How to buy a house in Crete (US Resident)

Are you thinking how to buy a house in Crete as US Resident?

You’re not alone.

More and more US residents are turning their attention to this Mediterranean gem. And it’s easy to see why.

Crete offers a unique mix of sun-soaked beaches, vibrant culture, and real estate opportunities that are hard to beat. Whether you’re looking for a vacation retreat, a rental property, or a place to retire, Crete has something for everyone.

But here’s the deal.

Buying property abroad can feel like a maze of legal requirements, taxes, and cultural differences. And if you’re not careful, that dream home in paradise could become a nightmare.

That’s where we come in.

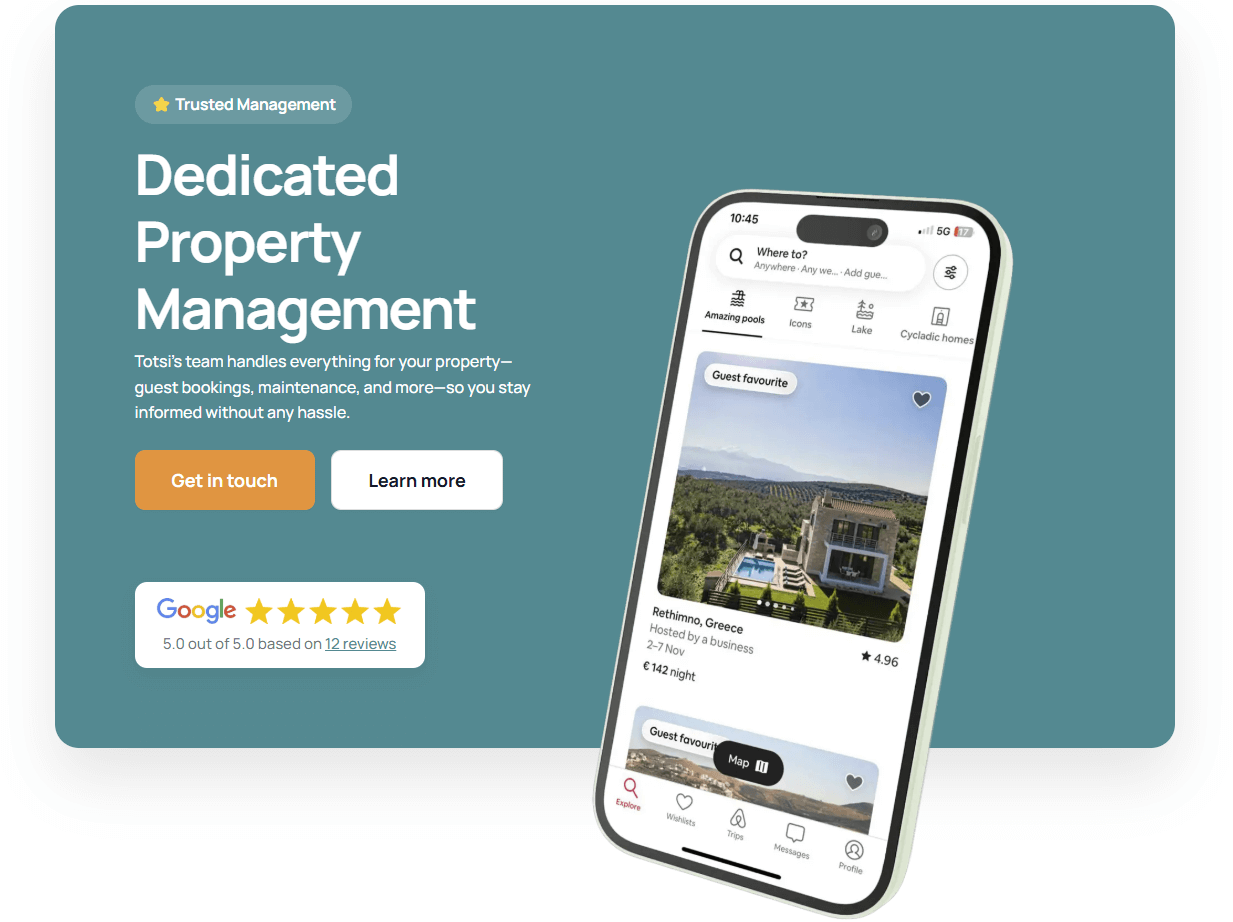

At Totsi, we specialize in helping clients like you navigate the ins and outs of Crete’s real estate market. From finding the perfect property to managing it long-term, we’ve got you covered.

In this guide, you’ll learn:

- The step-by-step process for US residents to buy property in Crete.

- What documents you’ll need to make it happen.

- The hidden costs you need to budget for.

And we’re not stopping there.

We’ll also cover insider tips to make your investment seamless and stress-free.

Ready to dive in? Let’s get started.

Can a US Resident Buy Property in Crete?

The short answer? Yes, absolutely.

As a US resident, you have the legal right to buy a property in Crete—and anywhere else in Greece. The Greek government welcomes foreign buyers, and the process is relatively straightforward.

But here’s the thing.

While buying property is legally possible, there are specific requirements and steps you’ll need to follow. Let’s break them down.

