end villas, wellness retreats, spa businesses

Smaller Villages

🌿 Affordable & slower pace

💰 Avg. Rent: €5–€10/m²

Best for: Agribusiness, eco-tourism, artisan shops

Crete is a large island with distinct economic hubs, each offering different advantages.

Chania is the most sought-after location for tourism, hospitality, and expat-friendly businesses.

It attracts a steady flow of international visitors and has a thriving community of remote workers, making it an excellent choice for co-working spaces, boutique hotels, and high-end restaurants.

Rental costs in Chania are higher than in other areas, but businesses benefit from strong consumer demand.

Heraklion, the largest city on the island, is Crete’s business capital.

It has the best infrastructure, the most developed commercial districts, and the highest number of professionals working in finance, logistics, and corporate services.

Businesses that rely on year-round customers, including retail stores, healthcare practices, and office-based companies, tend to do well in Heraklion.

It offers more stability than tourism-driven locations but comes with the higher costs of operating in a big city.

Rethymno provides a balance between urban and coastal life, making it attractive for entrepreneurs looking to run a business without the stress of a large city.

It is known for its strong university presence and growing expat community, which creates opportunities for businesses catering to students, digital nomads, and long-term foreign residents.

Find the Best Location for Your Business

Let’s identify the perfect spot based on your needs and market demand.Contact Us

Rental prices remain more affordable than in Chania or Heraklion, making it an appealing choice for those looking to minimize startup costs.

For entrepreneurs looking to embrace a slower pace of life while running a profitable business, Crete’s smaller towns and villages offer an attractive alternative.

Places like Apokoronas and Agios Nikolaos are becoming increasingly popular for boutique hotels, wellness retreats, and eco-friendly businesses.

Real estate prices are significantly lower, and businesses benefit from less competition compared to major cities.

However, businesses in these areas need a strong marketing strategy to attract customers from outside the local community.

Choosing the right location requires careful consideration of both customer demand and business costs.

Visiting multiple areas, speaking with local business owners, and understanding seasonal trends can help ensure a business is set up for success.

Once the ideal location is selected, the next step is hiring employees and understanding the local labor laws.

Hiring Employees and Understanding Labor Laws

Running a business in Crete often means hiring employees, whether it’s for a small café, a tourism service, or a tech startup.

Understanding Greek labor laws from the beginning helps avoid legal complications and ensures that employment contracts, wages, and benefits comply with local regulations.

Salary Expectations in Crete

Know the costs before hiring employees for your business.

Minimum Wage

€834/month

Hospitality Staff

€900–€1,300/month

Retail Employees

€1,100–€1,500/month

Skilled IT/Tech Workers

€1,800–€3,000/month

Employer Costs

+25% in EFKA social security contributions

Hiring Process

All contracts must be registered in ERGANI within 48 hours.

The Greek labor market follows strict rules designed to protect employees, and employers must follow specific guidelines when hiring staff.

The minimum wage in Greece is currently set at €780 per month, and all businesses are required to provide employees with social security coverage.

Employers contribute approximately 25% of an employee’s salary to Greece’s social insurance system, EFKA, which covers healthcare, pensions, and unemployment benefits.

Work contracts in Greece can be either fixed-term or indefinite.

Many businesses, particularly those in tourism, hire seasonal workers using fixed-term contracts, which allows them to scale their workforce based on demand.

However, if an employee continues working beyond the agreed contract period, their status automatically changes to a permanent contract, which provides them with stronger labor protections.

The standard workweek in Greece is 40 hours, with the option for up to 8 hours of overtime per week.

Any additional overtime must be compensated at a higher rate.

Employers must also provide holiday pay, annual leave, and social security benefits.

Greek labor laws strongly favor workers, so businesses need to ensure their employment contracts are compliant.

For entrepreneurs unfamiliar with the local legal system, working with an HR consultant or employment lawyer can simplify the hiring process.

They can draft legally compliant contracts, calculate social security contributions, and ensure that all employment regulations are followed.

Hiring employees in Crete comes with costs, but it also provides opportunities to grow a business sustainably.

Once the legal aspects of hiring are covered, the next priority is setting up business banking and payment systems to manage transactions efficiently.

Banking, Payments, and Managing Business Transactions

Once a business in Crete is registered and ready to operate, the next step is setting up financial systems to handle payments, salaries, and tax obligations efficiently.

💳 Best Payment Methods for Your Crete Business

Find the most efficient ways to send and receive payments in Greece.

🏦 Greek Business Banking

Businesses need a Greek IBAN for VAT compliance. Account setup takes 5-10 days.

🇬🇷 Local Payment Systems

Top options: Viva Wallet, Eurobank, Alpha Bank—widely used for domestic transactions.

🌍 International Payment Systems

Popular choices: PayPal, Wise, Revolut—ideal for lower international fees.

💳 Credit Card Acceptance

90% of businesses in Crete accept Visa/Mastercard, but American Express is less common.

Greek banking regulations require all businesses to have a local business bank account, even if they operate internationally.