Understanding the Legal Framework

In Greece, foreign nationals, including US citizens, can own property outright. This means you’ll have full ownership of the land or building once the purchase is complete.

However, there are a few administrative hoops to jump through:

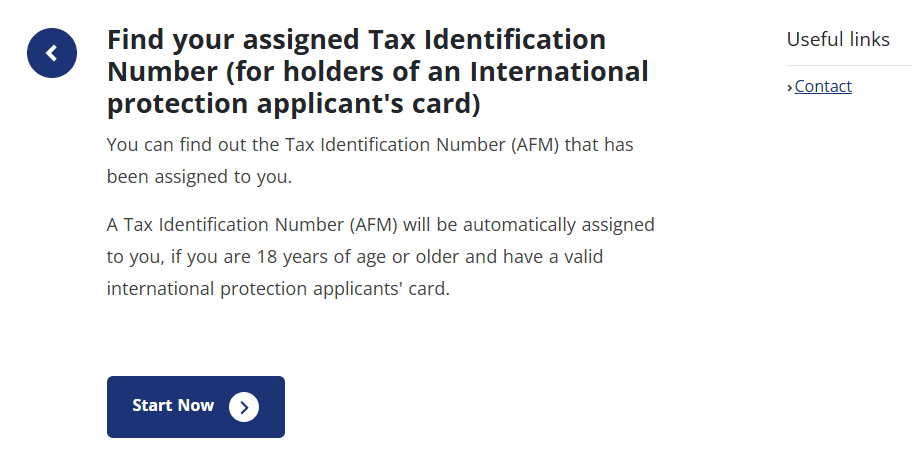

1. Get a Greek Tax Identification Number (AFM):

Think of this as your key to the system. Without an AFM, you can’t buy property, pay taxes, or open a Greek bank account.

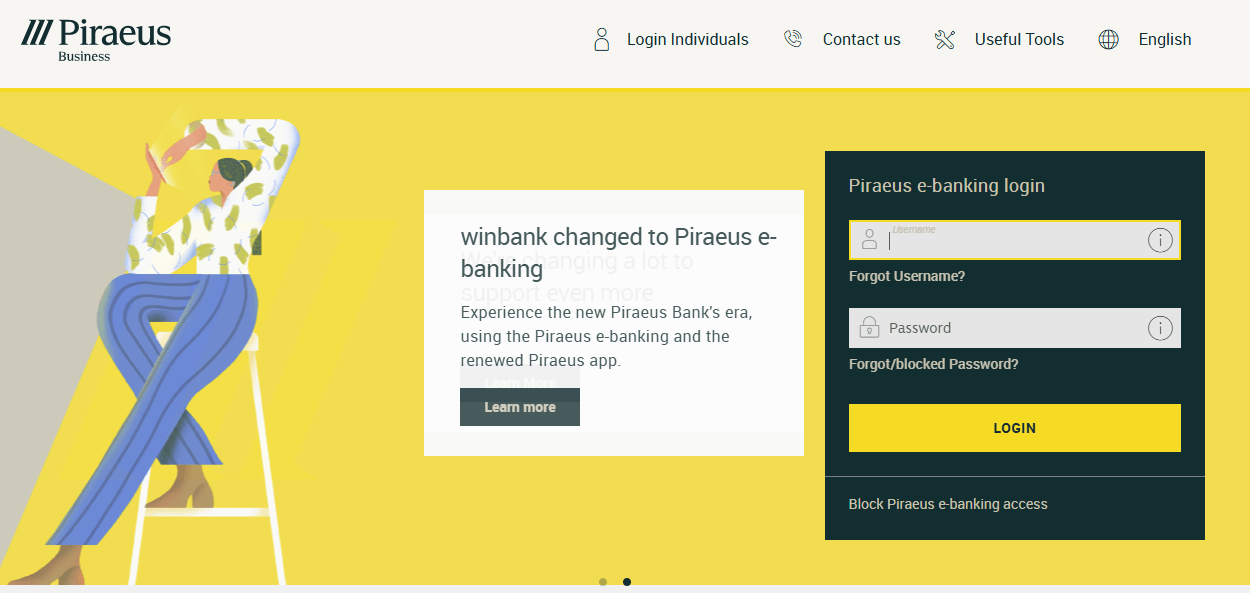

2.Open a Greek Bank Account:

This is essential for transferring funds during the purchase process. Greek law requires buyers to pay property-related taxes and fees through a local bank account.

3.Hire a Lawyer:

Having a lawyer by your side ensures you’re protected throughout the process. They’ll verify property titles, review contracts, and handle the nitty-gritty legal details.

What About Residency?

Here’s some good news: You don’t need to be a Greek resident to buy property.

However, owning property in Crete can open the door to residency opportunities, including the Golden Visa program. This program grants residency to non-EU nationals who invest at least €250,000 in Greek real estate.

It’s a win-win. Not only do you get a stunning property, but you also gain the freedom to live and travel within the Schengen Zone.

Key Takeaway

If you’re serious about buying property in Crete, start by securing your AFM and opening a Greek bank account. These are the first steps toward making your Mediterranean dream a reality.

Ready to learn how to find the perfect property? Let’s move to the next section.

Step-by-Step Guide for US Residents to Buy a House in Crete

Now that you know it’s possible, let’s dive into the “how.”

Buying a house in Crete as a US resident isn’t complicated when you have the right roadmap. Follow these steps to make your dream home a reality.

Step 1: Research and Choose the Perfect Location

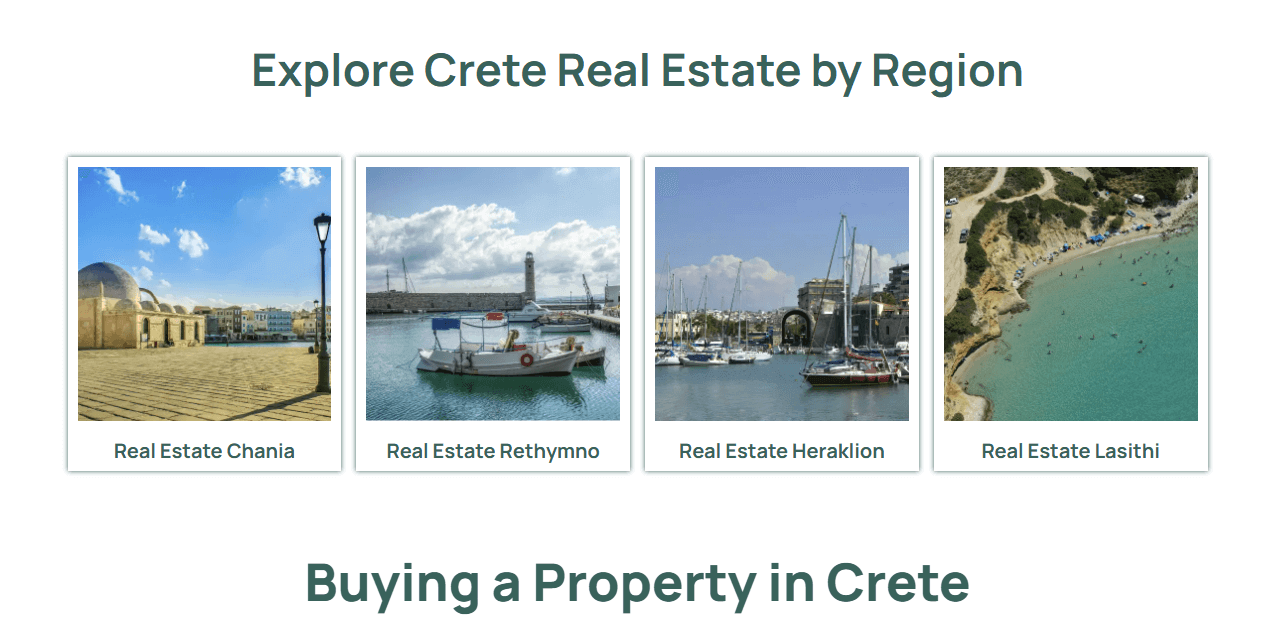

Crete isn’t just one destination—it’s a tapestry of unique neighborhoods and regions, each with its own charm.

Are you drawn to the historic beauty of Chania’s Old Town? Or do you prefer the modern amenities of Heraklion? Maybe the tranquility of a beachside villa in Rethymno sounds more appealing.

Pro Tip: Visit Crete in person if you can. Walk the streets, talk to locals, and see what feels right. If you can’t, work with a local real estate agent who knows the area inside and out.

Step 2: Understand Property Prices and Set a Budget

Here’s the deal.

Property prices in Crete vary widely depending on location, size, and proximity to the beach. For example:

- A cozy apartment in Chania might start at €100,000.

- A luxury villa in Elounda could cost €1,000,000 or more.

But don’t forget the extras. In addition to the purchase price, you’ll need to budget for:

- Property transfer taxes (around 3%)

- Legal fees (1-2%)

- Notary fees (1%)

- Land Registry fees (0.5-1%)

These costs can add up to 10% of the property price, so plan accordingly.

Step 3: Secure Your AFM and Bank Account

Before you can make an offer, you’ll need two essentials:

- Tax Identification Number (AFM): This can be obtained at a local tax office with the help of a lawyer or consultant.

- Greek Bank Account: This is mandatory for making payments and handling taxes. You’ll need your passport, AFM, and proof of address to open an account.

At Totsi, we help clients navigate these steps smoothly, ensuring no delays in the process.