Opening a Greek business bank account requires a Greek Tax Identification Number (AFM), proof of business registration, and in some cases, a deposit to activate the account.

Most major Greek banks, including National Bank of Greece, Alpha Bank, and Piraeus Bank, offer business banking services.

Some international banks also operate in Greece, but local accounts are required for payroll, VAT payments, and financial reporting.

For businesses that deal with international transactions, digital banking solutions like Wise, Revolut, and N26 are popular among entrepreneurs.

They provide lower transaction fees, multi-currency accounts, and better exchange rates than traditional banks.

Many businesses in Crete use a combination of local and digital banking to keep financial operations smooth.

Accepting payments in Greece is straightforward.

Most businesses rely on POS (point-of-sale) systems, which allow them to accept credit card payments from tourists and locals alike.

Contactless and mobile payments are increasingly popular, with services like Apple Pay and Google Pay widely accepted in larger cities.

Businesses that operate online also integrate Stripe, PayPal, or local Greek payment gateways for seamless digital transactions.

Set Up Your Business Banking Easily

Get the right payment solutions for your business in Crete.Contact Us

For businesses with employees, setting up payroll is an essential part of financial management.

Salaries are typically paid monthly, with taxes and social security contributions automatically deducted.

Using a local accountant or payroll service helps ensure compliance with Greek tax laws and prevents administrative mistakes.

Managing finances effectively is critical for long-term success.

Once the business is running smoothly, the next challenge is integrating into Crete’s business community and building a strong network.

Building a Business Network in Crete

Starting a business in a new country isn’t just about setting up legal structures and handling finances.

Success often comes down to who you know.

In Crete, networking is a crucial part of running a business, and building strong connections can open doors to new opportunities, partnerships, and clients.

Unlike in large cities where business relationships tend to be purely transactional, Crete operates on trust and community connections.

Business owners who take the time to engage with locals, attend events, and establish genuine relationships often find it much easier to navigate challenges and grow their customer base.

Entrepreneurs looking to expand their reach in Crete should start by joining local business associations and expat entrepreneur groups.

Organizations like the Chania and Heraklion Chambers of Commerce provide valuable resources, mentorship programs, and networking events that connect business owners with potential collaborators and service providers.

For those in industries like tourism, real estate, or hospitality, building relationships with local suppliers, property owners, and municipal offices is essential.

📊 Crete’s Business & Tourism Boom

See why Crete is becoming one of Greece’s top business destinations.

📈 Tourism Growth

Visitor numbers increased 60% from 2015 to 2022, fueling business expansion.

💶 Tourist Spending

Each visitor spends an average of €1,200 per trip—boosting hotels, restaurants, and retail.

🌍 Expat Growth

Crete now has over 30,000 expats, mainly from the UK, Germany, and the US.

💻 Digital Nomad Boom

Remote workers in Crete increased by 45% in 2023 due to its low cost of living and high quality of life.

Many business deals in Crete happen through word-of-mouth recommendations rather than formal contracts, and having a strong local network can make all the difference.

Coworking spaces in Chania and Heraklion also provide an excellent opportunity for networking, especially for digital entrepreneurs and remote business owners.

Spaces like Stone Soup and Bizrupt Hub host meetups, business workshops, and community gatherings where entrepreneurs can connect with like-minded professionals.

Beyond formal networking, simply being an active part of the community helps build trust.

In Crete, business is often personal.

Engaging with the local culture, supporting other businesses, and being visible in the community can turn casual relationships into long-term business partnerships.

With a strong network in place, the next step is ensuring that a business stays compliant with Greek regulations and avoids common legal and financial pitfalls.

Staying Compliant: Legal and Financial Responsibilities

Starting a business in Crete is only the beginning.

To ensure long-term success, business owners must stay compliant with Greek tax laws, financial regulations, and operational requirements.

Get Business Tax & Compliance Support

Ensure your business meets Greek tax regulations effortlessly.Contact Us

Failing to do so can lead to fines, legal issues, and unnecessary headaches.

One of the most critical responsibilities is filing taxes correctly and on time.

Businesses in Greece must submit annual corporate tax returns and quarterly VAT reports.

The tax year follows the January to December cycle, and all financial records must be kept organized for audits or reviews by the Greek tax authorities.

For those who hire employees, payroll taxes and social security contributions must be calculated and submitted monthly.

The Greek EFKA social security system requires employer contributions, and failing to pay on time can result in penalties.

Most businesses work with a local accountant to ensure payroll compliance and avoid administrative mistakes.

Aside from tax obligations, business licenses and permits must remain up to date.

Some industries, like hospitality, food services, and real estate, require annual renewals for operating permits.

Any changes to business ownership, structure, or location must also be reported to the General Commercial Registry (GEMI) to avoid regulatory issues.

Another key consideration is data protection and consumer rights compliance.

Businesses that handle personal data must follow GDPR regulations, which apply across the European Union.