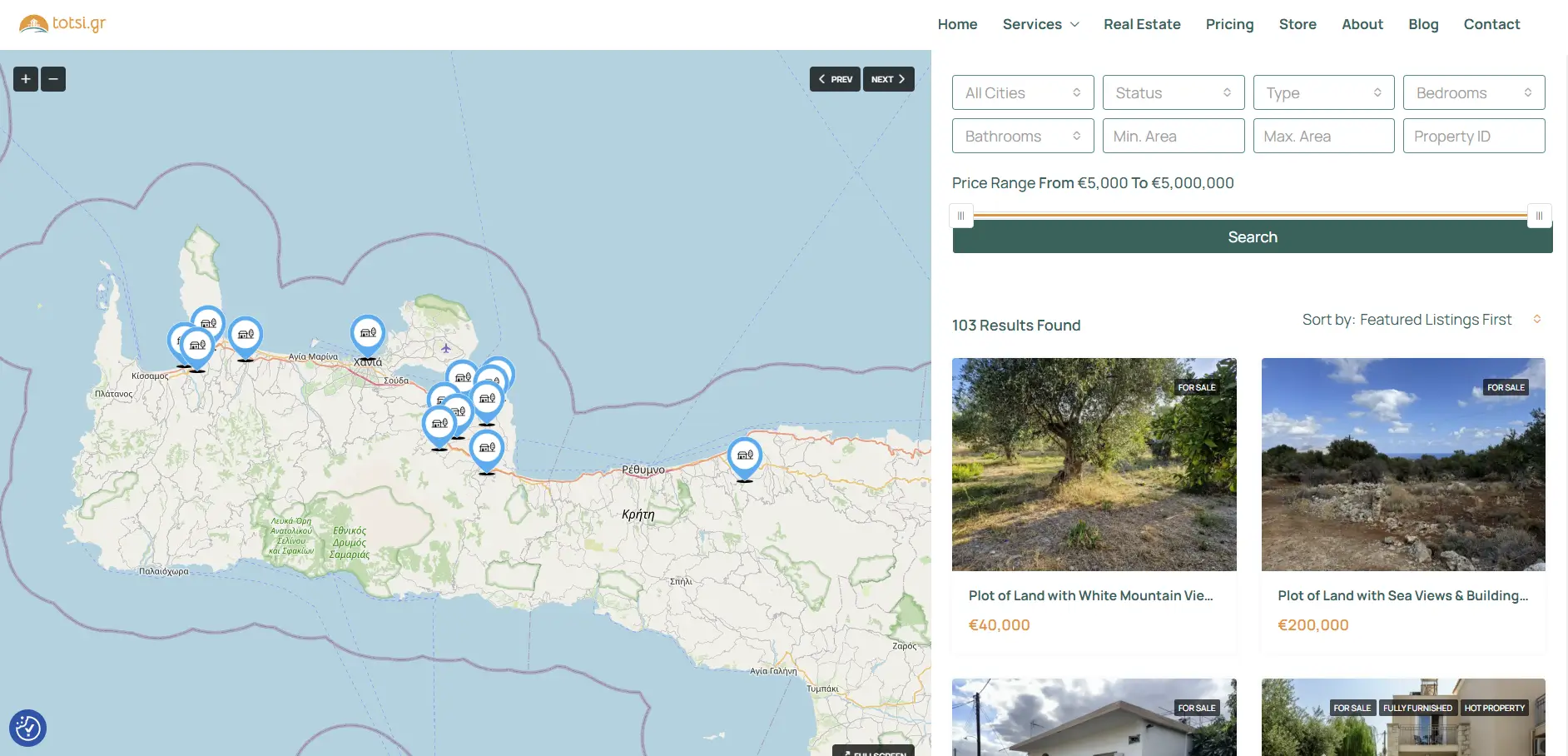

Step 4: Find Your Dream Property

This is where the fun begins.

Work with a trusted real estate agent to explore available properties. They’ll provide valuable insights, such as:

- The best neighborhoods for rental income potential.

- Properties with growth opportunities.

- Hidden gems that might not be listed online.

Our team at Totsi specializes in connecting buyers with properties that match their goals—whether it’s a holiday home, an investment property, or both.

Step 5: Conduct Due Diligence

This step is critical. Before you sign anything, make sure the property is free of legal issues.

Your lawyer will handle:

- Title Verification: Ensuring the seller has clear ownership.

- Building Permits: Confirming the property complies with local regulations.

- Debt or Encumbrances: Checking for unpaid taxes or liens on the property.

Skipping this step can lead to costly surprises down the road.

Step 6: Make an Offer and Sign the Preliminary Agreement

Once you’ve found the right property, it’s time to make your move.

Negotiate the price with the seller, and when both parties agree, sign a preliminary agreement. This document outlines the terms of the sale and typically requires a deposit (around 10% of the purchase price).

Step 7: Finalize the Purchase

Here’s where it all comes together.

Your lawyer will prepare the final contract, and a notary will oversee the signing. Afterward, you’ll pay the remaining balance and applicable taxes. Finally, the property will be registered in your name at the Land Registry.

Congratulations—you’re officially a homeowner in Crete!

Next, let’s explore the financial considerations and taxes involved in owning property in Crete. Shall we continue?

inancial Considerations and Taxes for US Residents Buying Property in Crete

Before you dive into property ownership in Crete, it’s essential to understand the financial commitments. Beyond the purchase price, there are taxes and fees that every buyer needs to account for.

Let’s break it all down.

Property Purchase Costs

Here’s what you can expect when buying a property in Crete:

Property Transfer Tax:

For most properties, this is 3% of the purchase price.

However, if the property was built with a permit issued after January 1, 2006, and sold for the first time, a 24% VAT applies instead.

The good news?

VAT on new builds has been suspended until the end of 2024.

Notary Fees:

Notaries oversee the signing of the final contract, and their fees are typically 1% of the property value.

Legal Fees:

Hiring a lawyer is crucial. Expect to pay around 1-2% of the property price for their services.

Land Registry Fees:

These range from 0.5% to 1% of the property’s declared value.

Together, these costs usually add up to about 8-10% of the total purchase price.

Annual Property Taxes

Once you own the property, you’ll need to pay Greece’s annual property tax, known as ENFIA.

The ENFIA rate depends on the property’s size, location, and age.

For most properties, annual taxes range from €3 to €16 per square meter.

Pro Tip: Work with an accountant to ensure your taxes are calculated and paid on time.

Rental Income Tax

If you plan to rent out your property, rental income in Greece is taxed on a sliding scale:

15% on income up to €12,000.

35% on income between €12,001 and €35,000.

45% on income above €35,000.

Expenses like maintenance and property management fees can often be deducted, reducing your taxable income.

Other Costs to Consider

Owning property comes with ongoing expenses, including:

Maintenance and Repairs: Particularly for older properties or those near the coast, where salt air can cause wear and tear.

Utilities: Electricity, water, and heating costs depend on usage and property size.

Insurance: Highly recommended to protect your investment from unforeseen issues.

At Totsi, we offer property management services to help owners streamline these ongoing responsibilities and ensure their properties stay in top condition.

Currency Exchange Considerations

Buying property in Crete means dealing in euros. If your funds are in US dollars, exchange rate fluctuations can impact your budget.

Pro Tip: Use a currency exchange service that offers competitive rates and the ability to lock in favorable rates for large transfers.

Understanding these financial details will ensure you’re fully prepared for your investment in Crete.

Next, let’s explore financing options for US residents.

Financing Options for US Residents Buying Property in Crete

Not all buyers pay cash for their dream property in Crete. If you’re considering financing, there are several options available to US residents. Let’s look at how you can secure funding for your investment.

1. Paying Cash vs. Financing

Many international buyers prefer to pay cash, which simplifies the buying process and avoids additional costs like loan interest. However, financing is a viable option if you want to preserve liquidity or invest in multiple properties.

2. Mortgages for Non-EU Citizens

Here’s the deal:

Getting a mortgage in Greece as a non-EU citizen is possible, but it requires some groundwork. Greek banks may offer loans to foreign buyers, but approval is contingent on:

A strong credit history.

Proof of income and ability to repay.

The property being used as collateral.

What to Expect from Greek Mortgages:

Loan-to-value ratio: Typically up to 70% of the property price.

Interest rates: Generally between 3-5%, depending on the bank and your financial profile.

Loan term: Usually 10-20 years.

Pro Tip: Start the mortgage process early, as it can take a few months to finalize.

3. Alternative Financing Options

If Greek mortgages aren’t an option, consider these alternatives:

Home Equity Loans: Use equity from your US property to finance your Crete investment.

Private Lenders: Some international lenders specialize in financing properties abroad.

Personal Loans: For smaller amounts, a personal loan from a US bank might suffice.

4. Currency Exchange and International Transfers

Here’s where financing can get tricky.

If you’re borrowing in US dollars but paying for the property in euros, currency fluctuations can impact your payments. Work with a currency exchange specialist to:

Lock in favorable exchange rates.

Minimize conversion fees.

At Totsi, we’ve guided many clients through financing their Crete properties, connecting them with trusted banks and financial advisors to make the process seamless.

5. Golden Visa as a Financing Opportunity

If you’re planning to invest €250,000 or more in property, the Golden Visa program offers added value.

This program doesn’t just give you residency—it opens doors for easier travel across Europe, making it a great option for buyers considering long-term investment or relocation.

With these financing options, buying a property in Crete can be more accessible than you think.

Next, let’s tackle one of the most challenging aspects of buying abroad—navigating Greek bureaucracy.

Navigating Greek Bureaucracy: What US Residents Need to Know

Buying a house in Crete involves more than just finding the perfect property. There’s paperwork, permits, and processes that might feel daunting—especially when dealing with a foreign system.

Don’t worry. With the right preparation and guidance, navigating Greek bureaucracy can be straightforward.

1. Obtain a Greek Tax Identification Number (AFM)

The AFM is your golden ticket to conducting any financial transaction in Greece, including buying property. It’s like a Social Security Number in the US.

Here’s how to get it:

Visit a local tax office in Greece.

Bring your passport and proof of address.

You can authorize a lawyer to obtain it on your behalf if you’re not in Greece.

Without an AFM, you can’t proceed with the purchase, so prioritize this step early.

2. Open a Greek Bank Account

Greek law requires all property transactions, including taxes and fees, to be paid through a local bank account.

What you’ll need:

Passport.

AFM.

Proof of address (a recent utility bill or bank statement).

Proof of income (bank statements, tax returns).

Opening an account might take a few days, so plan accordingly.

Pro Tip: Some banks now allow non-residents to open accounts remotely through authorized representatives.

3. Understand the Role of Notaries and Lawyers

In Greece, a notary is mandatory for property transactions. They oversee the signing of contracts and ensure all legal requirements are met.

A lawyer, while not required, is highly recommended. They’ll handle:

Title searches to verify the property’s legal status.

Reviewing contracts to protect your interests.

Ensuring there are no outstanding debts or encumbrances on the property.