This means that websites, online stores, and service providers must have clear privacy policies, cookie consent systems, and secure payment processing to protect customer information.

💰 How Do Greek Business Taxes Compare?

See how Greece stacks up against other EU countries.

🇬🇷 Greece

📌 Business Tax: 22% (Lower than Spain & Italy)

💰 Social Security: 20% (Self-Employed) | 25% (Employers)

📊 VAT: 24% (standard), 13% (food/tourism), 6% (medical, books)

🇪🇸 Spain

📌 Business Tax: 25%

💰 Social Security: 30% (Employers)

📊 VAT: 21% (standard), 10% (food), 4% (books)

🇮🇹 Italy

📌 Business Tax: 24%

💰 Social Security: 30% (Employers)

📊 VAT: 22% (standard), 10% (reduced), 4% (super-reduced)

🇩🇪 Germany

📌 Business Tax: 30% (Highest in EU)

💰 Social Security: 19% (Self-Employed) | 35% (Employers)

📊 VAT: 19% (standard), 7% (reduced)

Regular financial audits help business owners stay on top of expenses, optimize tax deductions, and ensure cash flow remains stable.

Many entrepreneurs schedule quarterly reviews with their accountants to adjust business strategies, plan for future growth, and avoid unexpected financial issues.

With compliance handled, the final step is optimizing operations for growth and long-term sustainability.

Scaling Your Business for Long-Term Success

Once a business in Crete is up and running, the focus shifts from setting up to scaling up.

Growth requires the right strategies, whether that means expanding to new locations, attracting international customers, or improving efficiency to increase profits.

For businesses in tourism and hospitality, seasonal planning is key.

While Crete benefits from year-round activity, the peak months between April and October generate the highest revenue.

Smart business owners prepare for the off-season by offering services that cater to locals or international visitors who stay long-term.

Many businesses in Crete also diversify by offering digital products, online services, or international shipping, reducing their dependence on foot traffic.

Investing in marketing and branding plays a huge role in long-term success.

Businesses that target expats, remote workers, or international customers should focus on SEO, social media engagement, and partnerships with travel platforms.

Creating an online presence that showcases the business in multiple languages, especially Greek and English, helps attract a broader audience.

For those looking to expand, reinvesting profits into new locations, additional services, or property purchases is a common strategy.

Crete’s real estate market remains affordable, making it possible for successful entrepreneurs to buy commercial spaces instead of renting, reducing long-term costs.

Collaboration is another powerful way to scale.

Forming strategic partnerships with local suppliers, hotels, tour operators, or other small businesses can create new revenue streams while strengthening the business community.

Many successful businesses in Crete grow through word-of-mouth referrals, so investing in strong relationships with partners and customers is just as valuable as traditional advertising.

The ultimate goal of any business is sustainability.

Launch Your Business the Right Way

We handle all the details so you can focus on success.Contact Us

Entrepreneurs who plan for steady growth, financial stability, and community integration are the ones who thrive long-term.

Whether the goal is building a local legacy or expanding internationally, Crete provides the perfect foundation for success.

Is Crete the Right Place to Start Your Business?

Starting a business in Crete isn’t just about profits; it’s about building something sustainable in a place that offers both opportunity and a high quality of life.

Entrepreneurs who move here are not just looking for financial success; they want a work-life balance that big cities cannot offer.

For those in tourism, hospitality, real estate, tech, and boutique industries, Crete presents a growing market with lower operational costs compared to Athens or Thessaloniki.

The year-round local economy ensures that businesses are not completely dependent on seasonal tourism, giving entrepreneurs more stability.

The legal process for opening a business is structured, and while Greek bureaucracy still exists, the right legal and accounting support makes the transition smoother.

With tax rates that are competitive within the EU, an affordable workforce, and an increasing number of digital professionals moving to Crete, the business landscape continues to improve.

However, success in Crete is not automatic.

Entrepreneurs who take the time to understand local customs, build relationships, and integrate into the community are the ones who thrive.

Those who expect the island to operate like a major metropolitan business hub may struggle with the slower pace and more relationship-based way of doing business.

For those who are prepared, Crete offers more than just an affordable place to run a business.

It offers a unique lifestyle, a welcoming community, and an environment where business ownership is enjoyable rather than stressful.

If you are considering launching a business in Crete, the next step is to navigate the setup process correctly, secure the right permits, and ensure compliance from day one.

That’s where expert guidance makes all the difference.

Making Your Move: Get Expert Help for Your Business in Crete

Totsi’s team specializes in helping entrepreneurs launch and grow businesses in Crete with a smooth, hassle-free process.

From securing permits to optimizing tax structures, we ensure that every step is handled correctly, so you can focus on running a successful business.

Get in touch today to start your business journey in Crete.

Start Your Business in Crete with Confidence

From legal setup to local expertise, we make your move seamless.Contact Us

Find Your Perfect Property

We’re Here to Answer All Your Questions About Buying Property in Crete

Start Your Property Journey

- STAY CONNECTED

Subscribe to Our Newsletter

Members