At Totsi, we connect clients with trusted legal experts who specialize in real estate for foreign buyers.

4. Property Valuation and Taxes

The property’s value will be officially assessed, which impacts the taxes you’ll pay.

The “objective value” is determined by local authorities and is often less than the market price.

Taxes like the property transfer tax and ENFIA are calculated based on this value.

Ensure all valuations and calculations are transparent by working with an experienced accountant or lawyer.

5. Residency and the Golden Visa Program

Owning property doesn’t automatically grant residency, but Greece’s Golden Visa program makes it easy for property buyers who invest €250,000 or more.

Benefits include:

Residency for you and your immediate family.

Freedom to live and travel in the Schengen Zone.

No minimum stay requirements.

This is a popular option for US residents who plan to use their property as a vacation home or rental investment.

Greek bureaucracy may seem complex, but with the right team by your side, it’s entirely manageable.

Next, let’s explore the cultural and practical considerations of buying property in Crete.

Cultural and Practical Considerations for Buying Property in Crete

Buying a house in Crete isn’t just a financial decision—it’s a cultural experience. Understanding local customs, practices, and expectations can make the process smoother and more enjoyable.

Here’s what you need to know.

1. Embrace the Greek Way of Doing Business

Greece operates at its own pace, often referred to as “Greek time.” Things may move slower than you’re used to in the US, especially when it comes to administrative processes.

The key? Patience and flexibility.

Build relationships with local professionals and trust their expertise. Greeks value personal connections, and a friendly rapport can go a long way.

2. Understand Local Property Market Customs

Real estate practices in Greece can differ significantly from those in the US. For example:

- It’s common for properties to be sold fully furnished.

- Listings may not always include the level of detail you’d expect, so property viewings are essential.

- Some properties, especially older ones, may not have all the necessary legal documentation (e.g., building permits). This is where a lawyer’s expertise is invaluable.

Pro Tip: Always verify that the property’s boundaries and ownership are clearly defined before proceeding with a purchase.

3. Navigate Building Regulations and Restrictions

If you’re buying land to build on, you’ll need to familiarize yourself with local building regulations. These include:

- Zoning laws that determine what type of property can be constructed.

- Height restrictions and design guidelines to preserve the island’s character.

- Coastal protection laws that limit development near the shoreline.

Working with a local architect or engineer can simplify the process and ensure compliance with all regulations.

4. Language Barriers and the Importance of Translation

While many professionals in Crete speak English, some documents and processes may only be available in Greek.

Tips for overcoming language barriers:

- Hire a bilingual lawyer or agent who can act as a translator.

- Learn basic Greek phrases to build rapport with locals.

- Use certified translators for legal documents to avoid misunderstandings.

At Totsi, we provide multilingual support to ensure our clients feel confident and informed every step of the way.

5. Immerse Yourself in the Community

Crete isn’t just a place to own property—it’s a place to call home. Get involved in the local culture by:

- Attending community events and festivals.

- Supporting local businesses and artisans.

- Learning about the island’s history and traditions.

Building connections with your neighbours can enrich your experience and make your transition to property ownership even more rewarding.

By understanding the cultural and practical aspects of buying property in Crete, you’ll not only navigate the process with ease but also create a lasting connection with this beautiful island.

Next, let’s look at the benefits of owning property in Crete as a US resident.

Benefits of Owning Property in Crete as a US Resident

Owning property in Crete isn’t just a financial investment—it’s an investment in a lifestyle. From stunning landscapes to lucrative rental opportunities, Crete offers unique advantages for US residents.

Let’s explore the key benefits.

1. A Vacation Home in Paradise

Picture this: You arrive in Crete, step into your own villa, and instantly feel at home. No hotels, no crowded spaces—just your private escape in one of the most beautiful places on Earth.

With over 300 days of sunshine a year, Crete is the perfect getaway destination. Whether it’s relaxing by the beach, exploring ancient ruins, or hiking through the Samaria Gorge, the island offers endless activities for every season.

And here’s the best part: Your property can serve as both a personal retreat and a source of income.

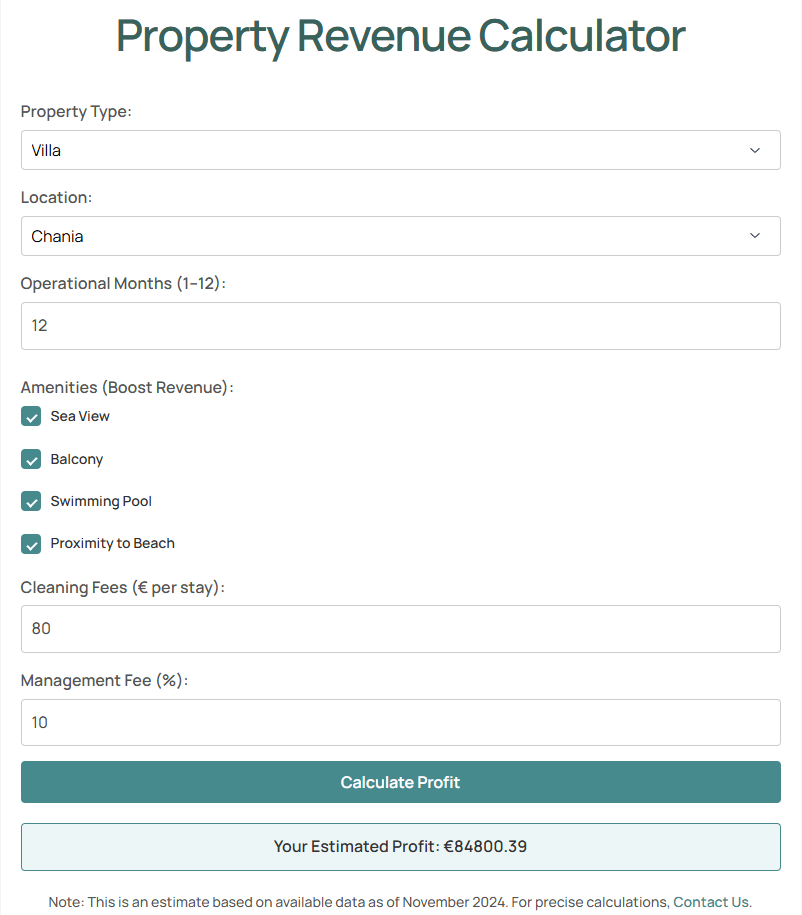

2. High Rental Income Potential

Crete is one of Greece’s most popular tourist destinations, attracting millions of visitors annually. This makes it a hotspot for short-term rentals.

Here’s why:

- Tourists prefer vacation homes and villas over hotels for privacy and space.

- Demand peaks during summer but remains strong year-round, especially in areas like Chania, Rethymno, and Heraklion.

- Rental yields for well-located properties can reach 8-10% annually, especially if marketed effectively on platforms like Airbnb or Booking.com.

At Totsi, we offer property management services to help maximize your rental income by handling everything from guest check-ins to maintenance.

3. Long-Term Investment Growth

Crete’s real estate market is on the rise. As more international buyers discover the island, property values continue to appreciate.

Key drivers of market growth:

- Increased tourism boosting demand for rentals.

- Infrastructure improvements, such as new airports and road networks.

- A stable political and economic environment in Greece.

- Investing now means you’re getting in before prices climb even higher, securing long-term financial returns.

4. Residency Benefits Through the Golden Visa

By purchasing property worth €250,000 or more, you become eligible for Greece’s Golden Visa program.

Benefits include:

Residency for you and your family, with no minimum stay requirement.

The ability to travel freely within the Schengen Zone.

No additional taxes or obligations beyond owning the property.

This program is ideal for US residents who want a foothold in Europe while enjoying the beauty of Crete.

5. A Mediterranean Lifestyle

Crete offers more than just beautiful properties—it offers a quality of life that’s hard to match.

What to expect:

- Fresh, locally sourced food (think olive oil, wine, and seafood).

- A slower, more relaxed pace of life.

- A welcoming community where neighbors quickly become friends.

For many US residents, owning property in Crete isn’t just about investment—it’s about finding a second home that enhances their lifestyle.

Owning property in Crete combines financial rewards with personal fulfillment. It’s an opportunity to enjoy the Mediterranean lifestyle while building a legacy for yourself and your family.

Next, let’s discuss the challenges you might face as a US resident buying property in Crete—and how to overcome them.

Challenges of Buying Property in Crete as a US Resident and How to Overcome Them

Buying property in Crete can be incredibly rewarding, but it’s not without its challenges. Navigating a foreign market, dealing with legalities, and managing cultural differences might seem daunting. The good news? With the right approach, these hurdles are easy to overcome.

Here’s how to tackle the most common challenges.

1. Navigating the Legal System

Greek property laws are different from those in the US, and they can feel complex if you’re unfamiliar with them.

Some common issues include:

- Verifying property titles.

- Ensuring compliance with local building regulations.

- Understanding tax obligations.

How to Overcome It:

- Hire a qualified Greek lawyer to handle legal checks and contracts.

- Work with a real estate agent who specializes in assisting international buyers.

- Ensure all property documents are reviewed for accuracy before signing.

2. Language Barriers

Although many professionals in Crete speak English, some aspects of the process, such as legal documents or tax forms, may be in Greek. Miscommunication can lead to delays or mistakes.

How to Overcome It:

- Choose a bilingual lawyer and real estate agent who can translate and explain every step.

- Use certified translation services for critical documents.

- Learn basic Greek phrases to build rapport with locals—it’s always appreciated.

3. Currency Exchange Risks

Since property purchases in Crete are conducted in euros, fluctuations in the USD/EUR exchange rate can impact your costs.

How to Overcome It:

- Use a foreign exchange service to secure favorable rates.

- Lock in rates ahead of large transfers to avoid surprises.

- Budget a buffer to accommodate minor exchange rate changes.

4. Seasonal Rental Market Challenges

If you’re planning to rent your property, you’ll likely see high demand during Crete’s tourist season (May to October) but slower activity in winter months.

How to Overcome It:

- Target long-term renters during the off-season, such as expats or university students.

- Diversify your property portfolio with homes in year-round tourist areas like Chania or Heraklion.

- Partner with a property management company to optimize pricing and marketing for different seasons.

At Totsi, we specialize in helping property owners maintain consistent rental income year-round through strategic marketing and management.

5. Property Maintenance and Management

Keeping your property in top condition can be challenging, especially if you don’t live in Crete full-time. Coastal homes, in particular, may require regular maintenance due to the salt air and humidity.

How to Overcome It:

- Hire a local property management company to handle cleaning, repairs, and guest services.

- Schedule routine inspections to catch potential issues early.

- Invest in durable materials and furnishings that withstand the coastal environment.

6. Cultural and Market Differences

Buying property in Crete involves understanding Greek customs and market practices, which may differ from what you’re used to in the US. For example:

- Verbal agreements may hold weight but should always be backed by a written contract.

- Negotiation is common but requires cultural sensitivity.

How to Overcome It:

- Work with professionals who understand both the Greek and US property markets.

- Take time to learn local customs and build relationships with sellers and agents.

Every challenge in the Crete property market is an opportunity to learn and grow as an investor. With the right team and preparation, you can overcome these obstacles and secure a successful investment.

Next, let’s wrap it all up with a guide on how to get started today.

How to Get Started with Your Property Investment in Crete

You’ve got the knowledge, and you’re ready to take the plunge. But where do you start?

Here’s a step-by-step guide to help you move forward with confidence and clarity.

1. Define Your Investment Goals

First things first—what do you want from your property in Crete?

Are you looking for a vacation home for personal use?

Is this an income-generating rental property?

Or are you investing for long-term capital appreciation?

Having a clear goal will shape your decisions, from the type of property to the location and budget.

2. Research the Market

Knowledge is power. Dive into Crete’s real estate market to identify trends and opportunities.

Explore neighborhoods like Chania for tourism appeal or Heraklion for residential comfort.

Compare property types—villas, apartments, or land.

Analyze market prices and rental demand in your target areas.

Pro Tip: Use online property portals and consult local real estate agents to get a comprehensive view of the market.

3. Partner With Trusted Professionals

Buying property abroad is easier when you have the right team by your side. At a minimum, you’ll need:

A Real Estate Agent: To find the perfect property and negotiate deals.

A Lawyer: To handle contracts, legal checks, and title searches.

An Accountant: To manage tax compliance and financial planning.

At Totsi, we provide a full suite of real estate services, from finding your dream home to managing it after purchase.

4. Set Your Budget and Secure Financing

Determine your total investment, including:

Property price.

Additional costs like taxes, notary fees, and legal expenses (typically 8-10% of the purchase price).

Renovation or furnishing costs if needed.

If financing, start the mortgage process early and explore options with Greek banks or international lenders.

5. Start Property Viewings

This is the exciting part—seeing your options firsthand.

Schedule in-person visits or virtual tours with your agent.

Pay attention to the property’s condition, location, and surrounding amenities.

Don’t be afraid to ask detailed questions about maintenance, legal status, or any renovations required.

6. Make an Offer and Negotiate

Once you’ve found the property, it’s time to make an offer.

Research comparable properties to ensure your offer is competitive.

Be prepared to negotiate on price, especially for older homes or properties needing renovation.

Pro Tip: Have your lawyer review all agreements before signing.

7. Finalize the Purchase

With an accepted offer, the process moves to the legal stage:

Sign a preliminary agreement and pay the deposit (usually 10% of the property price).

Your lawyer and notary will handle the final contract.

Pay the remaining balance and register the property in your name.

Congratulations—you’re now a proud property owner in Crete!

8. Plan for Post-Purchase Management

What’s next after the sale?

Decide if you’ll manage the property yourself or hire a local property management company.

Schedule any necessary renovations or upgrades.

Set up your rental listing or start preparing for your first stay.

At Totsi, we specialize in managing properties for owners, ensuring they remain in excellent condition and generate maximum income.

Owning property in Crete is more than just an investment. It’s a gateway to a lifestyle that combines beauty, culture, and financial rewards.

Your dream home in Crete is within reach—all it takes is the first step. Let’s make it happen together.

Why Crete is the Perfect Investment for US Residents

Crete isn’t just a destination—it’s an opportunity.

For US residents looking to buy property abroad, Crete offers the perfect combination of beauty, culture, and financial potential. From its stunning beaches and historical charm to its thriving real estate market, the island has something for everyone.

Whether you’re searching for a vacation home, a rental property, or a long-term investment, Crete delivers.

What Makes Crete Stand Out?

- High Rental Yields: The island’s booming tourism industry ensures steady demand for short-term rentals.

- Affordable Property Prices: Compared to other Mediterranean hotspots, Crete offers incredible value.

- Residency Benefits: The Golden Visa program makes property ownership even more attractive for US residents.

- Mediterranean Lifestyle: Owning property here isn’t just about financial returns—it’s about enjoying a quality of life that’s second to none.

Your Next Steps

If you’re ready to take the plunge, now is the time to act. Property prices are rising as more international buyers discover Crete’s potential, but the market still offers untapped opportunities.

At Totsi, we’re here to help you every step of the way. From finding the perfect property to managing it long-term, our team has the expertise to make your investment seamless and rewarding.

So, what are you waiting for?

Start your journey toward owning a piece of paradise in Crete today.